Here are the 3 Best Cryptocurrency stocks to buy in July 2024, according to Wall Street analysts. Bitcoin (BTC-USD) prices have been on a roll this year, gaining over 48.7% year-to-date. The bitcoin halving event in mid-April this year reduced the block reward for mining bitcoins by half.

It’s important to highlight that bitcoin prices rallied over $64,000 on July 15, following the news of the attempted assassination of former President Donald Trump. This was also accompanied by the share price surges of a majority of Bitcoin miners.

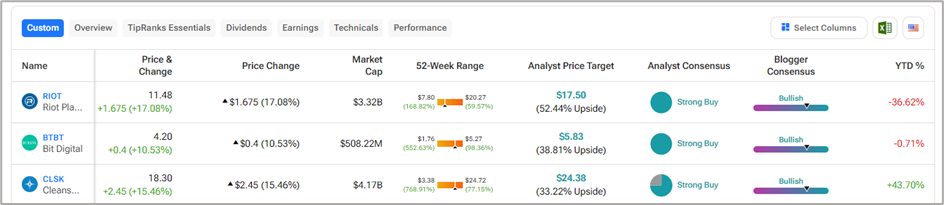

Investors seeking exposure to the dynamic crypto-mining industry often find it difficult to cherry-pick stocks. We leveraged the TipRanks Stock Comparison tool for Cryptocurrency Stocks to discover three miners with a “Strong Buy” consensus rating and over 30% share price appreciation potential in the next twelve months. Let’s learn more about why the three miners have earned analysts’ bullish views.

#1 Riot Platforms (RIOT)

Riot Platforms is one of the largest Bitcoin miners in the world. Riot also hosts data centers for miners and manufactures electrical components and immersion-cooling technology for Bitcoin mining.

Riot has been in the news lately for its planned hostile acquisition of fellow Canadian miner Bitfarms (BITF). As of date, Riot owns 14.9% of Bitfarms’ common stock and has nominated three new members to the latter’s board. Meanwhile, Bitfarms resorted to the Poison Pill strategy to avert the takeover.

In its June trading update, Riot Platforms exceeded its Q2 targeted hash rate capacity, by reaching 22 EH/s (exahash per second). This was possible as Riot’s Corsicana mining facility started operations in June.

Furthermore, Riot produced 255 bitcoins in June, up 19% sequentially but down 45% year-over-year. As of June 30, Riot held 9,334 bitcoins in its treasury.

Riot is on track to achieve a total self-mining hash rate capacity of 31 EH/s by year-end 2024 and 41 EH/s by the end of 2025, by deploying more miners at the Rockdale facility and energizing full capacity at its Corsicana facility.

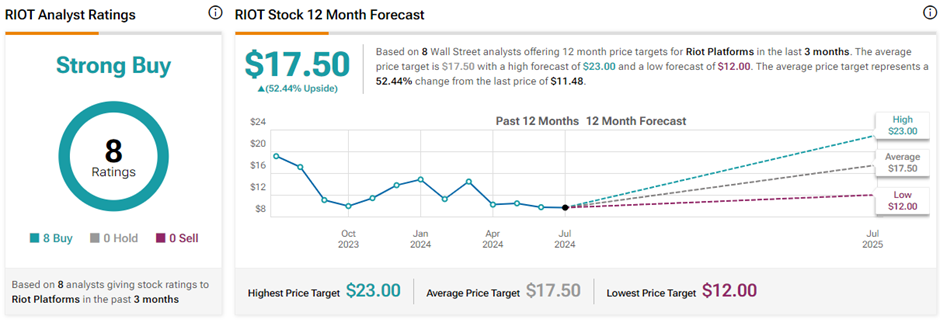

Is RIOT Still a Buy?

Eight analysts have given their unanimous Buy views on RIOT stock, leading to a Strong Buy consensus rating on TipRanks. Wall Street is optimistic about Riot’s growing hash rate capacity, low-cost mining operations, and solid balance sheet. Also, the average Riot Platforms price target of $17.50 implies 52.4% upside potential from current levels. Meanwhile, year-to-date, RIOT shares have lost 25.8%.

#2 Bit Digital (BTBT)

Bit Digital is a digital asset miner with mining operations in the U.S., Canada, and Iceland. Bit Digital uses carbon-free energy solutions for mining digital assets. Moreover, Bit Digital operates Bit Digital AI, offering specialized cloud infrastructure solutions for AI (artificial intelligence) applications.

In June, BTBT produced 61.7 BTC, down 2.5% from May 2024. At the end of the month, the company’s active hash rate was 2.57 EH/s. BTBT held 585.9 BTC and 29,927.9 Ethereum (ETH-USD) as of June 30, 2024.

Recently, the company expanded an existing customer contract to add 2,048 GPUs over a three-year term. The deal is expected to add additional revenue of $92 million on an annual basis for the next three years.

Is Bit Digital a Good Investment?

Three analysts have awarded a unanimous Strong Buy consensus rating for BTBT stock on TipRanks. The average Bit Digital price target of $5.83 implies a 38.8% upside potential from current levels. In the past six months, BTBT shares have gained over 51%.

#3 CleanSpark (CLSK)

CleanSpark is a sustainable Bitcoin mining company that uses renewable energy solutions such as nuclear, hydroelectric, solar, and wind to power its mining operations. The company operates data centers that run on low-carbon power and multiple mining facilities in Georgia, New York, and Mississippi.

As of June 30, CLSK had a hash rate of 20.4 EH/s, exceeding its half-year target of 20 EH/s, and growing 13.5% compared to May 2024. Also, CLSK mined 445 bitcoins in June and ended the month with 6,591 BTC in its treasury.

Remarkably, CleanSpark also announced a deal to acquire GRIID Infrastructure (GRDI) in an all-stock deal worth $155 million. The acquisition will significantly boost CLSK’s mining operations and hash rate capacity.

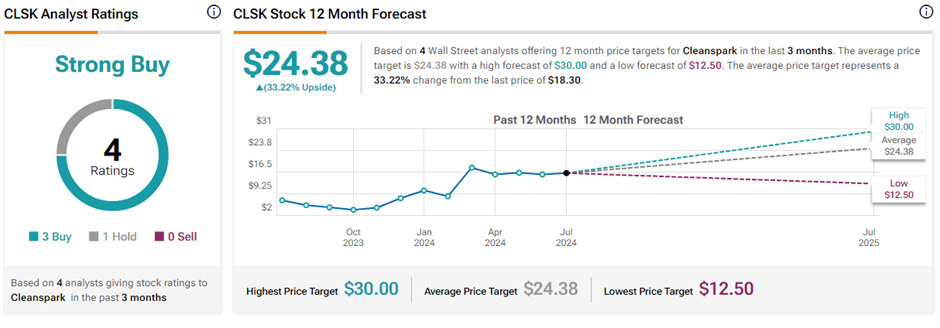

Is CleanSpark a Good Stock to Buy?

With three Buys and one Hold rating, CLSK stock commands a Strong Buy consensus rating on TipRanks. The average CleanSpark price target of $24.38 implies 33.2% upside potential from current levels. In the meantime, CLSK shares have zoomed over 65.9% so far this year.

Ending Thoughts

Investing in cryptocurrency miners carries a high risk-reward profile. Even so, investors looking to gain exposure to the rapidly evolving digital asset market might consider the aforementioned three cryptocurrency stocks to enhance their portfolio. These companies have received strong bullish ratings from analysts and show solid potential for share price appreciation.