Xiaomi’s (XIACF) billionaire co-founder, Lei Jun, just introduced the Xiaomi 17 smartphone, a new $631 device built to compete directly with tech giant Apple’s (AAPL) latest iPhone 17. Like Apple, Xiaomi is offering both Pro and Pro Max versions, but for more than $100 less than Apple’s base model. Lei made the comparison clear in a two-hour online launch event by showing how Xiaomi’s new phone stacks up against the iPhone in terms of battery life, screen quality, and camera features.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, the comparisons didn’t stop at phones. Indeed, Lei also highlighted Xiaomi’s growing electric vehicle business by directly comparing one of its cars to Tesla’s (TSLA) Model Y. Interestingly, Xiaomi’s EV efforts have been a big success so far, which has helped triple its market value in the past year. The company’s first model even outsold Tesla’s Model 3 by the time it launched its second vehicle, the YU7 SUV, in June.

As a result, its EV segment is becoming a key revenue driver and could possibly make up 10–15% of profits by 2026. In addition, despite a recent fatal accident that triggered a recall of over 116,000 cars, demand has remained strong. In fact, Xiaomi has already delivered over 40,000 YU7s and plans to launch its first EVs in Europe by 2027. Separately, Lei also pointed out that Xiaomi is investing in other advanced tech, like chips and AI. More specifically, Xiaomi now plans to spend $7 billion developing its own mobile processors.

Which Tech Stock Is the Better Buy?

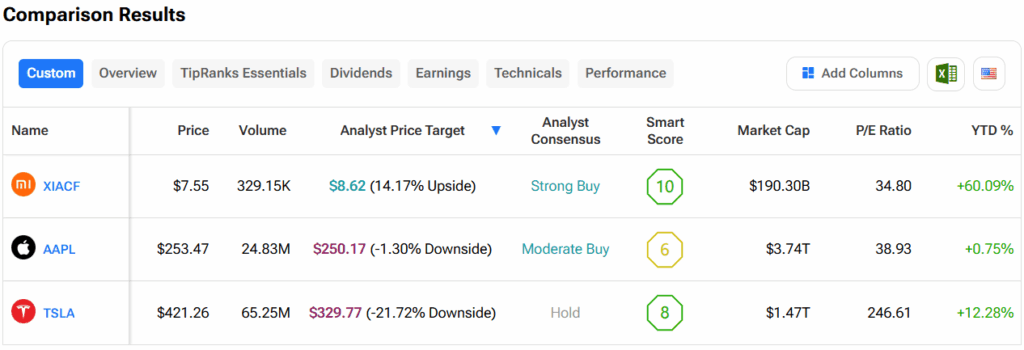

Turning to Wall Street, out of the three stocks mentioned above, analysts think that XIACF stock has the most room to run. In fact, XIACF’s average price target of $8.62 per share implies more than 14% upside potential. On the other hand, analysts expect the least from TSLA stock, as its average price target of $329.77 equates to a loss of 21.7%.