Using TipRanks’ Stock Screener Tool, we selected the 2 Best Canadian Penny stocks to buy in the week of June 24-28. These two penny stocks have a Strong Buy consensus rating from analysts and could offer solid share price appreciation in the next twelve months. In Canada, a penny stock is defined as a company whose shares are trading at less than C$5 per piece.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Investing in penny stocks has its share of merits and demerits. An investor having a high risk-return appetite can consider penny stocks, as they have the capacity to generate enormous returns with their highly volatile nature. With this background in mind, let’s understand more about the two penny stocks.

Lithium Ionic Corp. (TSE:LTH)

Ontario-based Lithium Ionic Corp. is a Canadian mining company. LTH engages in the exploration and development of lithium in the Bandeira Lithium Project, located in Minas Gerais state, Brazil. The company claims to be a near-term producer of high-quality, low-cost lithium concentrates, with the aim of supporting the growing EV (electric vehicle) transition and battery supply chains.

Lithium Ionic is a pre-revenue company. In Q1 FY24 results, the company’s net loss narrowed from C$0.22 per share in the prior year quarter to C$0.05 per share. The expenses related to the acquisition of Neolit property in Q1 FY23 led to a higher loss in the prior-year quarter.

Is Lithium Ionic Corp a Buy?

Based on the huge demand potential for lithium, analysts are highly bullish about Lithium Ionic Corp. stock’s trajectory. On TipRanks, LTH stock has a Strong Buy consensus rating, backed by three unanimous Buy ratings. The average Lithium Ionic Corp. price target of C$3.42 implies a massive 545.3% upside potential from current levels. Year-to-date, LTH shares have declined 69.7%.

Green Impact Partners (TSE:GIP)

Green Impact Partners aims to create a sustainable, clean energy world by focusing on renewable natural gas (RNG). The company develops, builds, acquires, and operates RNG projects across North America.

In Q1 FY24, GIP’s revenues plunged 13.4% year-over-year to C$33.32 million. At the same time, the company reported a diluted loss of C$0.25 per share, against a diluted profit of C$0.22 per share reported in the prior year period. The lower revenues were attributed to declining revenue from the company’s Energy Product Optimization Services. The unit experienced lower production volumes and decreased oil prices as compared to Q1 FY23.

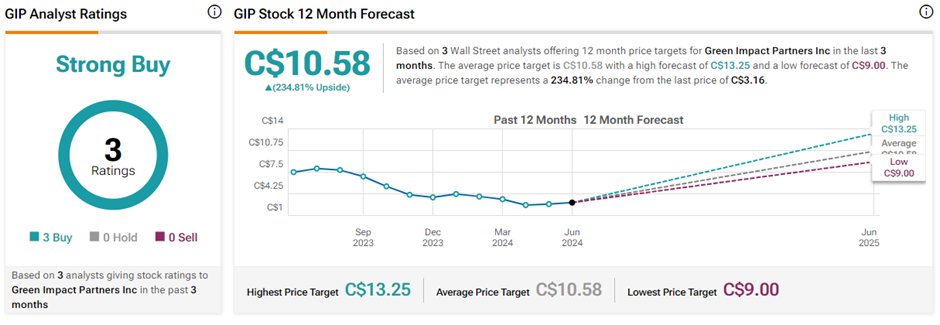

What is the Price Target for GIP Stock?

On TipRanks, the average Green Impact Partners price target is C$10.58, which implies an impressive 234.8% upside potential from current levels. Also, GIP stock has a Strong Buy consensus rating based on three unanimous Buy recommendations. Meanwhile, GIP shares have lost 28.3% of their value so far this year.

Key Takeaways

Investing in penny stocks requires a reasonable risk appetite. The two penny stocks discussed here could deliver solid returns, as reflected in analysts’ bullish views. Investors seeking exposure to attractive penny stocks can consider them after thorough research.