Ripple’s XRP (XRP-USD) is once again testing investors’ patience. After a steep pullback from its July highs, the token is struggling to hold above the $2.70 level. This is a key zone that could decide whether the recovery has legs or gives way to a deeper decline.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

XRP’s Bounce Still Needs Conviction

XRP has bounced from its recent lows near $2.00, but traders remain wary of calling it a comeback. The daily chart shows the token trapped inside an ascending channel, which is a structure that often signals a correction rather than a new bullish trend.

Analysts note that the key now is whether XRP can reclaim and hold above $2.70, which has acted as both support and resistance in recent months. Failing to do so could open the door to new lows below $2.00.

Momentum indicators aren’t helping. Both the Relative Strength Index (RSI) and the MACD remain weak, showing limited buying power behind the recent move.

Why $2.70 Is the Key Threshold

The $2.70–$2.75 zone marks a key threshold. It was once a strong base of support before flipping to resistance after the October sell-off. Until XRP can reclaim that range, analysts say the path of least resistance remains lower.

On-chain data also shows heavy profit-taking among long-term holders, suggesting many traders view current levels as an opportunity to exit rather than double down.

Still, there are pockets of optimism. Activity on the XRP Ledger continues to rise, and institutional demand through derivative markets remains healthy. If momentum in those areas carries through, it could help stabilize price action heading into November.

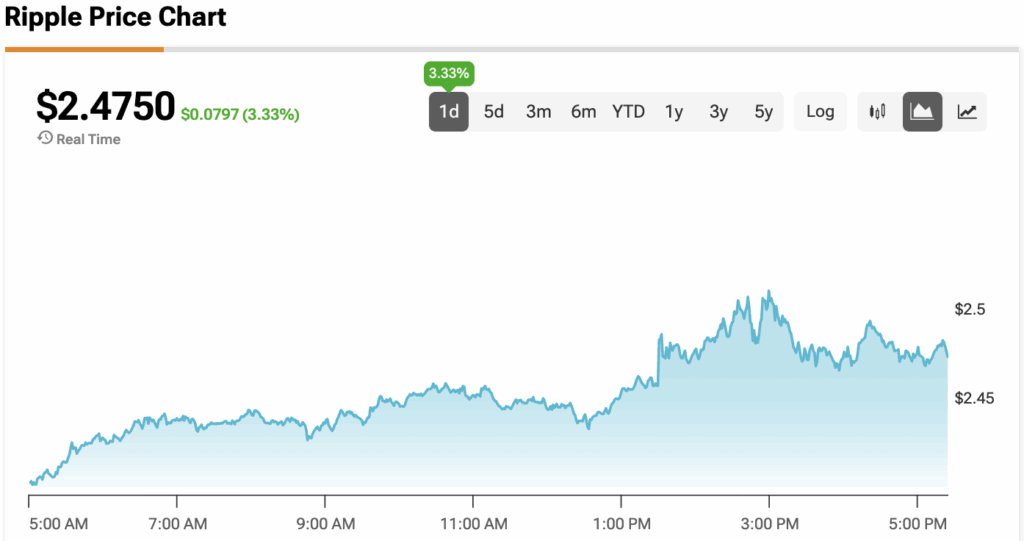

At the time of writing, XRP is sitting at $2.4750.