IPOs don’t always get the attention they deserve, yet they play a vital role in renewing the stock market. They bring new companies to market, inject additional capital, and open up new opportunities for investors. In that sense, IPO also serves as a clear barometer of broader economic health.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In this past year, we’ve seen the IPO market stabilize after several years of large-scale uncertainties – think post-COVID economic disruptions, the high inflation, and the policy shake-up that accompanied the start of Trump’s second term – but now the effects of those headwinds have been factored in.

The numbers help tell the story. In 3Q25, 100 companies went public, raising a combined $21.2 billion. That marked a 67% increase in IPO count versus 3Q24, while total proceeds nearly doubled.

With issuance picking up, investors are being presented with a growing roster of newly public companies. J.P. Morgan analysts have been closely tracking the rebound and have flagged two recent IPOs they believe offer attractive entry points.

That view is shared more broadly, as TipRanks data shows both stocks also carry Buy ratings from other Wall Street analysts. Let’s take a closer look.

BillionToOne (BLLN)

We’ll start in the medical world with BillionToOne, a company focused on molecular diagnostics – a precision-driven field that examines DNA, RNA, and proteins to uncover genetic markers that can detect disease, assess risk, and guide more personalized treatment decisions. By using tools such as gene sequencing and PCR, molecular diagnostics can pinpoint minute changes in genetic code – subtle shifts that can have outsized clinical consequences.

That need to detect rare, meaningful signals amid vast genetic data is exactly where BillionToOne’s technology comes into play. The company’s proprietary QCT platform – short for quantitative counting templates – is designed to identify these small but clinically significant alterations using minimal amounts of cell-free DNA. In practical terms, this allows physicians to extract actionable diagnostic insights from a simple blood draw, making the approach especially well suited to prenatal screening and oncology.

Currently, BillionToOne has three main products on the market, using its QCT methodology. These are Unity Complete, Northstar Select, and Northstar Response. Unity is currently the only commercially available non-invasive screening test for various important fetal risk assessments – including aneuploidies, recessive conditions, and fetal antigens. The test is conducted with a maternal blood draw at 9+ weeks of pregnancy. The Northstar products are liquid biopsy tests, used in selecting oncological therapy options and in monitoring treatment response.

BillionToOne has protected its technology with more than 90 patents issued or pending. The company has conducted over 1 million molecular tests.

That combination of differentiated technology, commercial traction, and scale set the stage for the company’s move into the public markets. On November 5, BillionToOne announced the pricing of its IPO and closed the offering on November 7. In total, the company sold 5,233,765 shares, including the full exercise of the underwriters’ option for 682,665 shares, raising $314 million in gross proceeds before expenses.

After the IPO, in December, BillionToOne released its 3Q25 financial results. The company reported $83.5 million at the top line, beating the forecast by $623,300. At the bottom line, the company’s 10-cent GAAP EPS was 22 cents per share worse than had been expected.

That earnings miss hasn’t distracted J.P. Morgan analyst Casey Woodring, who maintains an upbeat view of the company, pointing to the strength of its underlying technology and operating performance as the key drivers of the long-term story.

“BLLN’s technical edge is translating into strong commercial momentum in its Prenatal testing portfolio and is driving rapid adoption of its Oncology testing portfolio. Additionally, BLLN has demonstrated a proven ability to reduce cost of goods sold through workflow improvements and to scale efficiently with disciplined capital deployment, resulting in gross margins and operating margins above its peers. We forecast above-market growth over the coming years as the company expands its salesforce, which remains relatively small compared to peers, supporting healthy margin expansion while also generating peer-leading free cash flow. Overall, we believe BLLN’s premium to the diagnostics peer group is justified, and as such, we rate BLLN as Overweight,” Woodring noted.

The Overweight (i.e., Buy) rating is paired with a $145 price target that suggests a 12-month gain of 70%. (To watch Woodring’s track record, click here)

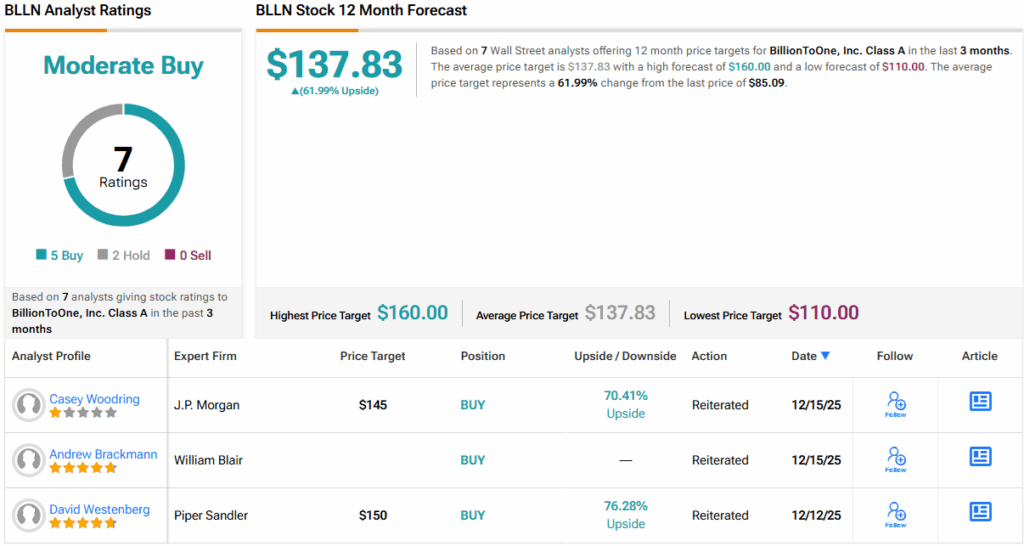

Overall, BLLN carries a Moderate Buy consensus, backed by 7 recent analyst reviews, including 5 Buys versus 2 Holds. With shares trading at $85.09, the Street’s average price target of $137.83 suggests a compelling 62% upside over the coming year. (See BLLN stock forecast)

Grupo Aeromexico (AERO)

The second JPM pick is Grupo Aeromexico, the holding company that owns Aeromexico, Mexico’s principal airline company – and the only full-service carrier airline fully based in that country. Aeromexico has been in operation since 1934. Its headquarters are located in Mexico City, and it operates important hubs in Guadalajara and Monterrey. On average, the airline operates more than 500 daily flights.

Aeromexico prides itself on being a modern airline, with all the amenities that international travelers have come to expect. These include full meal services, seating choices with options for increased legroom, and first-class cabins. Aeromexico offers digital options for travelers to manage their flight plans and itineraries, smooth out a digital check-in process, and complete check-in via the company’s app.

When it comes to the airplanes, Aeromexico operates a fleet of 162 modern airliners (as of September 2025). The bulk of the company’s fleet is made up of Boeing products – late-model variants of the 737 and 787 commercial passenger aircraft. Keeping the fleet entirely from Boeing allows the company to streamline its flight and ground crew training, maintenance training and scheduling, and spare parts procurement.

Grupo Aeromexico returned to the public markets this past November, marking its first time trading since completing a bankruptcy restructuring three years earlier. In the IPO, AERO shares began trading at $19 per American depositary share (ADS), broadly in line with expectations. The offering raised about $222.8 million from investors.

JPM analyst Guilherme Mendes, an expert on the Latin American transportation sector, sees plenty of reasons to take a bullish stance on Aeromexico: “We rate Aeromexico Overweight based on: (i) its strong market position and premium pricing power, supported by a diversified customer base and high share of USD-denominated revenues; (ii) a young, efficient fleet and ongoing cost discipline, resulting in competitive margins; (iii) decent cash flow generation and relatively unlevered balance sheet; and (iv) room for a valuation re-rating, as we see upside from a potential demand recovery and increasing fleet utilization, although we acknowledge that growth is likely to be more moderate than peers’.”

That Overweight (i.e., Buy) rating comes with a $28.50 price target, signaling confidence in a 28% upside over the next year. (To watch Mendes’ track record, click here)

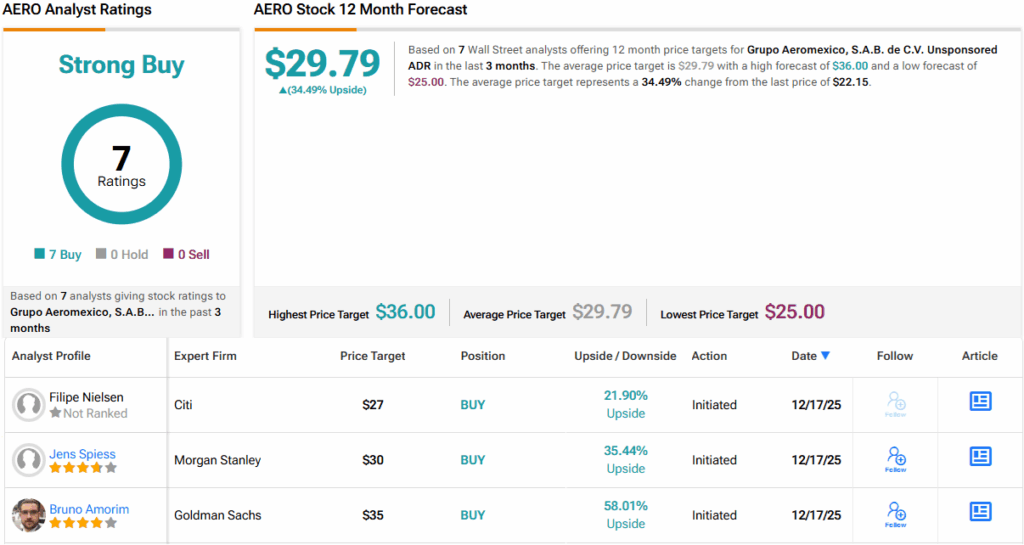

Wall Street broadly agrees. All 7 recent analyst reviews on the stock are positive, giving AERO shares a unanimous Strong Buy consensus. With the stock trading at $22.15, the $29.79 average price target suggests a potential 34% one-year gain. (See AERO stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.