Shares of personal loan providers and buy now, pay later (BNPL) companies Block (XYZ), SoFi Technologies (SOFI), PayPal (PYPL), Affirm (AFRM), and Upstart (UPST) are rallying in pre-market trading. Mizuho Securities analyst Dan Dolev argues these sectors are poised to benefit from President Donald Trump’s proposed 10% cap on credit card interest rates. The policy could pressure credit card giants like Visa (V), Mastercard (MA), American Express (AXP), and Capital One Financial (COF), whose shares dipped on the news.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Trump posted the idea on his Truth Social (DJT) account on Friday, leaving unclear whether it would advance through executive order or new legislation. A Republican senator confirmed he had spoken with Trump, who fully backs a bill and wants it ready by January 20, exactly a year after he took office.

One Company’s Loss Is Another’s Gain

Trump claims that credit card rates of 20%-30% are “ripping off” Americans, and thus, vows to cap them at 10%, starting January 20. This would halve typical borrowing costs from the current roughly 20% average APR. At the same time, it could prompt banks to tighten lending to low-credit-score customers.

According to Dolev, this shift could drive borrowers toward alternatives like BNPL firms like Affirm, Block, PayPal, and personal loan providers like SoFi and Upstart, some of which are particularly focused on the lower-FICO customer. The New York Fed estimates that the U.S. has $1.2 trillion in credit card balances, with Dolev estimating over 50% of consumers holding FICO scores below 745 and facing higher interest rates.

Dolev noted that lower-FICO consumers face tighter restrictions on traditional credit cards, boosting demand for alternatives. This creates strong volume growth opportunities and upside potential for credit-heavy names, translating to net revenue if they underwrite and select new borrowers effectively.

Which Is the Best Fintech Stock, According to Analysts?

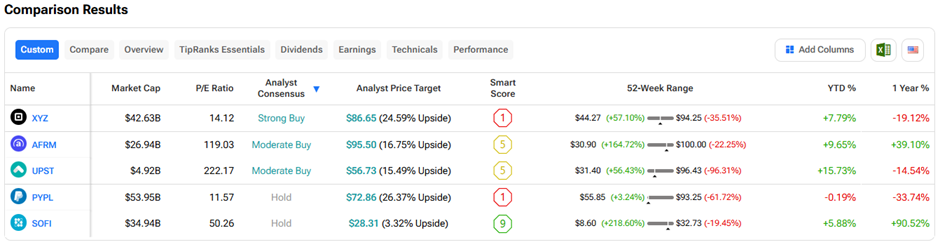

We used the TipRanks Stock Comparison Tool to determine which stock among those mentioned above, analysts are currently most bullish on. Analysts have assigned a “Strong Buy” consensus rating to Block stock, with a 25.6% upside potential over the next twelve months.