ASX-listed Woolworths Group Ltd. (AU:WOW) reported a 5.6% growth in its FY24 revenue to AU$68 billion. However, its NPAT (net profit after tax) plunged 93% to AU$108 million, hit by impairments of $1.5 billion related to its New Zealand food business. Excluding impairments, the grocery chain’s profit fell only 0.6% to $1.7 billion. WOW stock gained 3.27% in today’s trading session.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Woolworths’ smaller rival Coles Group (AU:COL) also reported its FY24 results today, with an 8.2% jump in its earnings to AU$3.66 billion. Meanwhile, its revenue was up 5.1% year-over-year.

Woolworths Group is a grocery chain in Australia and New Zealand, with well-known brands such as Woolworths, Big W, and Countdown.

Woolworths Delivers Mixed FY24 Results

In FY24, Woolworths’ sales were mainly driven by the solid performance of its Australian Supermarkets segment. The company’s customers experienced some relief in FY24, with average prices falling 0.6% in the fourth quarter ending in June.

Another highlight of Woolworths’ results was the strength in its eCom sales, which grew 18.5% on a normalised basis to about AU$8 billion.

On the flip side, the company’s EBIT (earnings before interest and tax) in its New Zealand division plummeted 57% in FY24. This was mainly due to its AU$1.5 billion impairments. Additionally, its investment in Endeavour Group led to an overall loss of around AU$100 million.

Woolworths Declares Special Dividend

Woolworths declared a special, fully franked dividend of AU$0.40 per share, funded by the $498 million sale of its interest in Endeavour Group. Along with this, Woolworths announced a final dividend of 57 cents per share, marking a decline of 1.7% from the previous fiscal year.

Nonetheless, the total dividend for FY24 increased 38.5% year-over-year to AU$1.44 per share.

Is Woolworths a Good Stock to Buy?

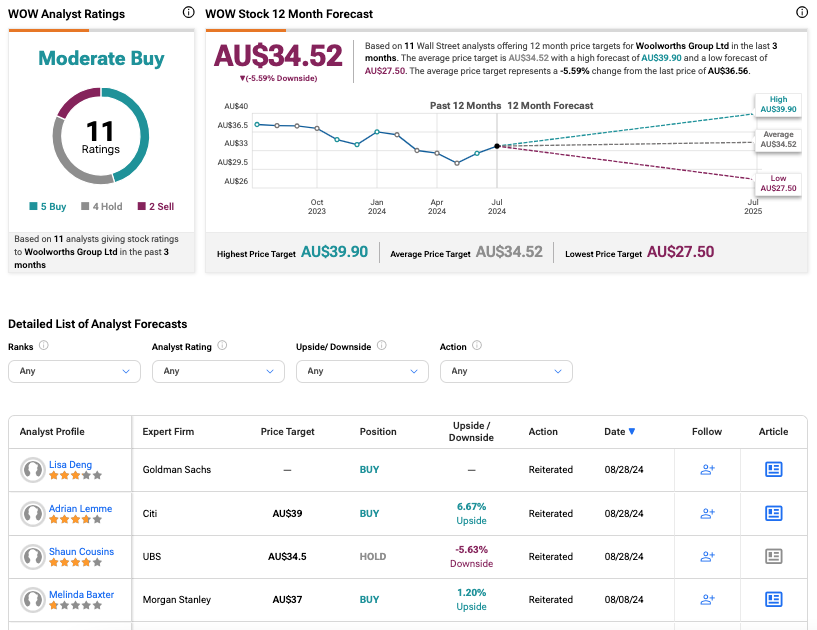

According to TipRanks’ consensus, WOW stock has received a Moderate Buy rating based on five Buys, four Holds, and two Sell recommendations. The Woolworths share price prediction is AU$34.52, which is 6% below the current trading level.