Zendesk (ZEN) is closing in on a deal that could see Hellman & Friedman LLC and Permira acquire it. The Wall Street Journal reports that a deal with the private equity firms could be reached in the coming days. The acquisition would be the biggest private equity takeover of the year.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

ZEN provides software-as-a-service products related to customer support, sales, and other customer communications.

A deal with the private equity firms comes on the heels of ZEN ending a bid to sell itself in a private equity auction. In addition, the company expected to reach a settlement agreement with activist investor Jana Partners LLC, which could have resulted in Mikkel Svane stepping down as CEO. However, it is still unclear whether the negotiations with Jana will continue in light of the new buyout push.

Zendesk’s Takeover Push

Last month, the software company said it would stay independent after failed takeover bids. In February, it turned down a $17 billion takeover bid from a group of private equity firms. Shareholders have also shot down a planned acquisition of Momentive Global (MNTV) for about $4.1 billion. Reuters reports that Jana had nominated four directors to the Zendesk board, insisting that the company must be rehabilitated after the unpopular move to acquire Momentive Global.

The software giant has been the subject of takeover bids from private equity firms armed with mountains of cash they urgently need to put to work. It continues to attract strong interest, partly because of a solid core business backed by over 160,000 paid accounts. In addition, the company continues to enjoy a surge in business as its enterprise customers accelerate the digital transformation.

Wall Street’s Take

The Street is optimistic about the stock, with a Moderate Buy consensus rating, based on three Buys and eight Holds. The average Zendesk price target of $116 implies a 100.2% upside potential from current levels.

Blogger Opinions

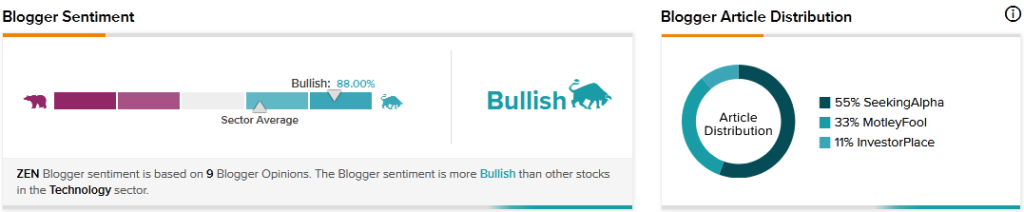

TipRanks data shows that financial bloggers’ opinions are 88% Bullish on ZEN, compared to a sector average of 65%.

Key Takeaway for Investors

Zendesk faces an uncertain future amid mounting activist investor pressure pushing for changes in the management hierarchy. The company has also struggled to sell itself for the better part of the year, having also failed to acquire Momentive Global.