Global container shipping services company ZIM Integrated Shipping (ZIM) released its earnings report for the third quarter of 2024 on Wednesday. The report starts with earnings per share of $9.34, compared to Wall Street’s estimate of $6.95. This is also a positive change from its EPS of -$18.90 during the same period of the year prior.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Adding to this is ZIM Integrated Shipping’s revenue of $2.77 billion, beating analysts’ estimates of $2.41 billion for the quarter and representing an impressive 118.11% increase year-over-year from $1.27 billion.

What’s Behind ZIM’s Stellar Q3 Performance

Two factors fueling revenue growth were increases in carried volume and freight rates. In Q3 2023, the company carried 907,000 twenty-foot equivalent units (TEUs) with an average freight rate of $2,480 each, compared to 867,000 TEUs with an average freight rate of $1,139 each.

It’s also worth mentioning that ZIM Integrated Shipping suffered an impairment loss in Q3 2023. This helps explain why it went from a net loss of $2.27 billion during that quarter to a net income of $1.13 billion in its latest earnings report.

ZIM Dividend Coming Next Month

ZIM Integrated Shipping has announced a quarterly dividend of $2.81 per share for investors. In addition, the shipping company is offering a special dividend of 84 cents per share, bringing the total to $3.65 per share.

ZIM Integrated Shipping will pay these dividends to shareholders on Dec. 9, 2024, if they are on record as of Dec. 2, 2024.

ZIM Updates 2024 Outlook

With all this positive earnings news, ZIM provides investors with increased guidance for 2024. It expects Adjusted EBITDA to range from $3.3 billion to $3.6 billion and Adjusted EBIT between $2.15 billion and $2.45 billion. Its previous guidance was for Adjusted EBITDA between $2.6 billion and $3.0 billion and Adjusted EBIT ranging from $1.45 billion to $1.85 billion.

Is ZIM Stock Worth Buying?

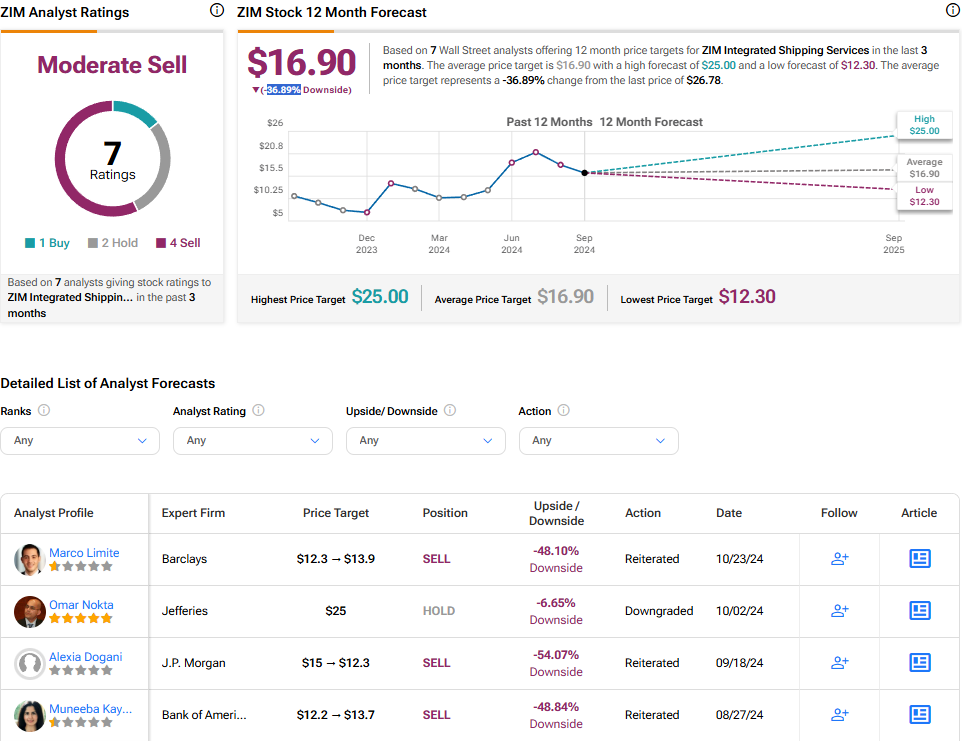

Turning to Wall Street, the analyst’s consensus for ZIM Integrated Shipping is Moderate Sell based on one Buy, two Hold, and four Sell ratings over the last three months. This also comes with an average price target of $16.90 with a high of $25 and a low of $12.30. That represents a potential 36.89% downside for the stock.