We knew that legacy automaker Ford (F) would have to make some changes with July’s arrival, as its friends and family pricing specials were set to expire. And what Ford has waiting in the wings might be just what it needs to keep customers’ interest. The phrase of the day is “zero, zero, zero,” and investors see a surprising positive out of all this neutral emptiness. Investors sent shares up fractionally in Tuesday afternoon’s trading.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

From now until Labor Day—basically the rest of the summer—Ford is offering the new “zero, zero, zero” plan. That calls for zero down payment, zero payments for the first 90 days, and zero percent interest for four years. This move will cost Ford a bit in terms of lost interest income. It will also likely draw interest from potential buyers who will, basically, have a car for the price of gas for the rest of the summer, before payments start kicking in.

Ford’s director of United States sales and dealer relations, Rob Kaffl, noted that the move was a response to dealership suggestions. Kaffl noted, “Employee pricing for all was easy to understand and resonated with customers. But we also heard from our Ford and Lincoln dealers that more customers could benefit if we could reduce the upfront, out-of-pocket expense to buy or lease a vehicle.” However, reports noted that several models—including a large portion of Ford’s 2025 lineup, and several elements of the 2024 lineup—were excluded. Thus, the “zero, zero, zero” play is so limited in scope that it will only help a few buyers and ultimately cost Ford very little.

The Battery Plant Continues

Meanwhile, Ford’s plans to bring a battery plant to Marshall, Michigan seem to be continuing apace. In fact, word from Ford is that the plant is still “on track” to receive tax credits for battery production, despite concerns that the program could be canceled this year.

The plant is already 60% complete, reports note. Apparently, that level of completion, with a plan to start rolling out batteries in 2026, means that the Marshall plant will be able to get in tax credits after all. The plant was always somewhat controversial; its connections to a Chinese company have not gone unnoticed, and there were signs that the locals of Marshall were not especially interested in having a battery factory in their backyard. But the controversy has not impeded Ford by much, and the project continues.

Is Ford Stock a Good Buy Right Now?

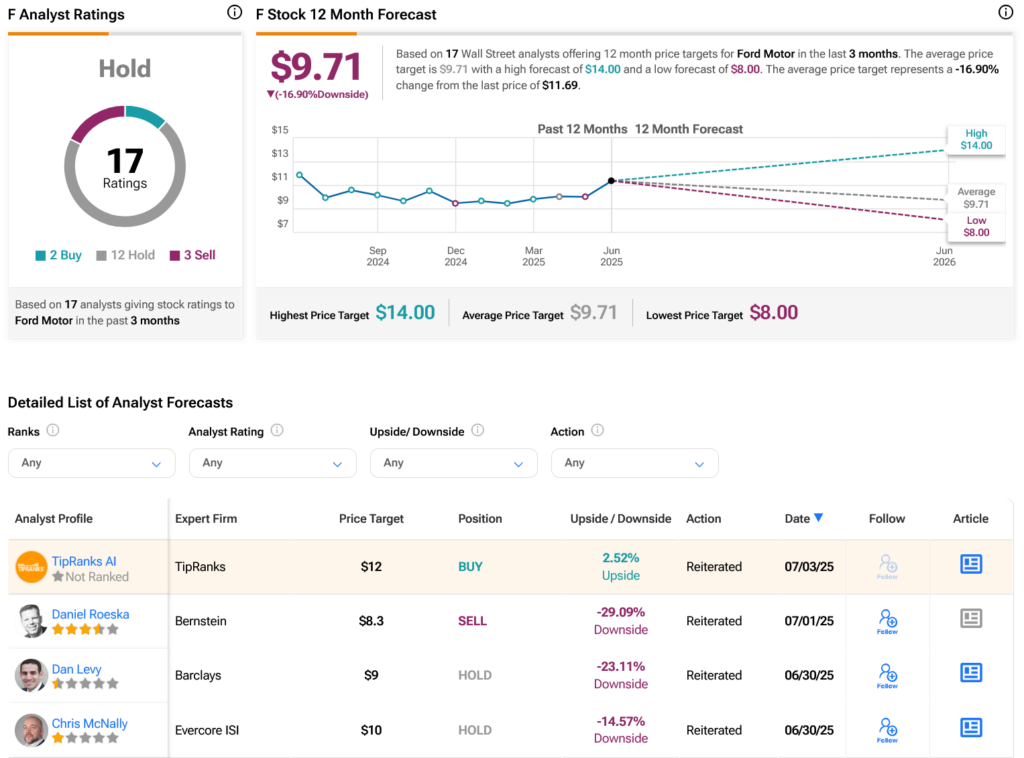

Turning to Wall Street, analysts have a Hold consensus rating on F stock based on two Buys, 12 Holds and three Sells assigned in the past three months, as indicated by the graphic below. After a 10.16% loss in its share price over the past year, the average F price target of $9.71 per share implies 16.9% downside risk.