Shares of 1stdibs.com, Inc. (DIBS) were down almost 19% in Wednesday’s extended trading session after the company delivered weak debut second-quarter earnings results since its IPO in June this year.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

1stdibs.com is an e-commerce company with a leading online marketplace that sells luxury items like furniture, home décor, fine art, and jewelry. Currently, the company has a market capitalization of about $656 million. (See 1stdibs.com stock charts on TipRanks)

The company reported a net loss of $0.44 per share in Q2 versus a loss of $0.63 per share in the prior-year period.

Additionally, revenues jumped 29% year-over-year to $24.7 million compared to $19.1 million in the prior-year quarter. The increase in revenues reflected a 34% surge in Gross Merchandise Value (GMV) and a 29% increase in seller marketplace services revenue to $23.8 million.

On the negative side, the adjusted EBITDA margin worsened to (12.3%) compared to (10.7%) in the prior-year quarter.

Follwing the release of the Q2 results, 1stDibs CEO David Rosenblatt commented, “We are excited about the opportunity ahead of us, as luxury design continues to move online.”

Rosenblatt further added, “In addition to the secular shift to digital, we have an ambitious roadmap and are investing in multiple growth opportunities like new buyer activation and international expansion.”

Looking forward, for Q3, the company forecasts revenues to be in the range of $23.6 – $24.3 million. However, the company expects a negative adjusted EBITDA margin range of -18% to -21%.

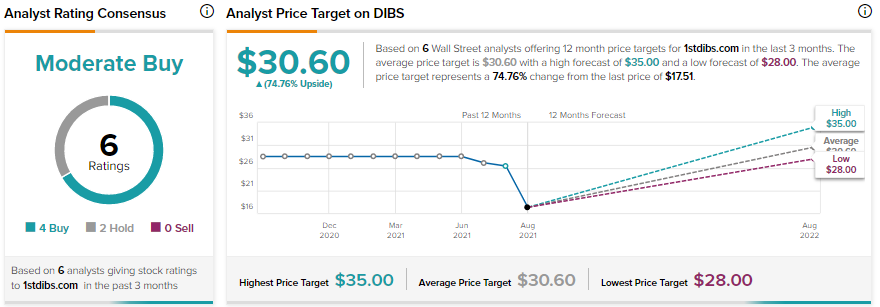

Ahead of the Q2 results, Evercore ISI analyst Mark Mahaney reiterated a Hold rating on the stock with a price target of $29 (65.6% upside potential).

Overall, the stock has a Moderate Buy consensus rating based on 4 Buys and 2 Holds. The average 1stdibs.com price target of $30.60 implies 74.8% upside potential from current levels.

Related News:

Upstart Holdings’ Q2 Revenues Grow Over 1,000%; Shares Leap 18%

Beauty Health Q2 Revenues Grow 372%; Shares Soar 6% After-Hours

TaskUs Delivers Strong Q2 Results