Software company Workday (WDAY) is set to release its Q3 FY25 results today. Wall Street analysts expect the company to report earnings of $1.76 per share for Q3, up 15% year-over-year. Revenues are also expected to rise by 15% year-over-year, reaching $2.13 billion for the quarter.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Over the past year, Workday’s shares have gained about 14%, driven by advancements in artificial intelligence (AI). The company has been improving its platform by adding AI technologies into it, making it better at things like data analysis, automation, and decision-making. With the upcoming results, everyone will be focused on how these AI advancements are impacting the company’s financial performance and future growth.

Interestingly, Workday has maintained a strong record of earnings surprises, surpassing estimates in each of the last nine quarters.

Analysts’ Mixed Sentiment Ahead of WDAY’s Q3 Earnings

Ahead of the results, Monness analyst Brian White Bank reaffirmed a Neutral rating on WDAY stock, citing the company’s challenges in a tough macroeconomic environment. White noted that though Workday is likely to meet its revenue and earnings targets for the third quarter, its growth appears to be slowing compared to earlier periods. This deceleration reflects the impact of external pressures and intense competition in the software sector.

Meanwhile, TD Cowen analyst Derrick Wood reiterated a Buy rating on Workday stock with a price target of $290. He noted that the company’s growth plans are on track, with growing interest in its Illuminate platform. This platform is an advanced data and analytics solution that uses AI and machine learning (ML) to improve decision-making across different business areas.

Further, the analyst believes that WDAY’s recent acquisitions and advancements, especially in AI, will strengthen its platform and help attract new users.

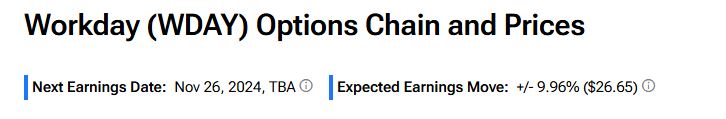

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you. Indeed, it currently says that options traders are expecting a large 9.96% move in either direction.

Is Workday a Good Stock to Buy?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WDAY stock based on 21 Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. The average WDAY price target of $292.28 per share implies 9.19% upside potential.