2025 was a landmark year for on-chain privacy. Zcash (ZEC-USD), one of the industry’s original privacy-centric assets, surged more than 600% to become one of the year’s standout success stories. Meanwhile, giants like Ethereum (ETH-USD) and Solana (SOL-USD) launched major initiatives to bake privacy directly into their networks, signaling that “Privacy Szn” has evolved from a niche movement into a core requirement for global adoption.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

But what does 2026 hold? According to a series of expert predictions first gathered and reported by CoinDesk, the privacy landscape is entering a new era of industrialization and regulation.

Privacy Becomes a Practical, Non-Binary Tool

In 2026, the industry will stop viewing privacy as a simple “on-off” switch. According to Bobbin Threadbare, co-founder of Miden, neither absolute transparency nor absolute secrecy is sustainable for the real world.

Instead, the coming year will see the rise of conditional privacy. This model provides full confidentiality for low-risk, everyday transactions while allowing for tradeoffs in high-risk contexts. By creating a system that is difficult for nefarious actors to exploit, developers hope to make privacy protocols more “threat-resistant” and palatable to global law enforcement without sacrificing the rights of honest users.

Private Stablecoins Dominate Global Payment Rails

Privacy isn’t just about hiding; it’s about business. Khushi Wadhwa, head of business development at Predicate, predicts that 2026 will be the “Year of Private Stablecoins.” Enterprises are increasingly demanding confidentiality to protect their sensitive commercial relationships and internal treasury data.

We are likely to see stablecoins that embed “configurable privacy” by default. This allows users to choose what they disclose, such as transaction amounts or sender identities, depending on the situation. By integrating policy controls directly into the payment layer, these tokens can remain compliant with regulations like MiCA while finally giving institutions the privacy they need to move trillions of dollars on-chain.

Developers Industrialize Privacy for Mass Production

After years of theoretical research, privacy tech is finally ready for the assembly line. Paul Brody, EY Global Blockchain Leader, notes that 2026 is the year privacy gets “industrialized.” Solutions such as Aztec, Nightfall, Railgun, and COTI are graduating from experimental testnets into live production environments.

The challenge for 2026 won’t be the math behind the tech, but the user experience. Most consumer wallets still don’t support these advanced privacy features, and regulatory compliance remains a patchwork quilt across different countries. However, Brody believes this is the official start of a massive shift: moving from “can we do this?” to “how do we scale this for millions of users?”

Key Takeaway

The bottom line is that 2026 will be the ultimate trial for whether on-chain privacy can legally coexist with global regulation. The crypto industry is maturing into a responsible privacy model, one that protects honest spenders while actively deterring money laundering.

Success now depends on whether developers can bridge the gap between complex cryptography and simple user interfaces; if they can, privacy will finally become the foundational layer that moves the rest of the financial world on-chain.

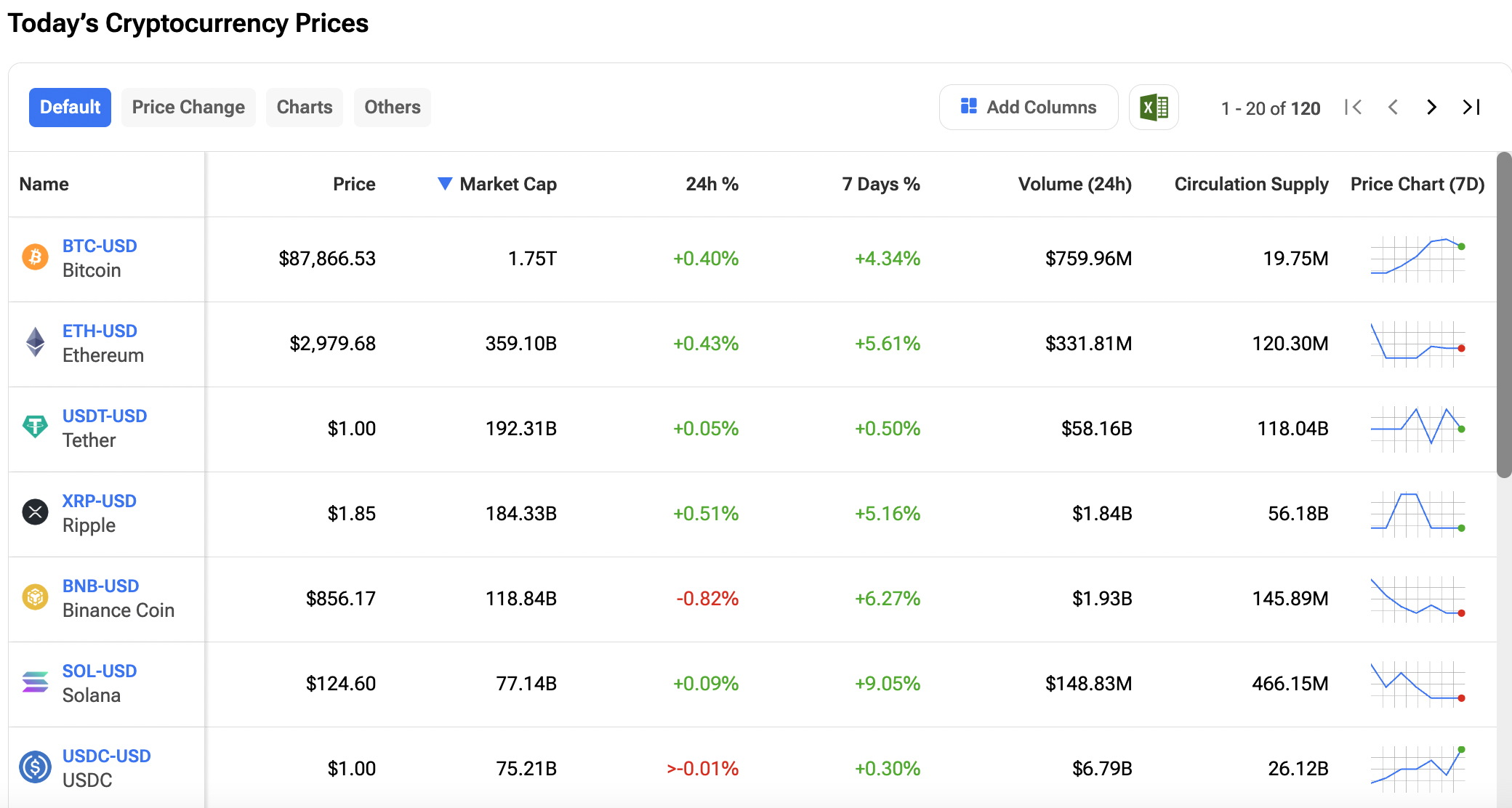

Investors can track the prices of their favorite cryptos on the TipRanks Cryptocurrency Center. Click on the image below to find out more.