Shares of Block (XYZ) sank in after-hours trading after the company reported earnings for its first quarter of Fiscal Year 2025. Earnings per share came in at $0.56, which missed analysts’ consensus estimate of $0.97 per share. Sales decreased by 3.1% year-over-year, with revenue hitting $5.77 billion. This also missed analysts’ expectations of $6.19 billion.

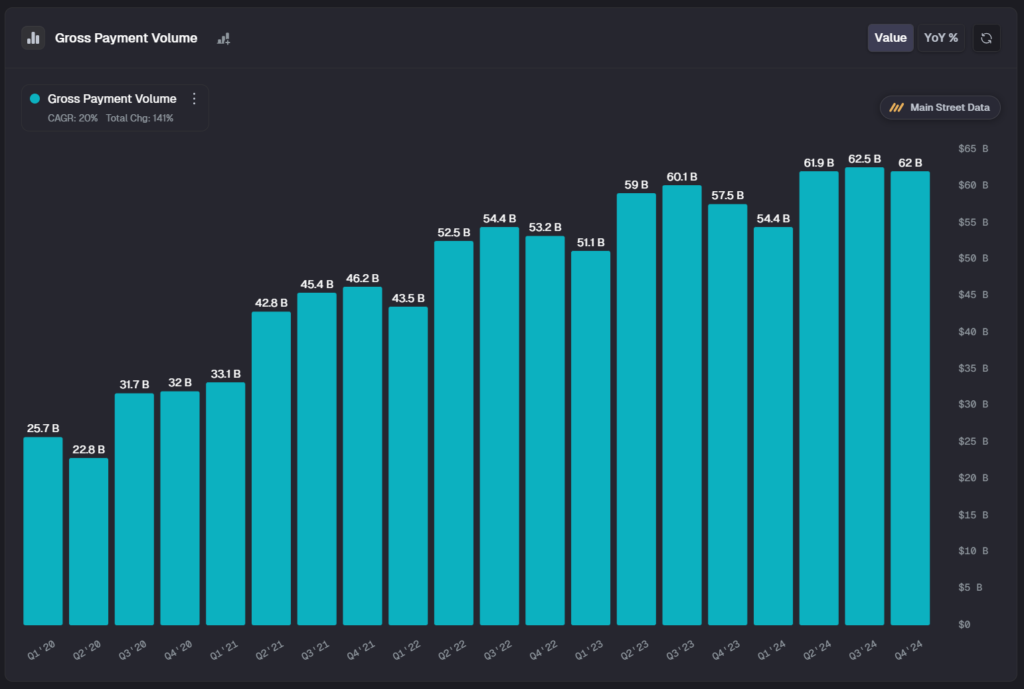

Gross payment volume reached $56.8 billion, which missed expectations and dropped from the prior quarter, but increased from a year earlier, as per the image below from Main Street Data. Gross profit came in at $2.29 billion, slightly below forecasts, with Cash App bringing in $1.38 billion (up 10% year-over-year) and Square generating $898 million (up 9%).

This performance was mostly due to weaker spending on Cash App Cards. Cash App’s gross profit missed forecasts as both inflows and card spending were softer than the company had predicted. As a result, Block lowered its guidance and took a more cautious approach. However, it still expects gross profit growth to pick up in the second half of 2025, especially starting in Q3.

2025 Outlook

For the full year, Block now expects gross profit of $9.96 billion, which is lower than both its previous forecast of $10.22 billion and the $10.18 billion analyst consensus. To help drive future growth, the company is expanding its Cash App Borrow loans to more users and improving loan terms to raise limits. Block is also working to strengthen its network and focus more on marketing strategies that deliver strong returns.

What Is the Price Target for XYZ?

Overall, analysts have a Strong Buy consensus rating on XYZ stock based on 27 Buys, three Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average XYZ price target of $81.93 per share implies 38.4% upside potential.