Restaurant operator Yum! Brands (NYSE:YUM) witnessed robust sales gains across its major brands in the third quarter, with worldwide system sales rising by 10% and same-store sales increasing by 6%. EPS of $1.44 exceeded expectations by a wide margin of $0.17. Revenue of $1.7 billion came in lower than the anticipated mark of $1.77 billion.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

During the quarter, the company opened over 1,100 gross new units, with digital sales now contributing over 45% to its top line. System sales experienced double-digit growth at KFC and Taco Bell, while Pizza Hut’s system sales increased by a modest 4%.

In the Habit Burger Grill division, system sales grew by 4%. The company’s KFC division clocked a total revenue of $700 million and saw 664 gross new restaurant openings. In the Taco Bell division, total revenue reached $629 million, with 74 gross new restaurant openings. The Pizza Hut division delivered a total revenue of $242 million and opened 383 gross new restaurants.

What Is the Price Forecast for YUM Stock?

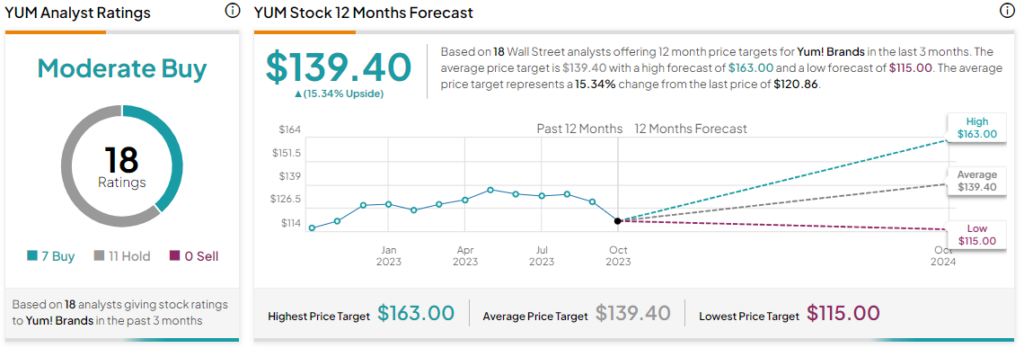

Overall, the Street has a Moderate Buy consensus rating on Yum! Brands. The average YUM price target of $139.40 implies a 15.3% potential upside.

Read full Disclosure