In a crowded ETF landscape, finding proven performers is key. TipRanks’ ETF AI Analyst selects three ETFs offering with an Outperform rating and at least 10% upside.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

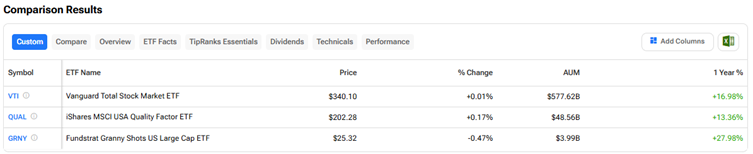

See how these ETFs compare on key metrics using TipRanks’ ETF Comparison Tool.

- Vanguard Total Stock Market ETF (VTI) — The VTI ETF tracks the CRSP U.S. Total Market Index. It provides exposure to large-, mid-, and small-cap stocks diversified across growth and value styles. The ETF AI Analyst has a price target of $377 for the VTI ETF, implying about 11% upside potential. The AI Analyst’s bullish stance is based on the strong performance of holdings like Apple (AAPL) and Microsoft (MSFT).

- iShares MSCI USA Quality Factor ETF (QUAL) — The QUAL ETF tracks the results of an index composed of U.S. large- and mid-capitalization stocks. It offers exposure to profitable U.S. companies that have low leverage and deliver consistent earnings over time. The ETF AI Analyst has a price target of $225 for the QUAL ETF, indicating an upside potential of 11.2%. The fund’s Outperform rating is based on top holdings, such as Apple and Microsoft.

- Fundstrat Granny Shots U.S. Large Cap ETF (GRNY) — The GRNY ETF seeks to offer the growth and stability of the U.S. large-cap equity market. The ETF AI Analyst has a price target of $28 for the GRNY ETF, indicating an upside potential of about 11%. The fund’s Outperform rating is based on high-quality companies like Alphabet (GOOGL), which is gaining from growth in artificial intelligence (AI) and cloud, and Monster Beverage (MNST), which shows robust performance and a bullish outlook.

Power up your ETF investing with TipRanks. Discover the Best AI ETFs, carefully curated based on TipRanks’ analysis.