Two days ago, entertainment giant Comcast (CMCSA) landed a serious win, revealing that it sold out of ad slots for the upcoming Winter Olympics. Now, Comcast landed another sports-related win by bringing the YES Network back on board. The news was reasonably good to investors, meanwhile, who sent Comcast shares up fractionally in Friday morning’s trading.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Negotiations between YES Network—which handles televised games of the New York Yankees—and Comcast had gone on for quite some time. But with a new deal, and a new multi-year deal at that, YES Network games will be airing on Comcast. Better yet—at least as far as viewers are concerned—the games will remain available on Comcast’s basic tier.

This had been an issue for Regional Sports Networks (RSNs) for some time now. Comcast was moving their content to higher tiers of programming, requiring viewers to pay more to watch the same content. But YES Network held the line, and will be available on the lower-tier Comcast packages, if only in the New York area. Still, for viewers increasingly frustrated by price hikes on just about everything, this will be welcome news.

Maybe It Was a Good Idea After All

Meanwhile, Comcast’s move to spin off Versant (VSNT) might have proven a better idea than most might think, as evidenced by its recent share performance. Within days of the spinoff, Versant—new home to MS NOW, CNBC, and SyFy, among others—lost about 25% of its market value. Investors have long questioned the value of a stock that focuses on a dying media, and they have voted with their collective wallet accordingly.

Interestingly, reports note, much of the move away from Versant is not really about its connection to Comcast, or lack thereof. Rather, most of the move comes from institutional buyers like large index funds who are pulling out of Versant. Versant does not meet investment guidelines, reports note, and they are departing accordingly.

Is Comcast Stock a Good Buy Right Now?

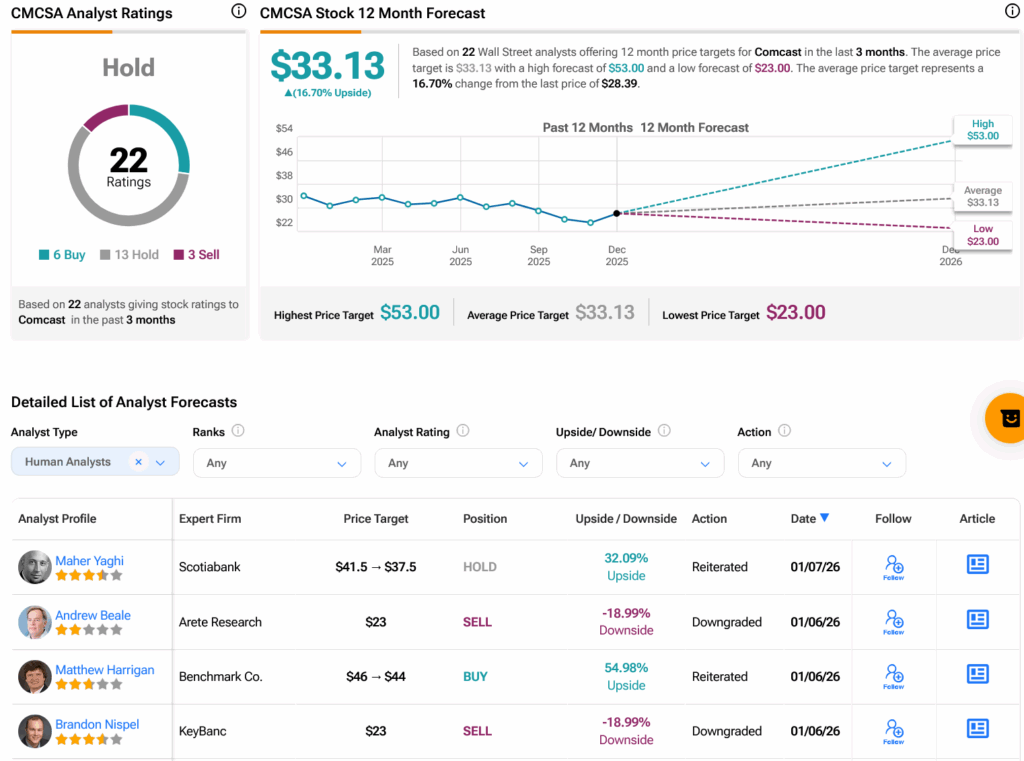

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CMCSA stock based on six Buys, 13 Holds and three Sells assigned in the past three months, as indicated by the graphic below. After a 26.23% loss in its share price over the past year, the average CMCSA price target of $33.13 per share implies 16.7% upside potential.