Earlier this month, Zimbabwe introduced a new gold (CM:XAUUSD)-backed currency, called the ZiG (Zimbabwe Gold). However, even a well-intentioned path to fiscal prudence can become paved with unintended setbacks, including a stock market wipeout.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Zimbabwe’s Stock Market Slump

The introduction of the ZiG has resulted in a difficult-to-digest 99.95% wipeout in the Zimbabwe Stock Exchange All Share Index so far this month. This major change required local institutions and businesses to reconfigure their systems to accommodate the new currency, resulting in the rebasing of share prices for all listed companies in the country. According to Bloomberg, investors rushed into stocks prior to the conversion to escape inflation and the collapse of the local dollar (Zimbabwe’s previous currency).

However, the trading volumes and the value of transactions on the exchange have plunged after share prices were rebased in the new currency. The low trading volumes are also taking a toll on the country’s stockbroking industry.

Meanwhile, many Zimbabweans still prefer to transact in the more stable U.S. Dollar. This preference has led to a black market, where the ZiG is trading at nearly 20 ZiG for 1 USD. The official exchange rate from the Zimbabwean authorities is 13 ZiG to 1 USD.

Next Steps

As Zimbabwe embarks on its sixth attempt to introduce a stable and credible currency, the next significant milestone approaches on April 30. This marks the introduction of physical notes and coins in the new currency for circulation across the country.

What Is the Forecast for Gold?

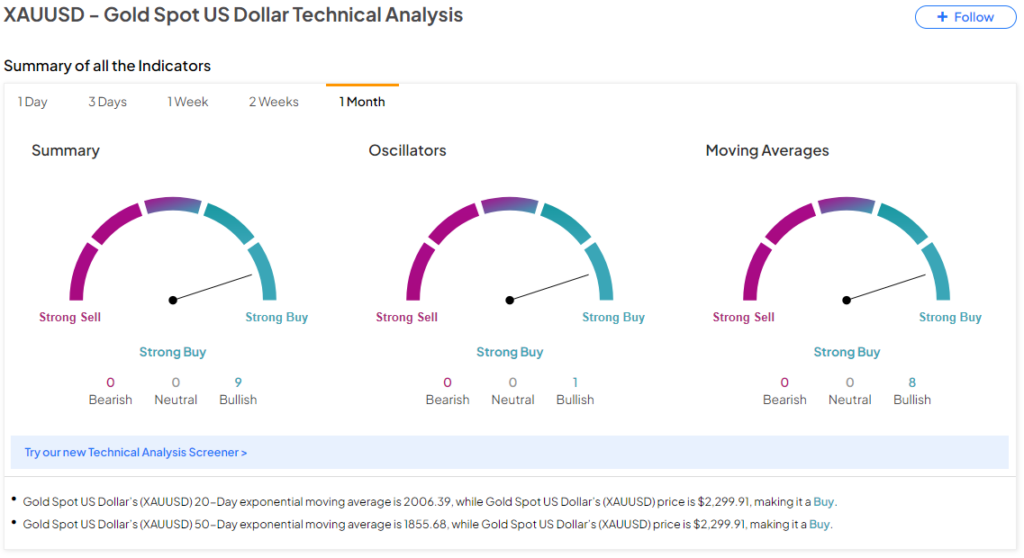

Meanwhile, gold prices have declined by nearly 1.77% over the past week as geopolitical tensions in the Middle East ease. However, gold is still up by nearly 11.6% year-to-date and the TipRanks Technical Analysis tool continues to flash a Strong Buy signal on the yellow metal.

Ready to ‘commodi-tize’ your knowledge? Click here to dive into the world of commodities on TipRanks

Read full Disclosure