Rivian Automotive (RIVN) stock is under pressure today after Wolfe Research analyst Emmanuel Rosner downgraded Rivian to Sell from Neutral and set a $16 price target, implying a downside potential of about 17%. Rosner said the recent rally in Rivian shares has been driven more by autonomy hype, not by stronger growth in the company’s core business, making the risk-reward profile less appealing now.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Estimates Look Too High for 2026

Looking ahead, Rosner believes Wall Street forecasts for 2026 are too high. He expects Rivian to post an EBITDA loss of about $2.1 billion, compared with consensus estimates near $1.76 billion. He also warned that free cash flow burn could rise above $4 billion, driven by higher capital spending, operating costs, and working capital needs.

The analyst also flagged risks to near-term demand for Rivian’s upcoming R2 model. He expects most R2 volumes to be pushed into the second half of 2026, which could limit growth in the earlier part of the year.

Unlike Tesla (TSLA), Rosner does not see many near-term autonomy or AI catalysts for Rivian. Most key launches tied to autonomy are not expected until late 2026, leaving a long gap with limited positive drivers for the stock.

Overall, Wolfe Research sees rising costs, heavy cash burn, and high expectations as key reasons for caution, helping explain the recent weakness in Rivian shares.

Is RIVN Stock a Buy or Sell?

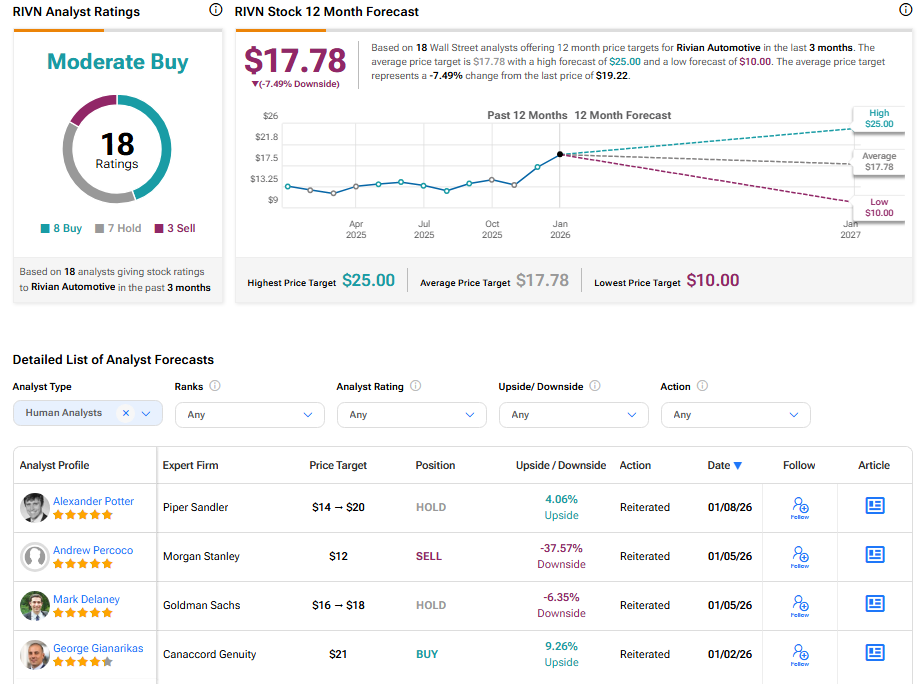

Turning to Wall Street, analysts have a Hold consensus rating on RIVN stock based on eight Buys, seven Holds, and three Sells assigned in the past three months, as indicated by the graphic below. Further, the average RIVN price target of $17.78 per share implies 7.49% downside risk.