Global container liner shipping giant ZIM (ZIM) reported robust growth for Q3, beating top-and-bottom-line expectations. The company further underlined this success by declaring an increased dividend of around $440 million. Amid operational expansion, the company is ushering in a fleet of 46 newly built containerships, 28 of which are powered by LNG. ZIM’s fleet diversification and modernization position it to effectively meet future emissions reduction targets. In addition, ZIM’s strategic investment in advanced tracking technology is set to revolutionize container visibility, granting its customers unparalleled real-time logistical data accuracy, reliability, and security.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

This continued innovation and steady financial growth make ZIM a solid option in the container shipping industry, though it has likely achieved peak earnings in the near term.

Zim Continues to Innovate

ZIM Integrated Shipping Services has carved out a niche as a prominent global container liner shipping company. The firm’s operations span over 90 countries, serving over 32,000 customers across nearly 300 ports worldwide.

ZIM’s strategy is underpinned by agile fleet management and deployment. It focuses on select markets where ZIM holds a competitive edge. ZIM’s primary trade routes encompass the Pacific, Latin America, Atlantic, Cross-Suez, and Intra-Asia.

The company is on track to deliver the remaining four out of 46 newbuild containerships, including 28 LNG-powered vessels, positioning its fleet to meet emission reduction targets, decreasing unit costs, and positioning the company for sustained profitable growth.

To meet customers’ increasing demands for real-time supply chain visibility, ZIM has introduced a smart container solution that offers end-to-end tracking and complete transparency. This enables customers to gauge accurate ETAs even after their shipments have left terminals or depots.

Zim’s Recent Financial Results

The company recently reported results for the third quarter of 2024, noting robust financial improvement compared to the same period in 2023. Total revenue for the quarter was $2.77 billion, reflecting year-over-year growth of 117%. The carried volume had a more modest growth of 12%, but the average freight rate per TEU increased dramatically by 118%. Net income of $1.13 billion marked a significant turnaround from a $2.27 billion net loss in the third quarter of 2023. Diluted earnings per share were reported at $9.345, replacing the diluted loss per share of $18.90 from the previous year.

As of the quarter’s end, the company reported an increase of $441 million in its total cash position, bringing it to $3.13 billion. However, ZIM’s net debt rose from $2.31 billion in December 2023 to $2.70 billion. The company’s net leverage ratio is 0.9x, down from 2.2x in December 2023.

Zim’s Board of Directors declared a regular cash dividend of approximately $340 million, or $2.81 per ordinary share. A special dividend of approximately $100 million, or $0.84 per share, was declared, resulting in a total dividend of roughly $440 million or $3.65 per share. This dividend is scheduled for payment on December 9, 2024, to holders of ZIM’s ordinary shares as of December 2, 2024.

What Is ZIM’s Price Target?

The stock has risen over 250% in the past year. It trades near the upper end of its 52-week price range of $6.39 – $27.48 and shows ongoing positive price momentum as it trades above all major moving averages.

Analysts following the company have taken a cautious stance on ZIM stock, citing concerns that it has hit peak earnings, as Red Sea vessel attacks that disrupted global supply chains significantly boosted carrier profits.

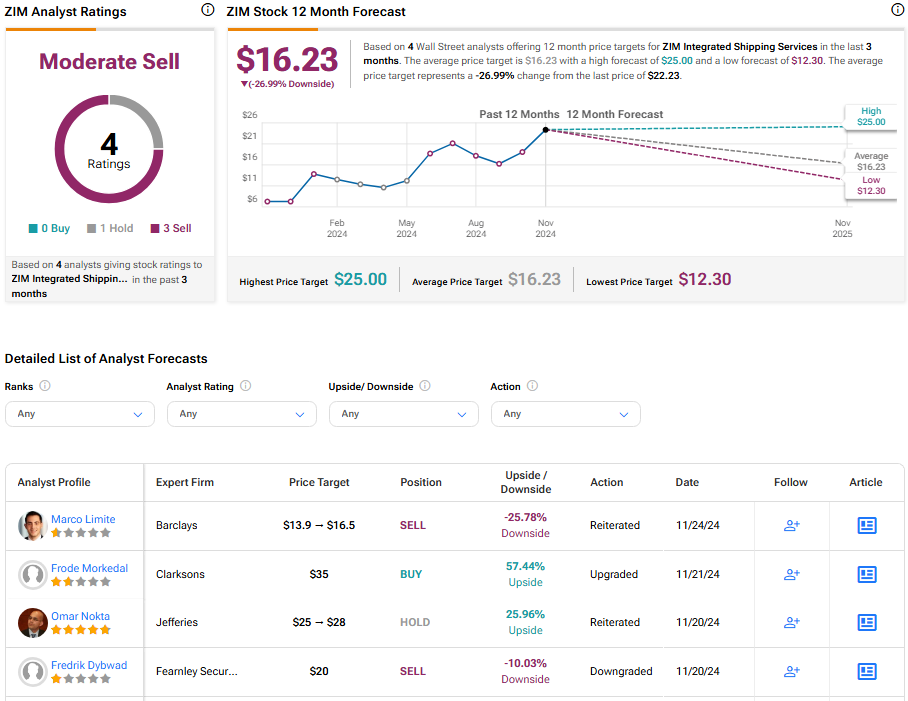

Based on four analysts’ recent recommendations, Zim is rated a moderate sell overall. The average price target for ZIM stock is $16.23, representing a potential downside of -26.99% from current levels.

ZIM in Summary

ZIM’s continuous commitment to innovation, fleet diversification, and strategic investments has allowed the company to maintain a strong place in an increasingly demanding market. Despite the company’s robust Q3 results, significant dividend increases, and investment in cutting-edge tracking technology, concerns about peak earnings persist. ZIM presents a solid choice for investors interested in global shipping, though it may require some patience.