There’s no doubt that overall market sentiment this year has been positive. However, try telling that to Ford (NYSE:F) investors, who have seen their stock slide by 14.5% year-to-date.

That doesn’t quite tell the full story, though, as the plunge into the red was triggered by a lackluster Q2 performance, with the stock taking a heavy beating in the subsequent session.

So, is this a good opportunity to jump in? Despite the recent challenges, Bank of America analyst John Murphy remains optimistic about Ford’s prospects.

Murphy concedes recent quality issues and launch execution have been “short of stellar,” and require improvement. “However,” he goes on to add, “a keen focus on product cadence and practical incremental profit opportunities should position Ford to grow earnings structurally.” A clear example of this is the potential of Ford Pro’s service and software offerings, while a more subtle opportunity lies in gradually applying its expertise to the retail sector. “These opportunities to strengthen the Core business should further bolster earnings, cash flow, and the balance sheet enabling further investment in the future,” Murphy explained.

On EVs, Murphy also notes the transition has “created new challenges,” but the company seems to be making headway in lowering the costs associated with them.

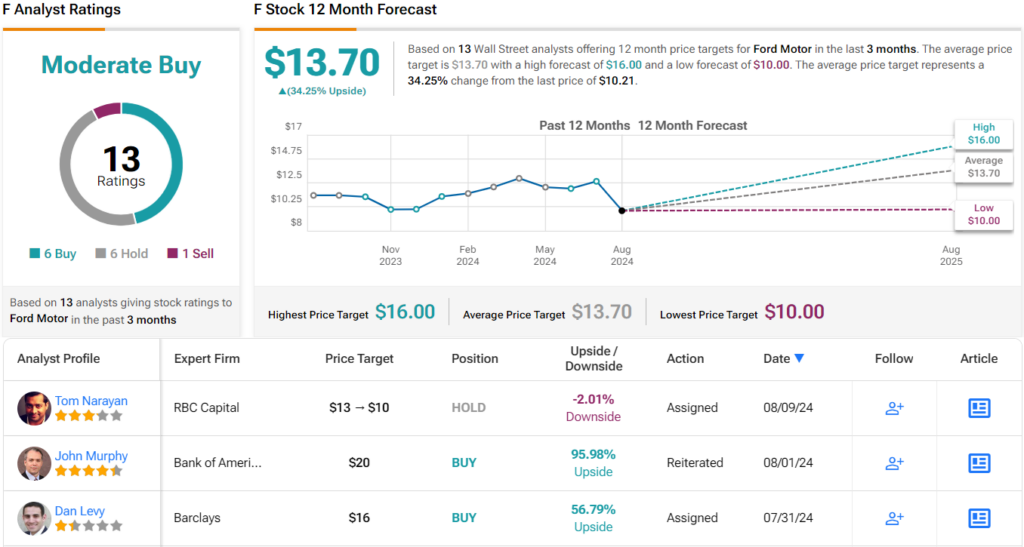

Overall, Murphy is bullish indeed. Along with a Buy rating, his Street-high price objective of $20 offers one-year upside of a hefty 97%. (To watch Murphy’s track record, click here)

On the other hand, RBC analyst Tom Narayan takes a more measured stance. That is partly down to investors taking a preference to Motor City rival, General Motors. While both Ford and GM boast a similar cash position, unlike its competitor, Ford is “not buying back its stock as aggressively.”

Over the past 12 months alone, GM has slashed its share count by 18%, and in June, gave the go-ahead for another $6 billion share repurchases, representing an additional 12.5% of the market cap. According to Narayan, “many investors we have spoken to continue to favor GM given differing capital return profiles.”

Accordingly, Narayan rates F stock as Sector Perform (i.e., Neutral), along with a $10 price target, suggesting the stock is now fully valued. (To watch Narayan’s track record, click here)

The rest of the Street is almost evenly split, with 5 Buy recommendations, 5 Holds, and 1 Sell, making the consensus view a Moderate Buy. That said, on where the share price is heading, the bulls take the lead; the average price target currently stands at $13.70, implying the stock will generate returns of 34% in the year ahead. (See Ford stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.