NetEase, Trip.com, and JD.com are the 3 Best Chinese Stocks to Buy in June 2024, according to Wall Street analysts. We leveraged the TipRanks Stocks Comparison tool for Chinese stocks to select the three companies with a Strong Buy consensus rating and attractive upside potential. Chinese stocks have always drawn investors’ attention due to their prospects in the world’s second-largest country by population.

However, investors are often skeptical about these stocks due to the high regulatory risks associated with Chinese companies and the growing tensions between the U.S. and China.

Having said that, investors with an apt risk-reward appetite can consider having some exposure to Chinese companies in their portfolios for diversification and better returns. Several Chinese companies boast very advanced technology and have state-of-the-art manufacturing capabilities, making their offerings very competitive. With this background in mind, let’s delve into the three Strong Buy Chinese stocks.

#1 NetEase, Inc. (NASDAQ:NTES)

NetEase is a prominent Chinese internet company that develops and operates some of the most popular and longest-running mobile and PC games in China and globally. It specializes in online games, e-commerce retailing, and email offerings. The company also owns Cloud Music, a leading music streaming platform. Plus, it owns a majority-controlled subsidiary Youdao, which specializes in intelligent learning. NetEase is listed on the Hong Kong Stock Exchange and Nasdaq in the U.S. (through ADS or American Depositary Shares).

NTES pays a regular quarterly dividend of $0.495 per ADS, reflecting an attractive yield of 2.89%. Under a share repurchase plan that commenced on January 10, 2023, the company has repurchased ADS worth $811 million.

In Q1 FY24, NetEase exceeded both revenue and adjusted earnings per ADS estimates. Net revenues grew 7.2% to RMB26.9 billion (or $3.72 billion), backed by solid demand for the company’s games. Further, adjusted earnings per ADS increased 7.1% year-over-year to $1.81.

Is NetEase a Good Stock to Buy?

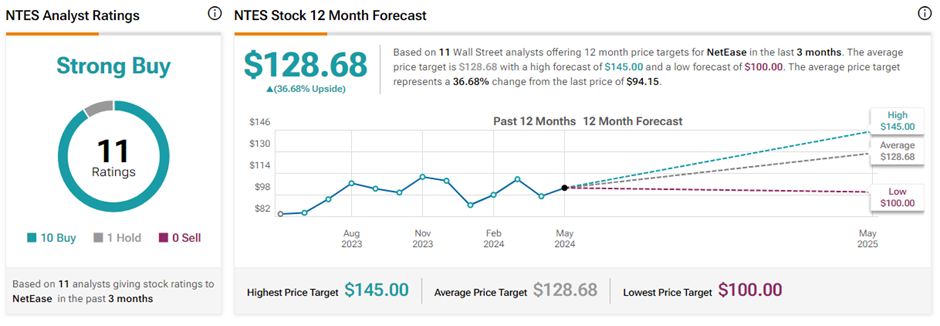

With ten Buys and one Hold recommendation, NTES stock commands a Strong Buy consensus rating on TipRanks. The average NetEase price target of $128.68 implies 36.7% upside potential from current levels. In the past year, NTES shares have gained 3%.

#2 Trip.com Group Ltd. (NASDAQ:TCOM)

Trip.com has emerged as one of the best global travel service providers. It operates through various platforms including Trip.com, Ctrip, Skyscanner, and Qunar. The company’s services include cost-effective air travel booking, hotel reservations, packaged tours, corporate travel management, and advertising.

In Q1 FY24, TCOM’s adjusted earnings of $0.83 per ADS almost doubled from the prior-year period, while beating the analysts’ consensus. Meanwhile, net revenue jumped 29% year-over-year to $1.6 billion and surpassed the consensus. TCOM’s robust Q1 performance was backed by more than 20% increase in both Domestic hotel and air bookings and over a 100% jump in Outbound hotel and air bookings compared to the same period last year.

The strong resurgence in travel demand in China and worldwide has led to Trip.com’s improved performance. Bookings momentum is expected to rise in the coming quarters, aiding Trip.com and its units in bolstering their performance. Importantly, TCOM recently announced the issuance of $1.3 billion of convertible bonds to reduce debt and increase liquidity. At the same time, the company intends to buy back shares worth $300 million to reduce the dilutive effect of the convertible bonds.

What is the Price Target for TCOM?

On TipRanks, the average Trip.com Group price target of $68.06 implies 31.8% upside potential from current levels. Also, TCOM stock has a Strong Buy consensus rating based on 14 unanimous Buys. In the past year, TCOM shares have gained 47.1%.

#3 JD.com (NASDAQ:JD)

JD.com is one of the largest Chinese e-commerce companies based on transaction volume and revenue. It operates several successful business lines, including retail, technology, logistics, healthcare, property development, industrial technology, and insurance. Backed by innovative robotics and automation technology, JD is also one of the largest players in the supply chain market.

Interestingly, JD.com boasts a healthy dividend yield of 2.47%, paying a regular annual dividend of $0.74 per share. The company also undertakes regular share buybacks to reward shareholders. As of May 15, 2024, JD had $2.3 billion outstanding under its current share repurchase program.

JD.com easily outpaced analysts’ estimates for the first quarter of Fiscal 2024. The company’s consolidated revenues grew 7% year-over-year, while adjusted earnings per ADS rose 18.7%. JD’s efforts to enhance user experience drove a higher number of active users and strengthened user engagement.

The company has strategically shifted its focus toward high-growth items, such as grocery and healthcare, to offset the diminishing demand for electronics and home appliances. Moreover, JD announced the issuance of $1.75 billion in convertible senior notes to repurchase shares.

Is JD a Good Stock to Buy?

With 16 Buys and five Holds, JD stock has a Strong Buy consensus rating on TipRanks. The average JD.com price target of $38.65 implies 26.4% upside potential from current levels. In the past year, JD shares have declined nearly 19%.

Key Takeaways

Chinese companies are world leaders in electric vehicles (EVs) and technological advancements, making them interesting stocks to invest in. Investors can consider the aforementioned three Chinese stocks after thorough research.