What would you tell someone if they were to ask you, “Should I buy Apple (NASDAQ:AAPL) stock right now?” For Morgan Stanley analyst Erik Woodring the answer is quite clear – the analyst sees Apple as a flower that keeps blossoming.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

In essence, Woodring’s optimism about Apple’s prospects is closely tied to the emerging possibilities within the AI space, which was met with widespread enthusiasm by investors and industry observers alike. Specifically, the analyst spies an “Edge AI” opportunity in Apple devices.

As Woodring goes on to explain, Apple stock was hit in the year’s first week with worries that

“near-term Product demand remains uneven” and “near-term supply chain checks are mixed” – reinforcing the impression that consumers are too keen on buying new iPhones this year. But Woodring takes the contrary view, pointing out that December sales of iPhones were actually a bit better than he had expected to see, and will probably top his estimate of 72.5 million units shipped. Moreover, the analyst notes that services revenues are tracking towards 10% year over year growth in Q4.

Fact is, even if sales are a bit slow right now, that wouldn’t frighten Woodring. For one thing, “near-term” sales performance shouldn’t necessarily be the thing that long-term investors focus on when examining Apple stock – or any stock. For another, Woodring believes Apple may have an underappreciated opportunity in the AI space, as its “GenAI efforts” to put artificial intelligence capabilities directly onto iPhones are “accelerating.”

According to the analyst, Apple may decide to launch an “AI iPhone” as early as Fall of 2024, using NAND flash memory instead of DRAM to power larger large language models (LLMs) installed directly on its smartphones. According to reports cited in Woodring’s research, this could increase the speed at which iPhones answer AI-oriented questions by a factor of anywhere from 20x to 25x. Apparently – and logically – Apple will be building this capability into its Siri virtual assistant, giving the product a much-needed refresh.

Why is this important? I mean, beyond the simple fact that anytime anyone says “AI” these days, investors tend to get excited? Well, Woodring notes that in recent years, consumers have been holding onto their old iPhones longer before laying out cash to upgrade. But the introduction of an AI iPhone could be the kind of revolutionary advance needed to extract cash from consumer wallets and shout “just take my money!” at Apple.

Come to think of it, if rumors of an AI-enabled iPhone start to get confirmed, then this could cause a perverse effect: Consumers may delay iPhone purchases even more as they save up to buy the latest new-and-improved iPhone, resulting in even weaker “near term” sales. But this would be the calm before the storm that hits when the AI iPhone finally arrives.

Woodring’s advice is to buy now before that storm hits. The Morgan Stanley analyst gives Apple shares a $220 price target, which implies an 18% upside potential on the 12-month horizon. (To watch Woodring’s track record, click here)

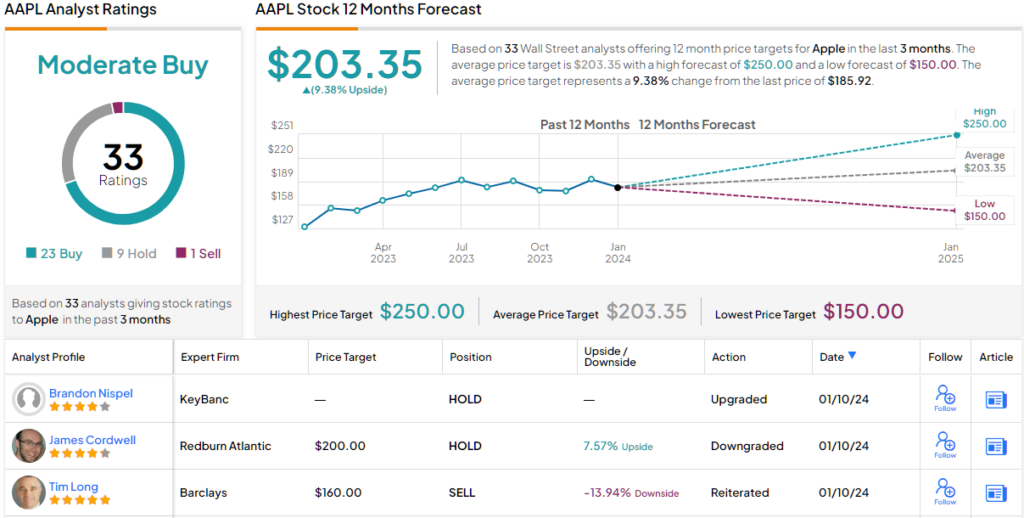

Overall, no fewer than 33 analysts have weighed in on AAPL, and their reviews include 23 Buys, 9 Holds, and a single Sell, for a Moderate Buy consensus rating. The stock’s current trading price is $185.92 and the $203.35 average price target suggests about 8% upside potential from current levels. (See AAPL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.