Over the past year, a few AI startups have together accumulated nearly $1 trillion in valuations despite remaining unprofitable. This comes as AI infrastructure continues to draw in massive investment, raising questions about a possible AI bubble and its potential impact on the stock market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to estimates, AI infrastructure spending by U.S. tech companies Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), and Meta Platforms (META) could reach almost $400 billion by the end of this year.

Is the Stock Market Overheating on AI Hype?

These developments have prompted Wall Street to warn that the current spate of investments in AI infrastructure, especially in data centers to power gigantic AI workloads, is comparable to the internet bubble of the 2000s. Several stakeholders have warned of the potential stock market fallout from an AI bubble.

These warnings come even as the price-to-earnings ratio of the benchmark index S&P 500 — which tracks the 500 largest publicly traded companies in the U.S. — is close to 23, according to new research from neobank OneSafe. This means that investors are willing to pay 23 times the earnings per share of the large institutions on the index.

In fact, recent research shows that more than half of global fund managers believe that tech stocks have become too expensive, with global stock valuations recently reaching a new high. The majority of the managers, therefore, believe that AI stocks are in a bubble.

Leading financial institutions, including the International Monetary Fund (IMF) and the Bank of England, have also issued similar warnings. However, the IMF believes that an AI bubble burst is likely to have a less systemic impact on the U.S. or global economy.

Is an AI Bubble Burst Coming or Not?

As the debate rages on, the question of whether the global economy, particularly America’s, is experiencing an AI bubble continues to attract opposing opinions from Wall Street.

According to veteran investor Howard Marks, who is the co-founder of Oaktree Capital Management (OAK), the market is not seeing an AI bubble yet. Marks has argued that while stock valuations are undeniably high, they are not irrational. He further observed that a true bubble is defined by psychological excess.

On the contrary, Jeff Bezos, founder of Amazon, has described as “very unusual” investments in AI companies that may not have solid business plans. Bezos believes that we are experiencing what he calls an “industrial bubble” — a type of bubble that benefits society in the long run.

Nonetheless, the Amazon founder emphasized that AI itself is not just hype and will have a palpable impact on every industry, even if many businesses wind up during the process.

What Are the Best AI Stocks to Buy?

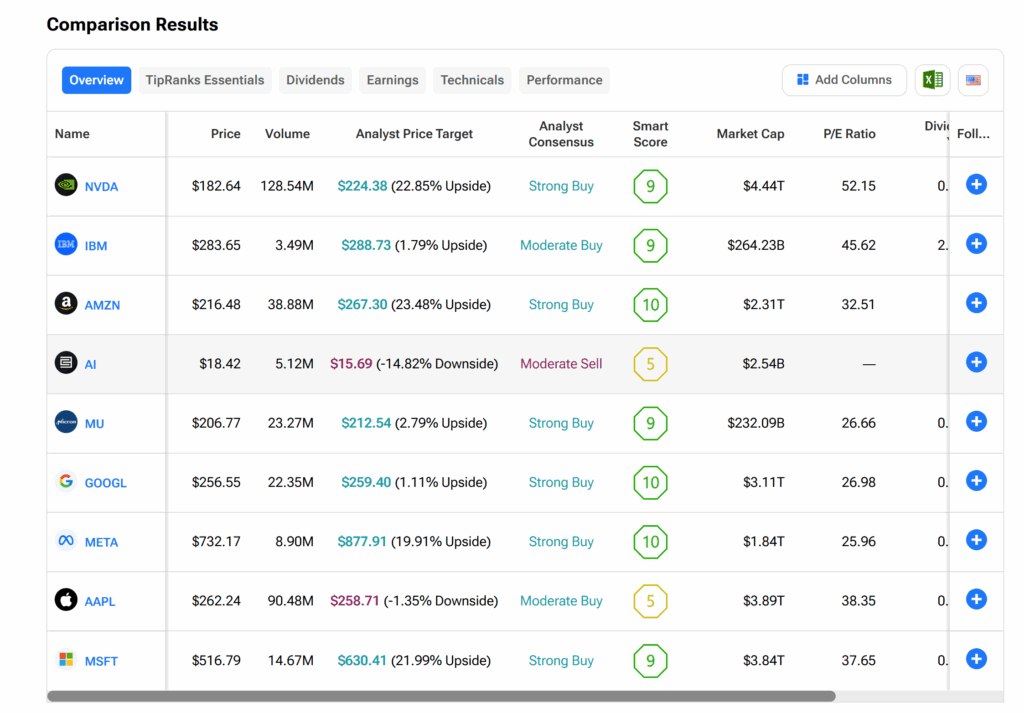

The massive investments in AI infrastructure, particularly in the U.S., continue to pose both a risk and an opportunity for investors. TipRanks’ Stock Comparison tool helps to guide investors on which AI stocks might be worth sticking with, based on the assessment of multiple Wall Street analysts. See the graphics below.