BigBear.ai Holdings (BBAI) stock has risen more than 58% year-to-date, driven by optimism about the growth potential of the data analytics and artificial intelligence (AI)-powered solutions provider. BBAI is scheduled to announce its third-quarter earnings on November 10. Amid concerns about declining revenue, rising losses, and high valuation, Wall Street is cautiously optimistic about BigBear.ai stock. Ahead of Q3 earnings, Wall Street’s average price target indicates a downside risk in BBAI stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Wall Street expects BBAI to report a larger loss per share of $0.07 for Q3 2025 compared to $0.05 in the prior-year quarter. The Street’s consensus Q3 revenue estimate indicates a 23.4% year-over-year decline to $31.81 million.

Cautious Optimism Ahead of BBAI’s Q3 Earnings

BigBear.ai has reported a wider-than-anticipated loss per share in each of the last three quarters. In Q2 2025, BBAI’s loss per share worsened to $0.71 from $0.06 in the prior-year quarter, as revenue declined 18% to $32.5 million. BBAI blamed disruptions in federal contracts from efficiency efforts, most notably in programs that support the U.S. Army, for the decline in its Q2 revenue. Nonetheless, management highlighted the sequential improvement in BBAI’s balance sheet and “record” cash balance of $390.8 million as of the end of Q2 2025.

Despite dismal Q2 results, there has been optimism about the road ahead, as BigBear.ai continues to announce major deployments and win attractive deals. For instance, on Friday, BBAI stock rose about 4% after the company announced the deployment of its veriScan biometric identity platform to support the U.S. Customs and Border Protection’s Enhanced Passenger Processing (EPP) program at Chicago O’Hare International Airport.

Meanwhile, critics continue to point out BBAI’s weak performance, especially in comparison to another data analytics company with a defense focus, Palantir Technologies (PLTR). Notably, PLTR has been delivering impressive revenue and earnings growth, with its quarterly revenue hitting the $1 billion mark for the first time in Q2 2025.

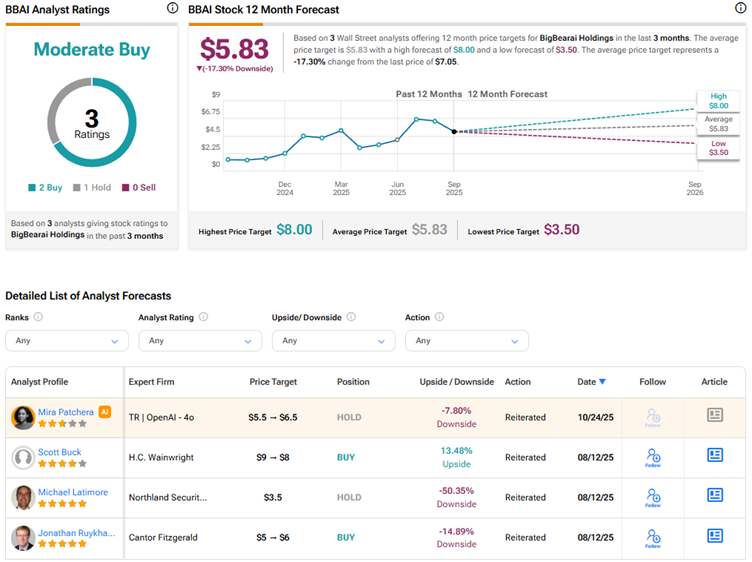

Currently, Wall Street is cautiously optimistic about BBAI stock. Despite valuation concerns, some analysts remain bullish on BBAI stock. In fact, H.C. Wainwright analyst Scott Buck expects better revenue visibility as BigBear.ai progresses into 2026. The 4-star analyst expects the company to benefit from the “One, Big, Beautiful Bill,” which involves higher spending on areas aligned with the company’s core competencies.

Is BBAI a Good Stock to Buy?

Overall, BigBear.ai Holdings stock scores a Moderate Buy consensus rating based on two Buys and one Hold recommendation. The average BBAI stock price target of $5.83 indicates a downside risk of 17.3%.