Stockakia - New Portfolio

Plu

StockakiaIndividual Investor

Ranked #35,504 out of 788,374 TipRanks' Investors

Success Rate

26 out of 40

profitable transactions

profitable transactions

Average Return

92.99%

Average return

per transaction

per transaction

Share this portfolio:

Allocation

Top Stocks

38.08% LMT

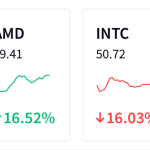

31.93% AMD

14.60% PLTR

14.45% NFLX

0.95% PSNY

By Assets

100.00% Stocks

0.00% ETFs

0.00% Funds

0.00% Cryptocurrency

0.00% Cash

By Sector

46.52% Technology

38.08% Industrials

14.45% Communication Services

0.95% Consumer Cyclical