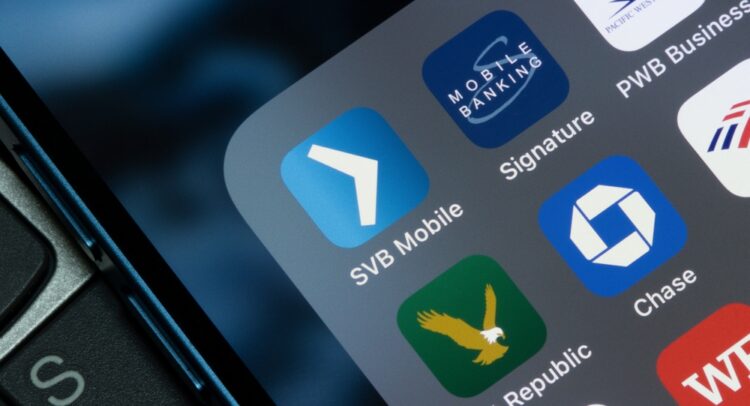

Regional bank stocks continued to be on a sharp downward trajectory in pre-market trading at the time of writing on Thursday even as PacWest BanCorp (NASDAQ: PACW) issued a statement late on Wednesday trying to reassure investors that it was exploring different options and the discussions are ongoing.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

In a bid to arrest the stock sell-off, another regional bank, Western Alliance Bancorp. (WAL) also issued a statement on Wednesday and stated that the bank has “not experienced unusual deposit flows following the sale of First Republic Bank and other recent industry news. Total Deposits were $48.8 billion as of Tuesday, May 2, up from $48.2 billion as of Monday, May 1, and flat to Friday, April 28.” The bank added that its capital base remains strong with its “CET1 ratio was approximately 9.7% as of April 30 compared to 9.4% as of March 31.”

Meanwhile, First Horizon Corp (FHN) also tanked in pre-market trading at the time of writing on Thursday as the bank holding company announced that its merger with TD Bank Group (TD) had been called off. The press release stated, “TD informed First Horizon that TD does not have a timetable for regulatory approvals to be obtained for reasons unrelated to First Horizon. Because there is uncertainty as to when and if these regulatory approvals can be obtained, the parties mutually agreed to terminate the merger agreement.”

Since the merger has been terminated, TD will make a cash payment of $200 million to First Horizon in accordance with its termination agreement. This will be in addition to a $25 million reimbursement fee related to the merger agreement.

Other regional banking stocks including Comerica (CMA) and Zion Bancorp. (ZION) were also down in pre-market trading on Thursday even as the Federal Reserve Chairman Jerome Powell tried to reassure investors that the U.S. banking system was “sound and resilient.”

Even the SPDR S&P Regional Banking ETF (KRE) has tanked by more than 35% in the past three months.