In this article, I’ll outline the reasons why I view CHWY stock as a “Buy” as the company approaches its earnings day.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

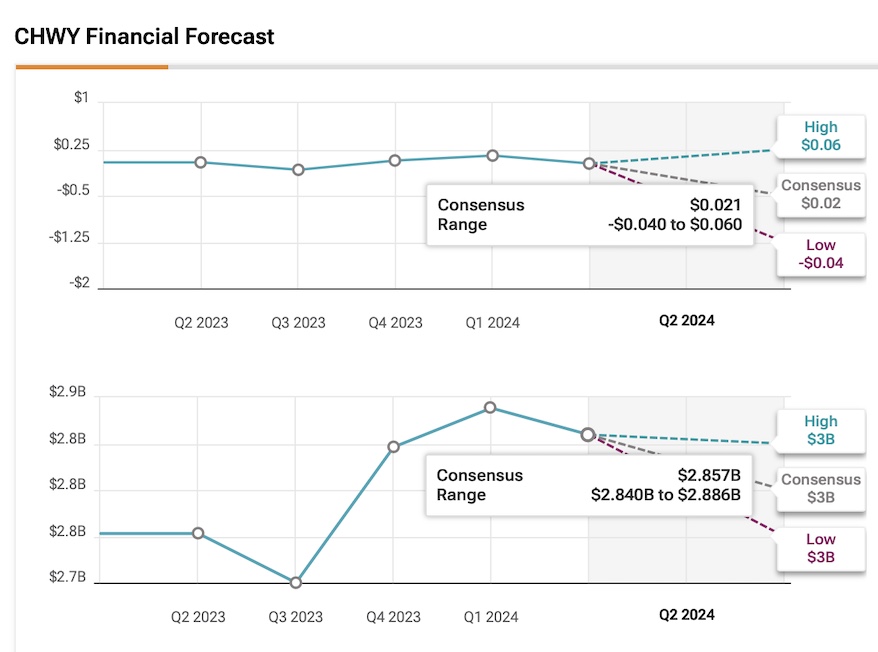

On August 28, pet retailer Chewy (CHWY) will release its second-quarter earnings report. I believe the company is well-positioned to deliver strong results, highlighting its long-term growth drivers. Wall Street expects Chewy to report earnings per share (EPS) of $0.02 and revenues of $2.85 billion, representing annual growth of 38.3% and 2.7%, respectively.

Overall, Chewy’s investment thesis centers around its strong market position in the pet industry, recurring revenue model, improving financial metrics, and current attractive valuation. These factors make the stock a compelling buy for long-term investors.

Therefore, I believe the July quarter will reaffirm the attractiveness of CHWY as a long-term investment. I will explore the details behind my bullish stance further below.

1. Chewy’s Strong Long-Term Growth Drivers

The short-term outlook typically drives attention ahead of earnings, but Chewy’s bullish thesis becomes more compelling when considering the company’s long-term drivers.

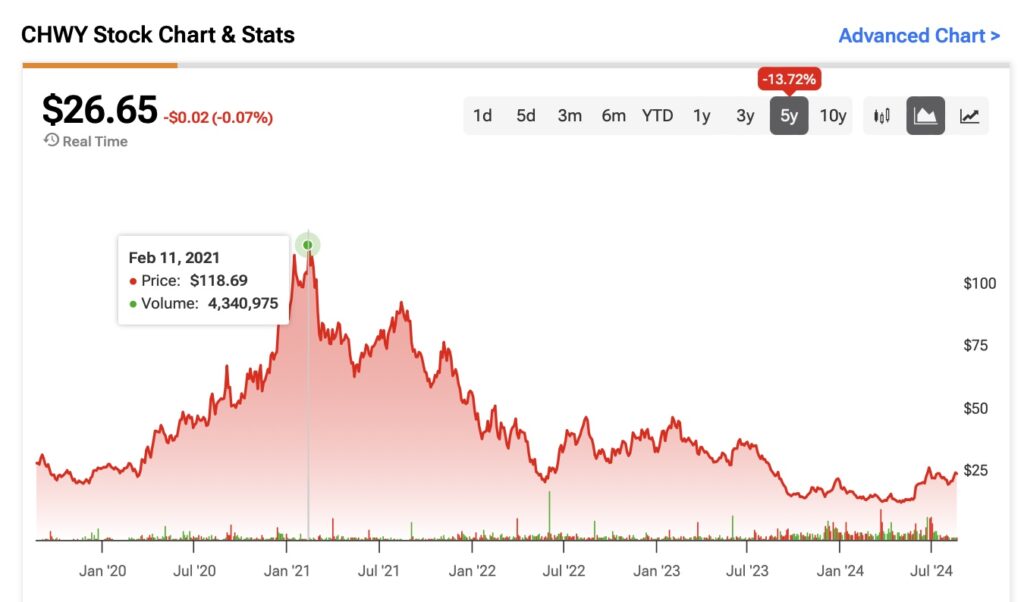

First, it’s important to recognize that Chewy’s sales growth will not come close to matching the explosive rates experienced during the pandemic. During that period, stay-at-home trends boosted its revenues by approximately 47% between 2020 and 2021. Chewy’s shares surged up to 300% from January to February 2021.

However, as these trends faded, the company’s revenue growth rate slowed significantly, dropping to just 3% in the most recent quarter. This deceleration explains why the stock has declined by 77% from its peak.

Even so, in the current context, this doesn’t mean that Chewy isn’t well-positioned to benefit from long-term growth drivers. Management is guiding for a 4% to 6% net sales growth this year, with 2% to 3% expected in Q2. The higher end of the range is expected to be achieved due to a stronger second half of the year. Furthermore, Chewy is anticipated to accelerate its sales growth next year as it expands into new markets, including Canada.

As an e-commerce company with a low-margin and recurring revenue model, Chewy’s business relies heavily on its Autoship program. Approximately 77% of Chewy’s sales come from this recurring revenue stream. Given this reliance, recurring sales growth is arguably the most critical metric to monitor.

However, on the profitability side, Chewy’s management has effectively improved margins, with the net profit margin rising from 0.8% to 2.3% over the past twelve months. Additionally, Chewy is expanding its product portfolio with offerings like pet health insurance, which are expected to strengthen margins further. I believe the company’s Q2 results will likely reinforce these long-term trends.

This is likely why analysts are projecting a 36.5% increase in Chewy’s earnings per share (EPS) growth rate for fiscal 2025, followed by a further 15.8% growth in fiscal 2026. Such projections reflect a more than 50% improvement in profitability within less than two years, highlighting a significant turnaround.

2. Signs of Stabilization in Active Customers

The company’s active customer base supports Chewy’s bullish outlook. Since recurring sales account for most of Chewy’s revenue, maintaining a strong user base is crucial for healthy revenue growth.

Chewy’s active customer numbers peaked at 20.7 million in the fourth quarter of 2021. However, this number has gradually decreased over the past few years, with the most recent quarter showing 19.9 million – a 3% drop over the period. This decline occurred during a period of imbalance between pet adoption and relinquishment. Nevertheless, there are signs that this trend may be reversing. As Chewy’s CEO Sunit Singh mentioned in the latest earnings call:

“Based on data from our shelter and rescue partners, we saw healthy growth rates in Q1 adoption year-over-year. While it is premature to declare an industry turnaround, we maintain that the pet industry is on track towards normalization.”

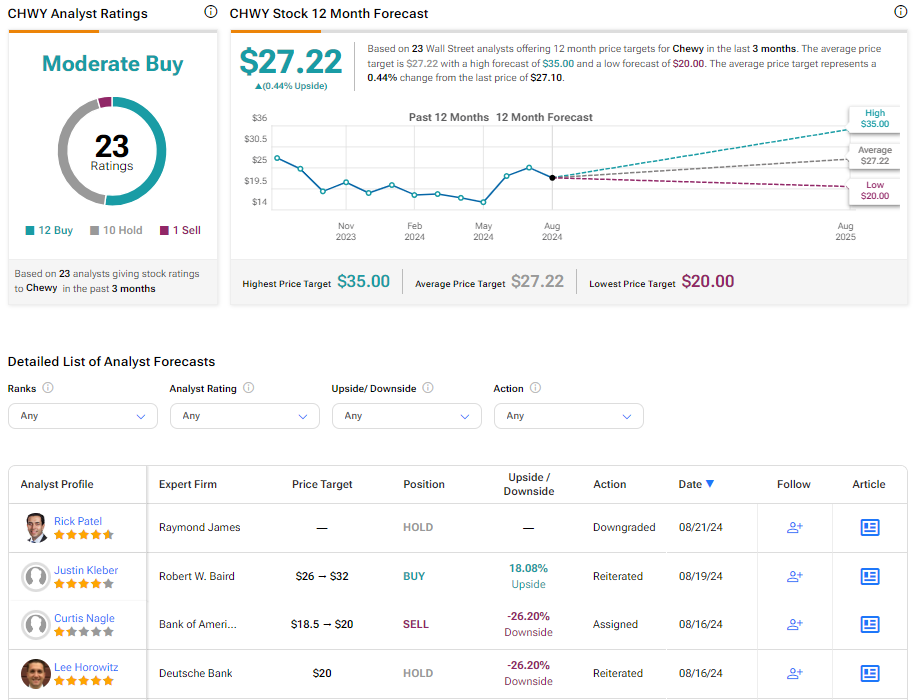

In other words, this suggests that the number of active customers could soon stabilize and potentially increase. According to Baird analyst Justin Kleber, who recently raised his price target on Chewy from $26 to $32, an immediate turnaround in net additions this quarter is not expected. However, he believes active customers have reached a low point and could start growing again later this year.

3. Chewy’s Attractive Valuation

Lastly, Chewy’s current valuation adds to the bullish case, making it a potentially wise move to buy before Q2 results are announced.

The company’s forward P/E ratio of 28.3x is the lowest in several years. While this still appears high compared to the industry average of 15x, it is important to consider future growth prospects. With an estimated average earnings growth rate for the next 3-5 years of 115%, Chewy’s forward PEG ratio stands at only 0.25x, suggesting that the stock is likely undervalued.

Furthermore, Chewy recently announced its first-ever stock buyback program, totaling $500 million – an impactful amount given that Chewy’s market cap is $11.73 billion. This move underscores the company’s commitment to returning value to its shareholders and typically indicates that the management, who knows the company best, believes its shares are undervalued.

Is CHWY A Buy, According to Wall Street?

Although the consensus average price target for CHWY is $27.22, indicating a modest potential upside of about 0.44% from the current share price, Wall Street analysts remain predominantly bullish. Of the 23 analysts covering the stock, 13 have a “Buy” recommendation, 9 have a “Hold” recommendation, and only 1 has a “Sell” recommendation, resulting in a “Moderate Buy” consensus rating.

Key Takeaways

I’m bullish on CHWY stock ahead of its Q2 earnings due to its strong growth drivers, such as expected sales growth and market expansion, stemming from its recurring revenue model. Signs of stabilizing active customers and an attractive valuation, highlighted by a $500 million stock buyback program, further reinforce the investment case, making CHWY a compelling buy for long-term investors.