If you’re shopping for a new pair of adidas sneakers in the U.S., expect to pay more. The iconic sportswear brand adidas AG (ADDYY) has confirmed that new U.S. tariffs are driving up prices, making its shoes and other sports gear noticeably costlier for American consumers.

adidas Reports Strong Q1 Results

Meanwhile, adidas delivered stronger-than-expected results for Q1 2025. Net sales rose 12.7% to €6.15 billion, while net income from continuing operations surged 155% to €436 million ($496.5 million), beating analysts’ forecast of €383 million. Analysts at Deutsche Bank highlighted that even with the rising uncertainty, adidas delivered a “good print,” showing progress across all key areas.

Following the results, ADDYY stock declined nearly 3% on Tuesday.

adidas Halts Profit Upgrade amid Trade War

Despite posting strong quarterly results, adidas suspended its full-year outlook upgrade due to uncertainty surrounding the ongoing trade war. CEO Bjorn Gulden said that “in a normal world,” the company would have raised its revenue and profit forecasts, but the unpredictability of tariffs made that impossible.

Furthermore, the company noted it’s only mildly impacted by the steep 145% U.S. tariffs on China, having already scaled back exports from its Chinese factories. However, it flagged broader concern over the 10% tariffs the U.S. has imposed on many other countries, calling it the bigger challenge. Even though adidas hasn’t raised U.S. prices yet, but is evaluating where increases might help offset tariffs. The company is closely monitoring competitors and prefers not to be the “first mover” on price hikes.

For now, Adidas forecasts its 2025 currency-neutral sales to grow by a solid 7% to 9%, with operating profit expected to land between €1.7 billion and €1.8 billion ($1.94 billion to $2.05 billion).

Is adidas stock a good buy?

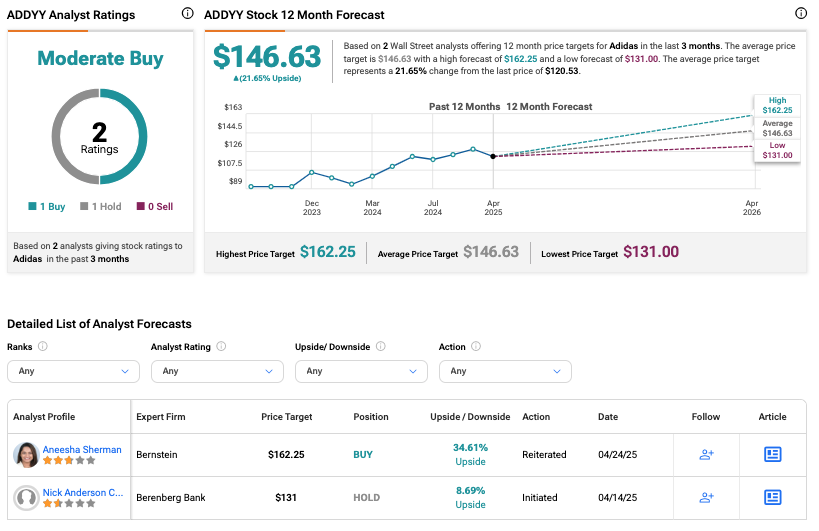

On TipRanks, ADDYY stock holds a Moderate Buy rating, supported by one Buy and one Hold assigned in the last three months. The adidas share price forecast is $146.63, representing a 22% upside from the current price.