Shares of Zoom Video Communications (ZM) gained in after-hours trading after the video communications platform reported earnings for its third quarter of Fiscal Year 2025. Earnings per share came in at $1.38, which beat analysts’ consensus estimate of $1.31 per share. Interestingly, ZM has beaten expectations every quarter since November 2020.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

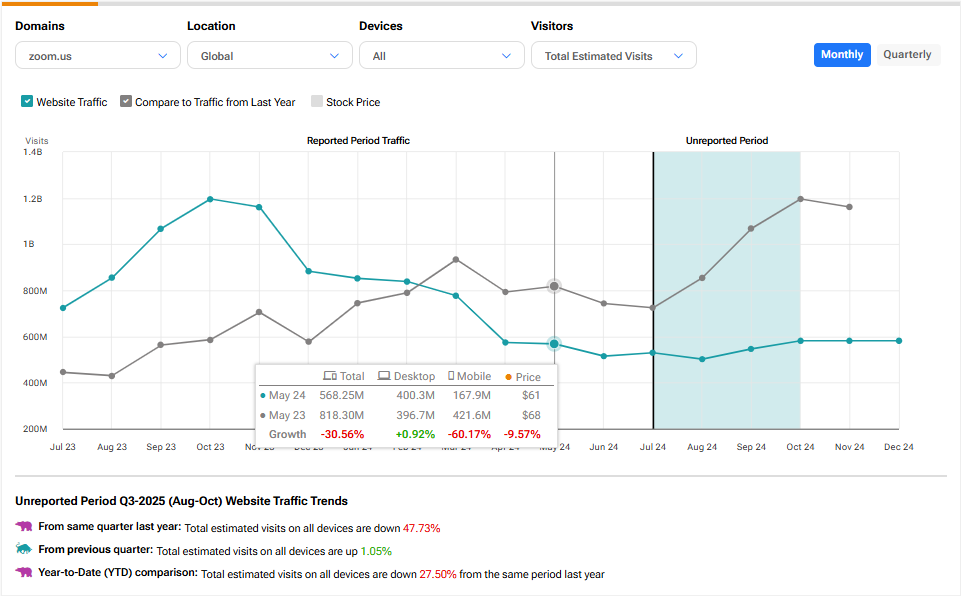

Meanwhile, sales increased by 2.6% year-over-year, with revenue hitting $1.17 billion. This also beat analysts’ expectations of $1.16 billion. What’s interesting about the results is that the company saw growth despite a 47.7% drop in website traffic when compared to the same quarter last year. This suggests that Zoom is doing a better job of monetizing the visitors it receives.

Q4 Outlook

Looking forward, management now expects revenue and adjusted earnings per share for Q4 2025 to be in the ranges of $1.175 billion to $1.18 billion and $1.29 to $1.30, respectively. For reference, analysts were expecting $1.17 billion in revenue along with an adjusted EPS of $1.28.

As we can see, the outlook is slightly better than what was expected, which, when combined with the most recent quarter’s beat, explains why the stock is slightly higher during after-hours trading. However, for those who might be wondering why the after-hours move is so small (less than 1% at the time of writing), it is likely because ZM stock has rallied over 12% in the past five days heading into earnings, which suggests that investors already priced in a beat.

Is Zoom a Buy, Sell, or Hold?

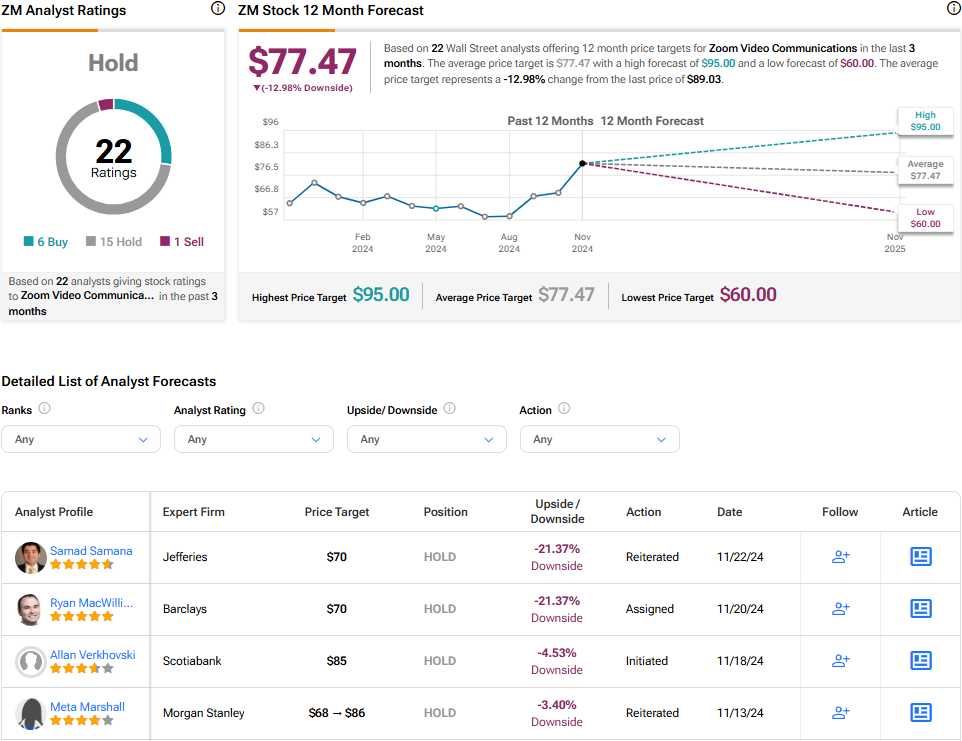

Turning to Wall Street, analysts have a Hold consensus rating on ZM stock based on six Buys, 15 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 36% rally in its share price over the past year, the average ZM price target of $77.47 per share implies 13% downside risk. However, it’s worth noting that estimates will likely change following today’s earnings report.