Wolfspeed (NYSE:WOLF) shares surged by nearly 14% in the pre-market session today after the energy products and solutions company’s first quarter EPS of -$0.53 came in narrower than estimates by $0.14. Additionally, revenue ticked 4.2% higher over the prior year period to $197.4 million.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company is experiencing market share gains with device design wins of over $1 billion during the quarter. While the end market for WOLF’s silicon carbide offerings continues to expand, the company’s new materials facility in Siler City is anticipated to boost its wafer production by over 10 times.

For the upcoming quarter, WOLF expects revenue from continuing operations to be in the range of $192 million to $222 million. EPS for the quarter is expected to be between -$0.56 and -$0.70.

Is WOLF a Good Stock to Buy?

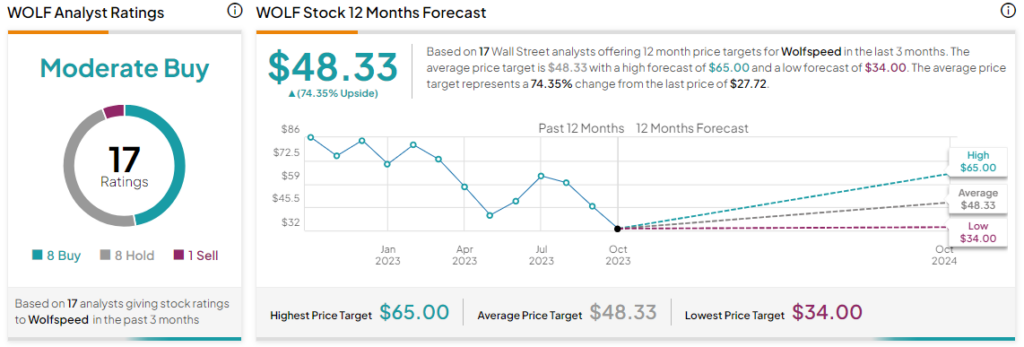

Overall, the Street has a Moderate Buy consensus rating on Wolfspeed. After a nearly 27.5% price erosion over the past month, the average WOLF price target of $48.33 implies a substantial 74.3% potential upside.

Read full Disclosure