Small-cap stocks often fly under the radar, but some are now drawing attention from Wall Street. Analysts have identified three such companies with strong fundamentals and growth potential, each offering more than 100% upside from current levels.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Let’s dive into the details. Click on any ticker to explore each stock further and decide if it deserves a spot in your portfolio.

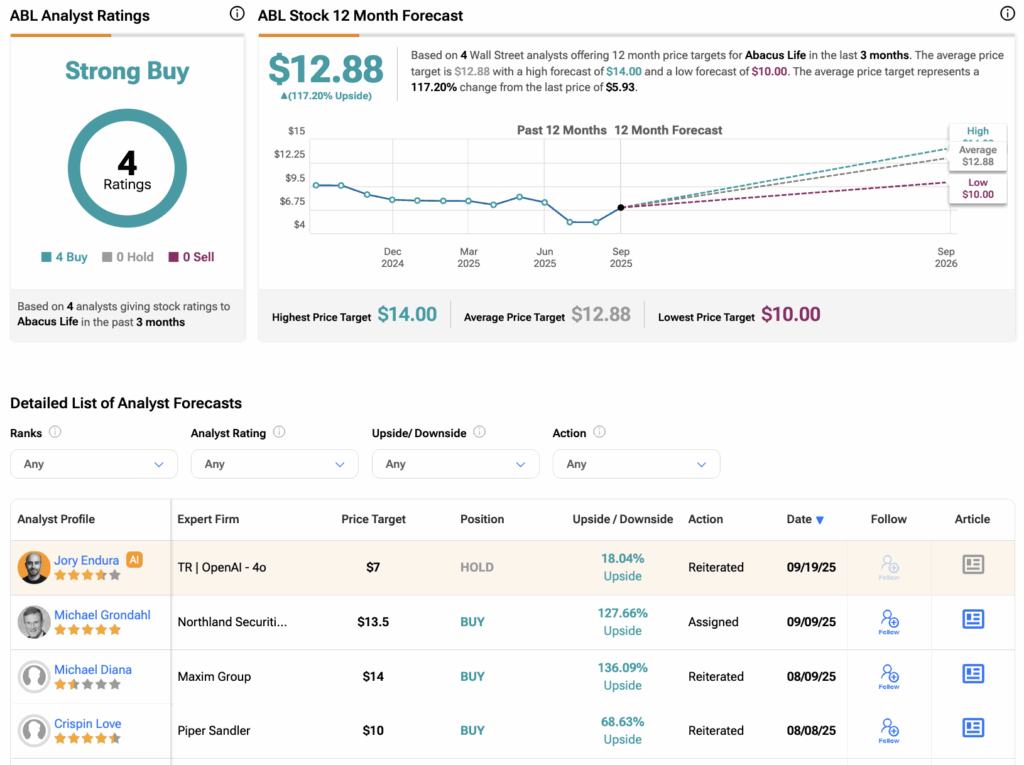

Abacus Life (ABL)

Abacus Life is an asset manager specializing in life settlements, acquiring life insurance policies to provide investors with uncorrelated, insurance-linked returns. Year-to-date, ABL stock has declined by 24.4%.

Overall, all four analysts currently covering ABL stock have issued Buy recommendations. Meanwhile, the Abacus Life’s stock price target of $12.88 suggests over 117% upside from current levels.

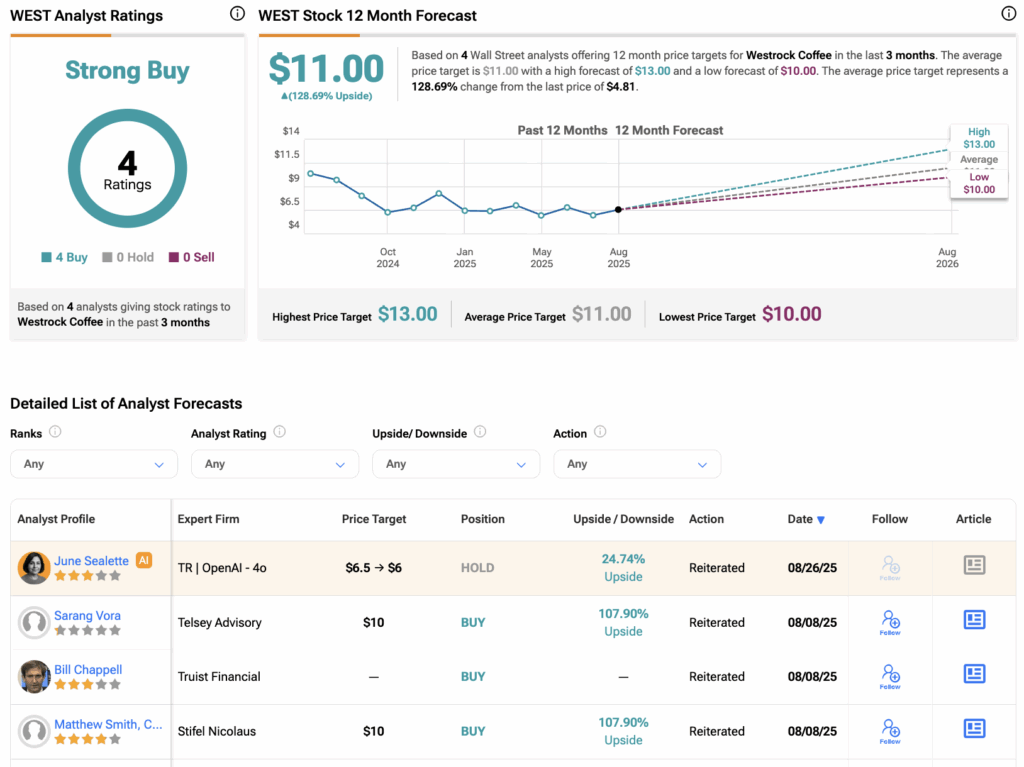

Westrock Coffee (WEST)

Westrock Coffee is a vertically integrated beverage solutions provider specializing in ethically sourced coffee, tea, and extracts. WEST stock has declined by 25% year-to-date in 2025.

Looking ahead, analysts are strongly bullish on WEST stock. On TipRanks, the stock has all Buy recommendations from four analysts. Meanwhile, Westrock Coffee’s average stock price target of $11.0 suggests a potential upside of 128% from current levels.

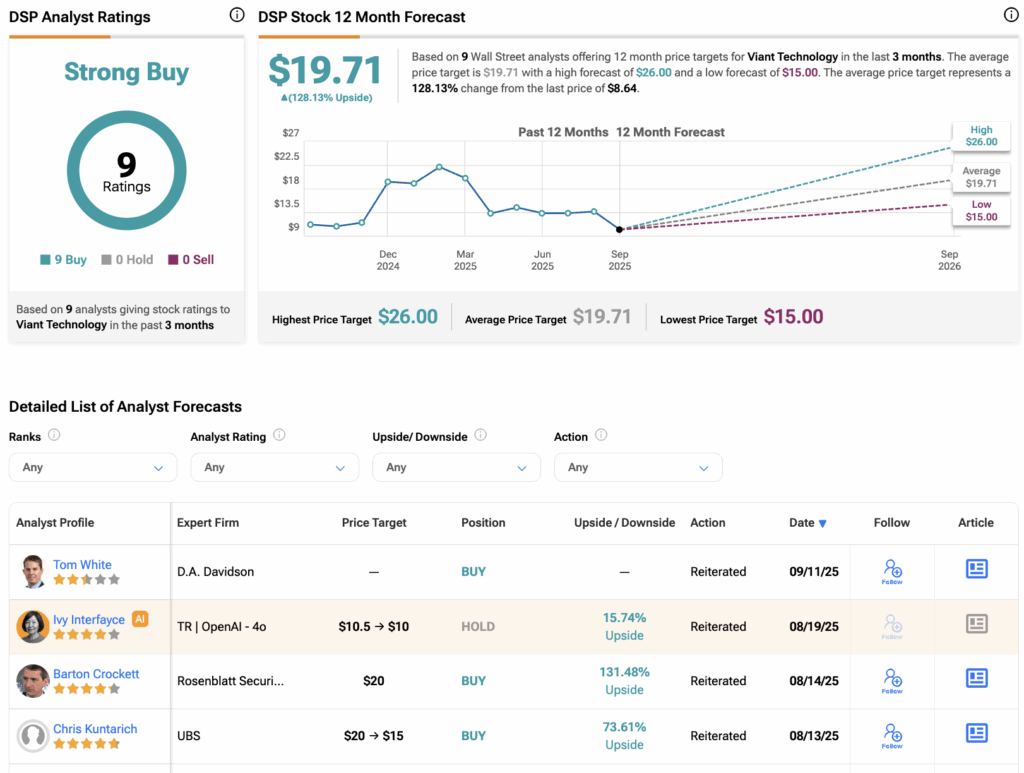

Viant Technology (DSP)

Viant Technology is an ad tech company offering AI-powered programmatic advertising solutions. Year-to-date, DSP stock has declined by 54%.

Overall, DSP stock has received all Buy ratings from the nine analysts covering the stock. Meanwhile, Viant Technology’s stock price target of $19.71 suggests a potential upside of 128.13% from current levels.