CrowdStrike Holdings (CRWD) is set to report its Q1 fiscal 2026 earnings later today, and investors are watching closely. Over the past few days, six new Buy ratings have been issued by Wall Street analysts, showing a wave of optimism. But does Spark, our AI Analyst, agree? Let’s take a closer look.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

CrowdStrikes’ Strengths

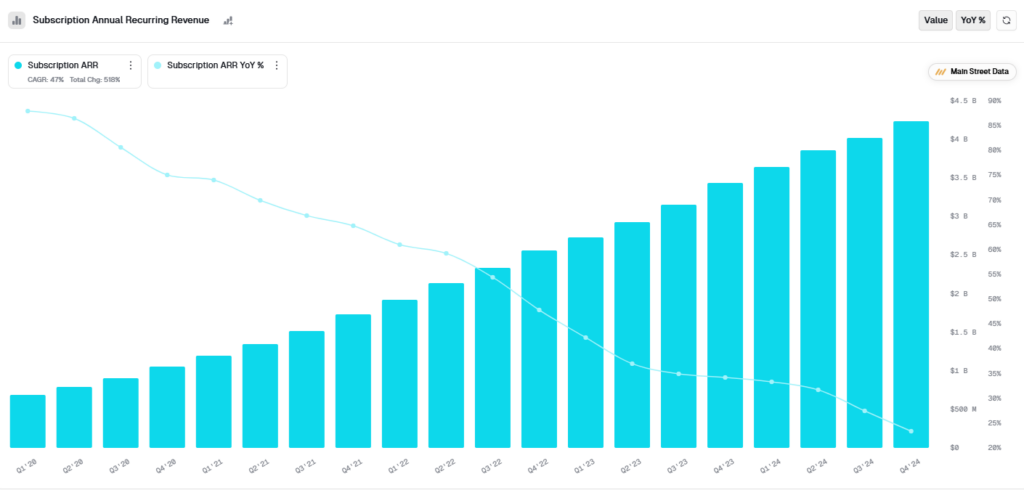

Spark gives CrowdStrike an Outperform rating with a score of 76, reflecting confidence in the company’s growth engine. Despite some macro concerns and a recent pre-market dip in its stock price, the fundamentals remain strong. CRWD ended fiscal 2025 with $4.24 billion in annual recurring revenue (ARR), and its free cash flow hit a record $1.07 billion, with a healthy 27% margin. In a high-growth SaaS model, that kind of cash generation is a big green flag.

The company’s business model, based on recurring subscriptions for its Falcon cybersecurity platform, is working. It boasts a 97% customer retention rate, indicating both high product satisfaction and customer loyalty. Falcon has expanded from just three modules in 2016 to 29 modules today, covering a wide range of topics, from cloud security to AI-powered identity protection.

CrowdStrike’s Weaknesses

While Spark sees a lot to like, it’s not all smooth sailing. CRWD is still not consistently profitable under Generally Accepted Accounting Principles (GAAP) accounting. In its most recent quarter, the company posted a net loss of $92.3 million, partly due to acquisition costs and strategic investments. Spark also notes that net new ARR slightly declined, raising questions about growth sustainability.

There’s also the matter of valuation. While some sources cite a forward P/E near 137, CrowdStrike’s trailing twelve-month (TTM) P/E is deeply negative at -5062, reflecting its ongoing GAAP net losses, driven by heavy investment in growth and stock-based compensation. Additionally, the company recently announced a workforce reduction of around 500 employees (about 5%) as part of a strategic restructuring plan. While the move is aimed at improving long-term efficiency, it reflects some internal cost pressure.

Further Positive Aspects

From a market perspective, CRWD is showing strong technical momentum, trading well above its 50-day and 200-day moving averages. It has outperformed most peers in the cybersecurity space over the past 12 months. According to Spark, sector strength is also above average, with CRWD holding its own against competitors like Palo Alto Networks (PANW) and Fortinet (FTNT).

Adding to the bullish case, six new Buy ratings have come in just days ahead of the earnings report, highlighting Wall Street’s growing confidence in CrowdStrike’s long-term trajectory. These fresh endorsements support Spark’s positive outlook and reinforce the view that the company is on the right path.

Is CrowdStrike a Buy, Sell, or Hold?

Wall Street Analysts see CrowdStrike as a Strong Buy, with an average CRWD stock price target of $443.63. This implies a 7.42% downside.

Bottom Line

So, is CRWD a Buy ahead of earnings? Sparks thinks so. With strong revenue growth, healthy cash flow, and expanding product adoption, the outlook is solid. The upcoming earnings will offer more clues—but for now, both Sparks and Wall Street seem to agree: CrowdStrike is still worth watching.