The video conferencing company Zoom Video Communications (ZM) is set to release its Q3 FY25 results on November 25. ZM shares have rallied 27% over the past year, reflecting optimism about the company’s new artificial intelligence (AI) products. Coming to Q3 FY25, Wall Street analysts expect the company to report earnings of $1.31 per share for Q3, up 2% year-over-year. Meanwhile, analysts expect revenues to increase 2% year-over-year to $1.16 billion in Q3.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

It is worth noting that Zoom has a very strong track record of beating market expectations and has surpassed earnings estimates in each of the each of the last nine quarters.

Analysts’ Views Ahead of Zoom’s Q3 FY25 Results

Ahead of Q3 FY25 results, Scotiabank analyst Allan Verkhovski initiated coverage on Zoom with a Hold rating and a price target of $85, citing valuation concerns. However, he believes the launch of AI Companion 2.0 could enhance customer retention and growth.

Similarly, Jefferies analyst Samad Samana also maintained a Hold rating on Zoom, noting that while lower churn rates in its online business are a positive sign, significant AI investments raise concerns about capital expenditures. Samana set a price target of $70 for ZM stock.

Here’s What Zoom’s Q3 Website Traffic Data Reveals

Being a cloud-based video conferencing company, tracking user visits to its website is crucial for determining the ongoing popularity of its solutions. As Zoom makes the majority of its money through subscriptions to its communications platform, more visits might lead to more subscriptions, resulting in more revenues for the firm, and vice versa.

Therefore, we investigated Zoom’s monthly user data using TipRanks’ website to get a clearer view of the company’s current status ahead of the Q3 print.

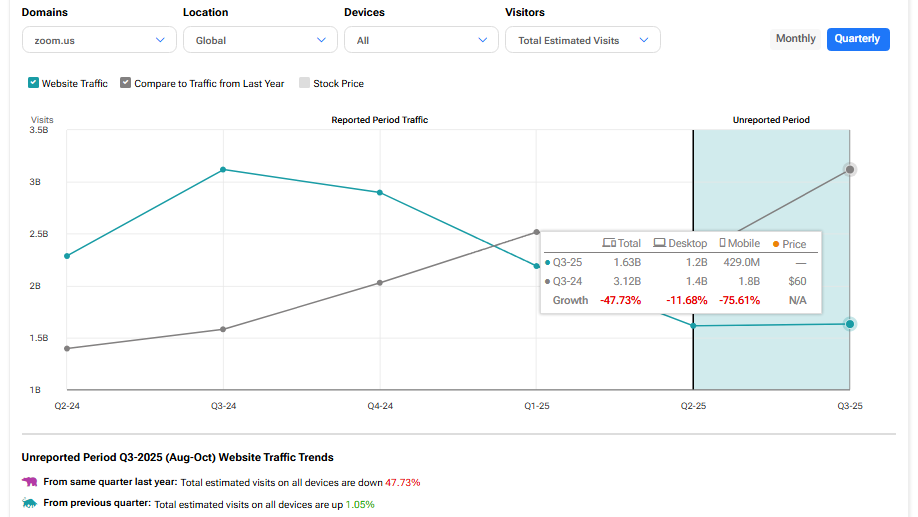

When taking a look at Zoom’s website traffic, the traffic screener shows a sequential increase in visits but a year-over-year decline in Q3. Specifically, visits to zoom.us fell by 47.73% compared to Q3 last year, but increased 1.05% on a sequential basis.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting an 12.08% move in either direction.

Is Zoom a Buy or Hold?

Turning to Wall Street, analysts have a Hold consensus rating on Zoom stock based on five Buys, 15 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. The analysts’ average price target on ZM stock of $73.19 implies a downside potential of 9.86%.