Shares of Yum! Brands (NYSE: YUM) fell in pre-market trading at the time of publishing on Wednesday after the fast food company behind the brands KFC, Pizza Hut and Taco Bell announced adjusted earnings of $1.06 per share in Q1 versus $1.05 in the same period last year but missed Street expectations of $1.13 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company’s revenues were up by 6% year-over-year to $1.65 billion versus consensus estimates of $1.62 billion. This is even as Yum’s same-store sales surged by 8% in Q1 to top the consensus estimates of a gain of 5.8%.

David Gibbs, CEO of Yum! Brands stated, “The demand for our iconic brands is evident as our incredible teams and franchise partners delivered another strong quarter with system sales growth of 13% excluding Russia, driven by 8% same-store sales growth and continued development momentum. We’re seeing broad-based accelerating digital sales growth leading to a record quarter for both digital system sales of nearly $7 billion and digital sales mix that exceeded 45%.”

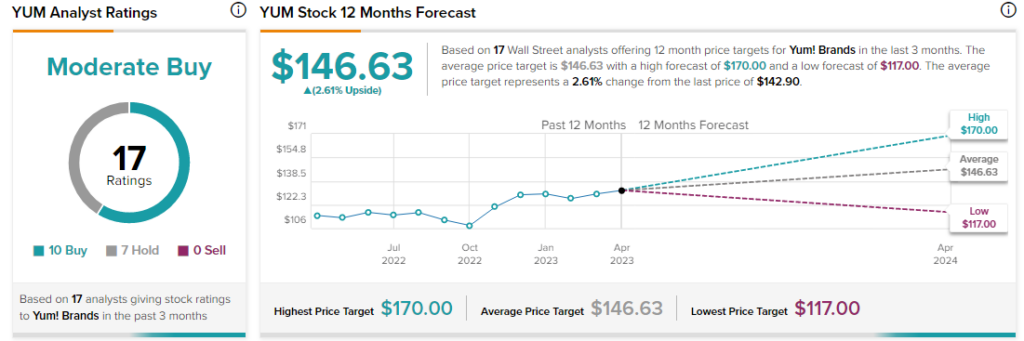

Analysts are cautiously optimistic about YUM stock with a Moderate Buy consensus rating based on 10 Buys and seven Holds.