Shares of Chinese financial technology platform 360 DigiTech, Inc. (QFIN) were down in the pre-market session on Friday after the company’s second-quarter bottom line came in lower than a year ago.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Revenue of $624.5 million inched up marginally by 0.8% year-over-year. EPS of $0.96 fell short of expectations by $0.01 and was markedly lower than the prior-year figure of $1.42.

While the revenue uptick was only marginal, QFIN has notched up certain impressive metrics. At the end of Q2, the platform had 133 financial institutional partners. It had 197.9 million consumers at the end of Q2, up 12.5% compared to the year-ago period. Additionally, total borrowers with a successful drawdown (including repeat borrowers) increased 14.8% to 25.6 million.

The total outstanding loan balance increased by 28% over the prior year to RMB150.49 billion. Furthermore, the number of loans originated by financial institutional partners came in at nearly 14.08 million.

The CEO and Director of QFIN, Haisheng Wu commented, “Despite experiencing a very challenging macro environment and prolonged lockdowns and travel restrictions in Shanghai and other regions of China to counter the spread of COVID-19, we managed to deliver another solid quarter during which we achieved our key operational and financial targets.”

Amid a continued challenging macro backdrop, QFIN expects its loan facilitation and origination volume to hover between RMB410 billion and RMB450 billion for 2022. This indicates year-over-year growth in the range of 15% to 26%.

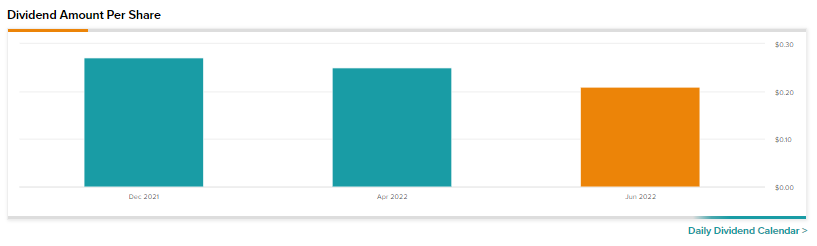

Additionally, its Board has approved a dividend of $0.09 per share for the quarter. The dividend is payable on October 28 to investors of record on September 16. The stock currently has a sizable dividend yield of 4.93% on a payout ratio of only 2.09%, indicating dividends could move upwards in the future.

Is QFIN Stock a Buy?

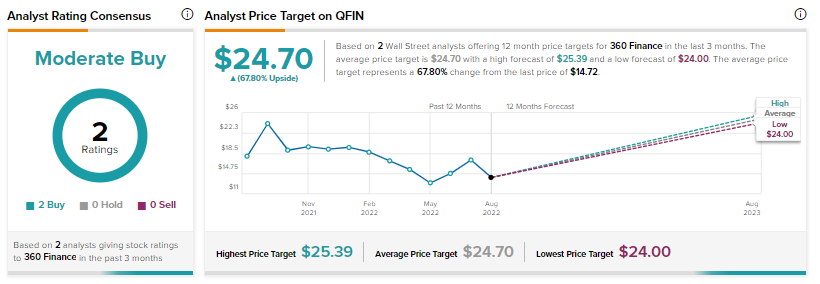

Daiwa analyst Leon Qi has initiated coverage on QFIN with a Buy rating and a price target of $24, implying a substantial 63.04% potential upside. QFIN is a leading name in the fintech space in China and Qi views the stock favorably owing to an improving regulatory environment in the country.

Overall, the Street has a Moderate Buy consensus rating on the stock alongside an average price target of $24.70, indicating 67.80% upside potential.

Is QFIN Undervalued?

QFIN missed Q2 earnings estimates but delivered certain impressive metrics in a challenging environment. A price-to-earnings multiple of 2.6, a price-to-sales ratio of 1.13, and a price to free cash flow ratio of 3.60 indicate that the potential for multiple expansion remains. Additionally, while the world is going into rate hikes, China is lowering interest rates. This should help the company further improve its performance in the coming periods as well.

Read full Disclosure