Advanced Micro Devices (AMD) is making steady strides in the AI chip race, fueled by strong demand for its GPUs and growing data center sales. The stock is up 14% year-to-date, including a sharp 65% rally over the past three months. Its latest Instinct MI350 chips are gaining ground among hyperscalers, helping AMD narrow the gap with Nvidia (NVDA) in the AI inference market. Riding the AI momentum, Vijay Rakesh, a 5-star analyst of Mizuho Securities, raised his AMD price target to $152 from $135, while maintaining his Buy rating. With the stock in focus, now’s a good time to take a closer look at who actually owns AMD stock.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Now, according to TipRanks’ ownership page, public companies and individual investors own 43.87% of AMD. They are followed by ETFs, mutual funds, other institutional investors, and insiders at 26.94%, 15%, 13.74%, and 0.45%, respectively.

Digging Deeper into AMD’s Ownership Structure

Looking closely at top shareholders, Vanguard owns the highest stake in AMD at 8.58%. Next up is Vanguard Index Funds, which holds a 7.10% stake in the company.

Among the top ETF holders, the Vanguard Total Stock Market ETF (VTI) owns a 3.21% stake in Advanced Micro Devices stock, followed by the Vanguard S&P 500 ETF (VOO), with a 2.82% stake.

Moving to mutual funds, Vanguard Index Funds holds about 7.10% of AMD. Meanwhile, Fidelity Concord Street Trust owns 1.71% of the company.

Is AMD a Buy or Sell Now?

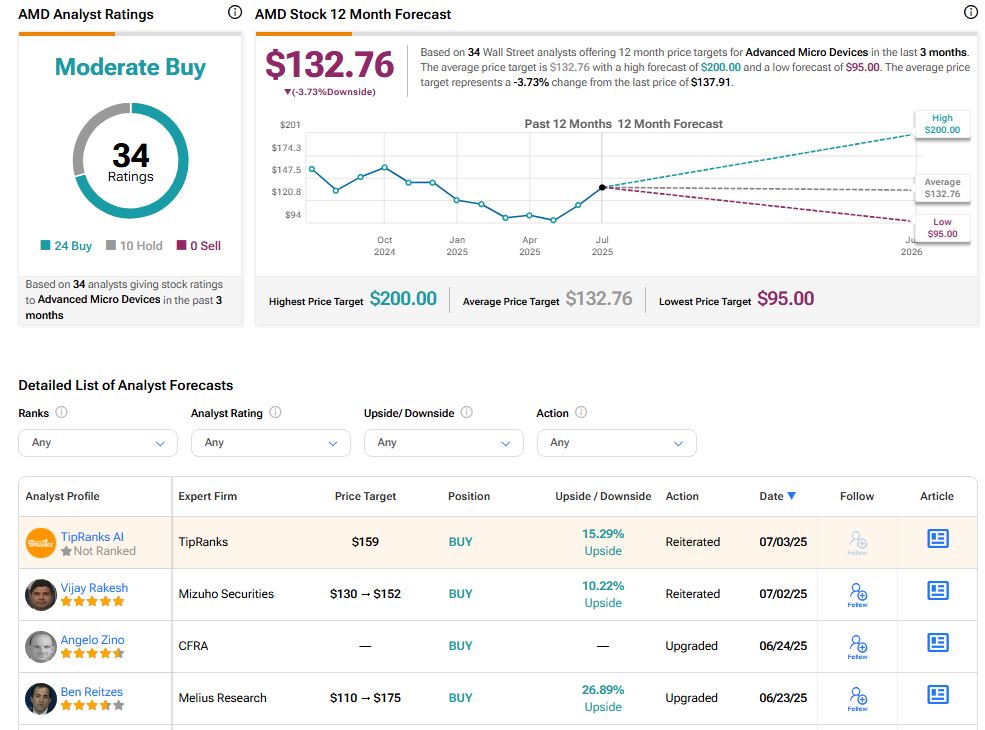

According to TipRanks, AMD stock has a Moderate Buy consensus rating based on 24 Buys and 10 Holds. The average AMD stock price target of $132.76 indicates a possible downside of 3.73% from current levels.