Yalla Group delivered a stronger-than-expected 4Q performance, driven by triple-digit growth in monthly active users as well as paying users. Shares of the voice centric social networking and entertainment platform were up about 8% in morning trade today.

Yalla Group’s (YALA) revenue jumped 150.9% year-over-year to hit $48.3 million, topping analysts’ estimates of $41.2 million. Its monthly active users (MAUs) increased 295.4% year-over-year to 16.4 million. Meanwhile, the company’s number of paying users on the platform witnessed a year-over-year surge of 624.2% to 5.2 million in 4Q.

The company posted adjusted earnings of $0.15 per share, up 150% year-over-year, with the figure exceeding analysts’ expectations of $0.12 per share.

The company’s founder, chairman and CEO Yang Tao said, “2020 concluded with an outstanding fourth quarter, as expansion of our user community and advancement of our monetization capabilities thrusted growth momentum even further.”

Looking ahead to 1Q, Yalla Group expects revenues to be in the range of $60 million to $63 million.

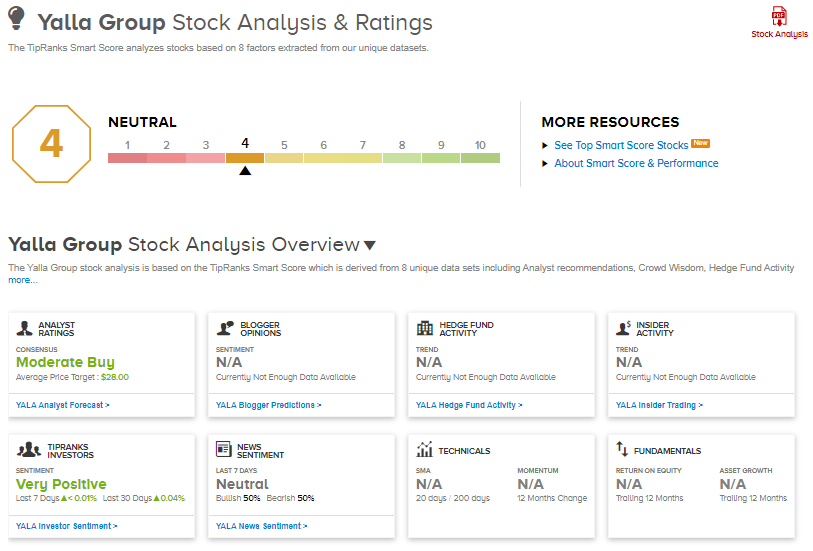

The company remains focused on creating a popular online social networking and entertainment platform in the Middle East and North Africa (MENA region). (See Yalla group stock analysis on TipRanks)

Today, in response to the 4Q results, Oppenheimer analyst Bo Pei assigned the stock a price target of $28 (7.3% upside potential) and a Buy rating.

Furthermore, Yalla Group scores a 4 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock may perform in line with the broader market.

Related News:

Dropbox To Snap Up DocSend For $165M; Shares Gain 4%

DuPont Inks $2.3B Deal To Snap Up Laird Performance Materials; Shares Gain

Chevron Inks Deal To Buy Noble Midstream Partners; Shares Gain 4%