SoFi Technologies (SOFI) stock has rallied more than 72% year-to-date, driven by continued strength in the company’s financials and a rapidly expanding customer base. The fintech company is scheduled to announce its third-quarter earnings on October 28. While investors remain optimistic, several Wall Street analysts are cautious on SOFI stock due to intense competition and steep valuation. Nonetheless, a solid Q3 earnings beat and strong outlook can be a catalyst for SOFI stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

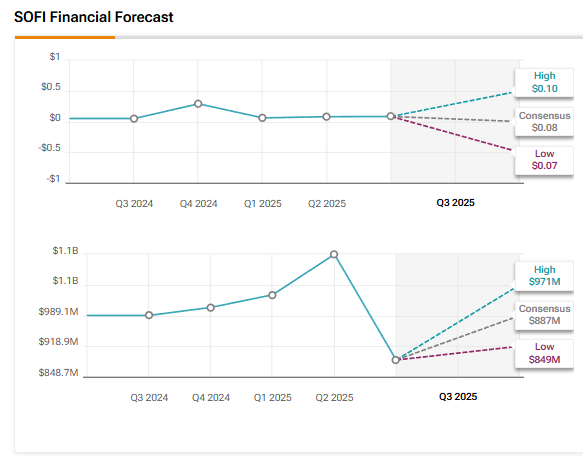

Meanwhile, Wall Street expects SoFi to report earnings per share (EPS) of $0.08 for Q3 2025, reflecting a 60% year-over-year growth. Revenue is expected to grow 27% year-over-year to $887.24 million.

Analysts Have Mixed Views on SOFI Stock

SoFi Technologies has rapidly grown its member base and enhanced its customer engagement with the continued expansion of its product portfolio. The company added an impressive 850,000 members in Q2 2025, leading to a 34% year-over-year rise in its total member base to 11.7 million. Moreover, SoFi’s product offerings jumped 34% to 17.1 million.

After delivering 44% growth in Q2 adjusted revenue and a massive jump in adjusted EPS to $0.08 from $0.01 in the prior-year quarter, expectations are high for SoFi Technologies’ third-quarter results.

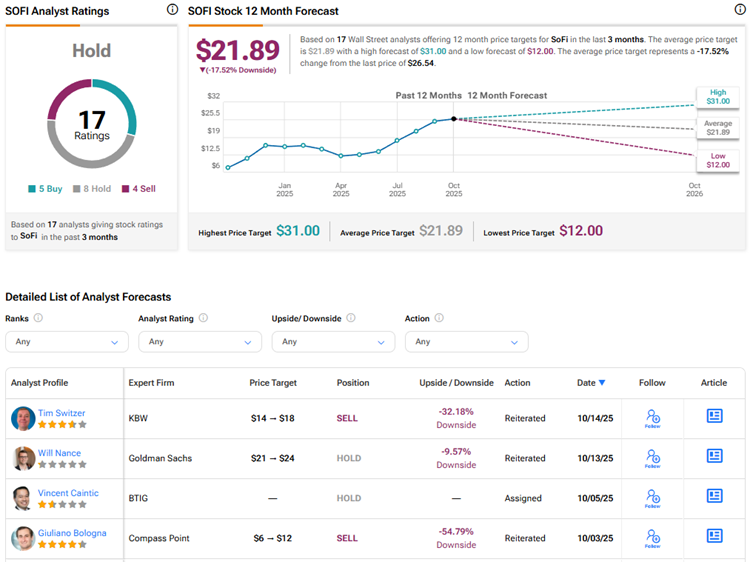

Recently, Mizuho analyst Dan Dolev increased his price target for SoFi Technologies stock to $31 from $26 and reaffirmed a Buy rating. Dolev’s analysis indicates that bank processors, consumer lenders, and exchanges are best positioned to benefit from interest rate cuts. Specifically, the top-rated analyst believes that SoFi’s “strong rate-driven outlook” commands a higher valuation multiple.

Last week, Keefe Bruyette analyst Timothy Switzer raised his price target for SOFI stock to $18 from $14 but reaffirmed a Sell rating. The analyst increased his estimates ahead of SoFi’s Q3 earnings to reflect higher net interest income and strong momentum in the company’s loan platform. While Switzer sees the possibility of many favorable potential catalysts supporting SOFI shares over the near term, he remains bearish as he believes that the stock’s risk/reward “seems skewed negatively over the long term given the premium valuation.”

Is SOFI Stock a Good Buy Now?

Currently, Wall Street is sidelined on SoFi Technologies stock, with a Hold consensus rating based on eight Holds, five Buys, and four Sell recommendations. The average SOFI stock price target of $21.89 indicates a downside risk of 17.5% from current levels.