Wingstop (NASDAQ:WING) shares are ticking lower today after the restaurant operator announced its results for the fourth quarter. Revenue increased by 21.2% year-over-year to $127.1 million, outperforming expectations by $7.1 million. Further, EPS of $0.64 fared better than estimates by $0.07.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

During the quarter, system-wide sales jumped by 24.5% year-over-year to $965.9 million. In sync, domestic same-store sales ticked up by 21.2%. Wingstop opened 115 net new locations in Q4. At the same time, the company’s cost of sales as a percentage of company-owned restaurant sales declined to 75.1% from 76.4% in the year-ago period. However, higher professional fees and compensation expenses led to an increase in its selling, general, and administrative expenses.

For Fiscal Year 2024, Wingstop expects same-store sales growth in the mid-single digits. Net New outlet openings are pegged at 270 units. At the end of December 2023, Wingstop had a total of 2,214 restaurants. The company plans to take this number to 7,000 locations over the coming years.

Is WING a Good Stock to Buy?

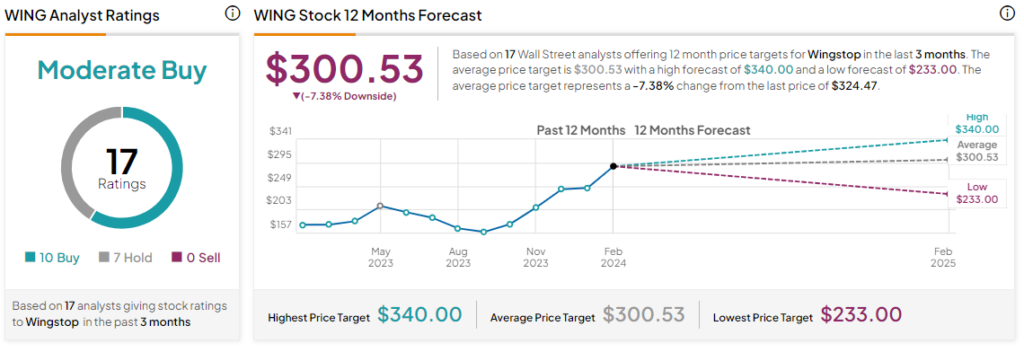

Shares of the company have rallied by nearly 101% over the past six months. Overall, the Street has a Moderate Buy consensus rating on Wingstop alongside an average price target of $300.53. However, analysts’ ratings on the stock could see a revision following its Q4 numbers.

Read full Disclosure