Expert market projections call for a favorable backdrop for real estate specialist Zillow Group (NASDAQ:ZG) (NASDAQ:Z). Per Freddie Mac, the framework of robust demand but lean inventory may yield upward home pricing pressure. That sounds great (for entities selling residential units). However, the hard data consistently clashes with this bullish narrative. Therefore, I am bearish on ZG stock and believe that it may be time for investors to cut their losses.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Troubled Consumer Economy Poses Problems for ZG Stock

To be sure, betting against the housing market (or related investments) seems like a foolish endeavor. After all, the sector has been incredibly robust despite numerous challenges. Further, it’s possible that prices could rise further because interest rates may have peaked. Should the Federal Reserve cut interest rates, that may kickstart positive sentiment.

However, that narrative goes against the most recent signals. As TipRanks reporter Paul Hoffman stated, Fed Chair Jerome Powell “left no doubt that the U.S. central bank intends to be quite patient before it acts to reduce high interest rates.” Arguably, you don’t need to be an economist to understand why this position is prudent.

If the Fed decides to intervene one way or another, it risks upsetting the delicate post-pandemic balance. Further, blistering inflation relative to recent historical norms represented a significant obstacle following COVID-19’s initial impact. Going back to a dovish monetary policy risks restarting an already frustrating dilemma.

Ultimately, the debate about the direction that policymakers should take reflects broader troubles for the consumer economy. Because of the aforementioned inflationary spike, regular folks have had difficulty scrounging up money for down payments. Now that borrowing costs have spiked, many families simply don’t qualify.

If prospective homebuyers don’t qualify for mortgages, then this dynamic necessarily reduces Zillow’s total addressable market. That’s a problem for ZG stock. Further, as this addressable market diminishes, the competition naturally becomes fiercer.

Let’s face it – Zillow doesn’t necessarily have an edge over similar enterprises. At the end of the day, real estate is real estate. Homebuyers will likely gravitate toward the entities that provide the best deals. So, the enhanced competitive environment poses additional obstacles for ZG stock.

“Days on Market” Metric Rises

One of the biggest factors to consider regarding the real estate sector’s health is the median days on market. This metric details how many days that a home has been listed until it falls under contract with a buyer. Naturally, a lower number means robust demand, while a higher number indicates a possible mismatch between seller expectations and demand.

In the first quarter of 2020, the median days on market stood at 71. By Q2 2022, this figure had dropped to 30. In early 2021, ZG stock reached a price of nearly $203 on a weekly average basis. However, by Q2 2022, the price had fallen off dramatically.

Notably for ZG stock, the decline continued into Q3 2022. At the end of this quarter, the days on market rose to 41. By Q1 2023, the metric stood at 63 days. This dynamic suggests that as properties stayed longer in the marketplace, demand for Zillow’s services faded.

Granted, on a monthly basis, the days on market ebbs and flows. However, the longer-term trend is clear. Since Q2 2022, this metric has been steadily rising. Arguably, this is a warning sign against ZG stock because buyers can’t cough up what sellers are asking for.

To be blunt, there may be further (and downward) price adjustments. The latest monthly jobs report shows that the labor market grew at a lower rate than expected. Moreover, technology sector layoffs have continued to accelerate from 2022 onwards. With fewer people having good jobs, that should reduce Zillow’s addressable market. Again, that’s not great news for ZG stock.

Forward Projections Seem Too Optimistic

Right now, ZG stock trades at 5.05x trailing-year revenue. That might seem like a relatively good deal, considering that in Q4 2023, the average multiple stood at 7.01x. However, the fundamentals mentioned earlier seem to clash with Zillow’s forward projections.

Analysts, on average, anticipate that in Fiscal 2024, the company will post revenue of $2.16 billion. In the following year, the top line could expand to $2.45 billion. These stats represent double-digit sales growth against the prior year’s results.

Still, with the addressable market being diminished due to various headwinds, these projections seem awfully optimistic. Even the low Fiscal 2024 estimate of $2.1 billion seems elevated based on broader challenges against the consumer economy. Therefore, I am skeptical about the relative value of ZG stock.

Is Zillow Stock a Buy, According to Analysts?

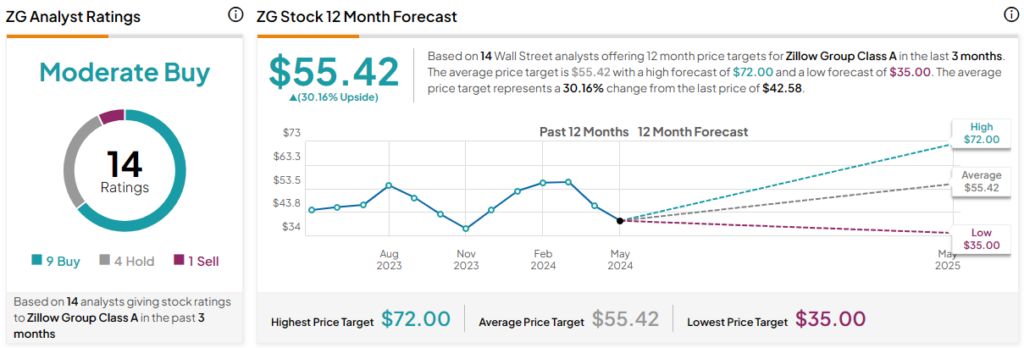

Turning to Wall Street, ZG stock has a Moderate Buy consensus rating based on nine Buys, four Holds, and one Sell rating. The average ZG stock price target is $55.42, implying 30.2% upside potential.

The Takeaway: Optimism for ZG Stock Runs Headfirst Into the Data

While real estate experts may have an optimistic view of the housing sector and, by extension, Zillow Group, the hard data clashes with this narrative. The consumer economy is clearly suffering from multiple headwinds. And that’s perhaps best reflected with rising days on market. Therefore, the seemingly good deal on ZG stock on a relative basis should be questioned thoroughly.