Exxon Mobil (XOM) stock jumped on Friday following the release of the oil company’s Q1 2025 earnings report. The report began with adjusted earnings per share of $1.76, beating Wall Street’s estimate of $1.74. However, the company’s adjusted EPS dropped 14.5% year-over-year from $2.06.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

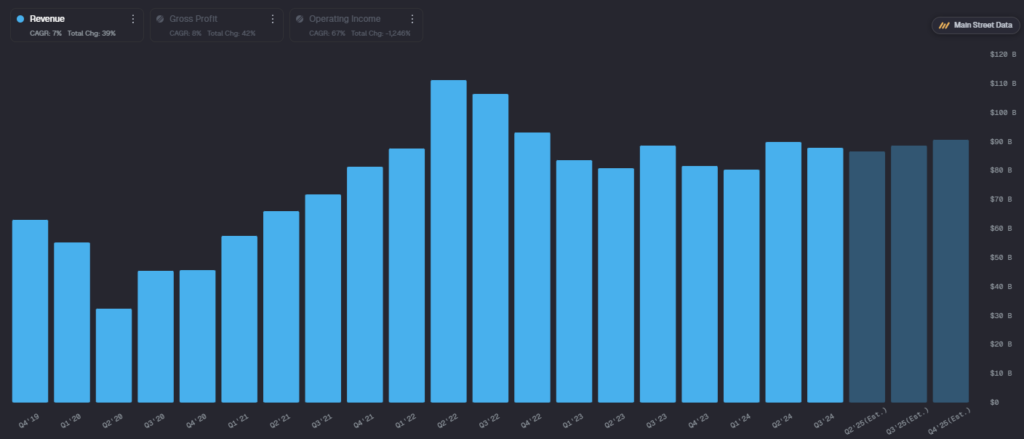

Revenue reported by Exxon Mobil in Q1 2025 was $83.13 billion, below analysts’ estimate of $86.3 billion. The company’s revenue growth was roughly flat compared to the $83.08 billion reported in Q1 2024. This is likely the result of falling oil prices keeping XOM’s revenue from growing.

XOM stock was up 0.35% in pre-market trading on Friday, following a 0.14% gain on Thursday. Even so, the company’s shares are still down 0.79% year-to-date. Exxon Mobil isn’t the only company affected by declining oil prices. Chevron stock dipped today after it failed to impress investors with its Q1 earnings report.

What’s Next for Exxon Mobil?

Exxon Mobil Chairman and CEO Darren Woods addressed the company’s ability to operate in the current economic environment. He said that “shareholders can be confident in knowing that we’re built for this,” and that its transformation over the last eight years “positions us to excel in any environment.”

According to MainStreetData, Exxon Mobil will have to get its revenue up if it wants to meet analysts’ estimates. They expect the company to report $86.6 billion in Q2, $88.7 billion in Q3, and $90.7 billion in Q4.

Is XOM Stock a Buy, Sell, or Hold?

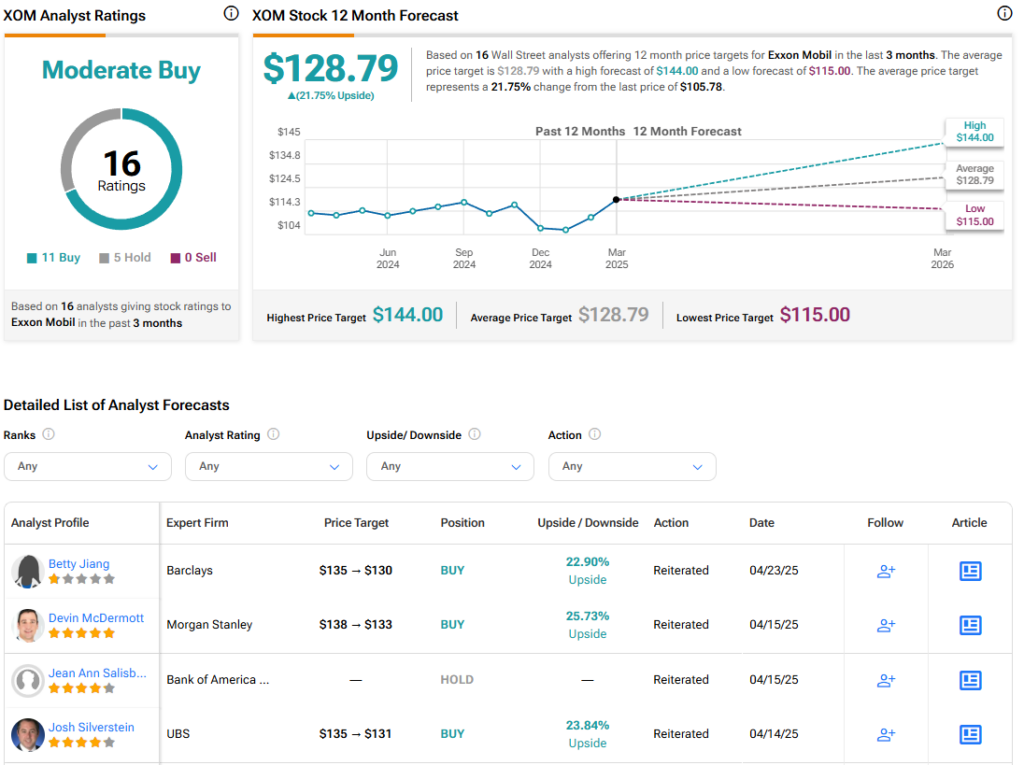

Turning to Wall Street, the analysts’ consensus rating for Exxon Mobil is Moderate Buy, based on 11 Buy and five Hold ratings over the last three months. With that comes an average price target of $128.79, representing a potential 21.75% upside for XOM stock. These ratings and price targets will likely change as analysts update their coverage after today’s earnings.