Advanced Micro Devices (AMD) has underperformed rival Nvidia (NVDA) over the last 12 months. However, AMD could makeup some of the lost ground in the artificial intelligence (AI) and data center segments amid reported delivery delays for Nvidia’s new Blackwell line of processors. For this reason, I’m bullish on AMD stock.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

AMD’s Changing Business

Change is underway at AMD, which is another reason why I’m bullish on the stock. AMD is a fabless semiconductor company that designs microchips and processors. But its business is undergoing a significant transformation, shifting towards AI and data center markets. In this year’s second quarter, that change became clear as data center revenue surged by 115% year-over-year to $2.8 billion and now accounts for more than 50% of AMD’s total revenue. This growth is being driven by the company’s Instinct MI300 accelerator, which generated over $1 billion in sales during the quarter.

While AMD has seen huge tailwinds in AI and data centers, other parts of its business haven’t fared as well. Client revenue increased by 49% to $1.5 billion, driven by Ryzen processors, but gaming revenue declined by 59% to $648 million. Embedded revenue decreased by 41% to $861 million. In short, we’re seeing AMD follow Nvidia into the AI and data center business. And, given its strong research and development funding, AMD is among the best-positioned companies to benefit from these tailwinds.

AMD versus Nvidia

AMD is gaining ground on archrival Nvidia, which is reason to be bullish on the company and its stock. AMD represents a challenge to Nvidia’s dominance of the AI and data center market. Nvidia controlled around 98% of the market in 2023, but that dominant position is being eroded as AMD moves toward high single-digit market share in the sector.

This increase in market share is due to several factors, one of which is performance. AMD’s latest Instinct MI300X chip has turned heads. The company claims it offers 40% greater inference performance compared to Nvidia’s H200 chip that’s used with the Llama3 AI model. However, Nvidia counters that when using their optimized software, the H100 outperforms the MI300X.

With data center revenue now accounting for than 50% of AMD’s total revenue, it goes without saying that this is an increasingly important sector for the company. The entire sector is growing fast, with analysts suggesting the market will be worth $364 billion by 2034. This would represent a compound annual growth rate (CAGR) of 11.4% over the next decade.

Will AMD Benefit from Blackwell Delays?

AMD might be able to take advantage of a current vulnerability with Nvidia, providing even more reason to be bullish on AMD stock. How can AMD get a bigger slice of the growing AI and data center market? Well, it has increased the pace of innovation and it’s improving its full-stack offering — providing software services as well as hardware. Now, the company may also benefit in the near-term from reported delays in Nvidia’s Blackwell line of chips.

With Nvidia’s Blackwell Graphics Processing Units (GPUs) reportedly sold out for the next 12 months, AMD’s upcoming MI325X accelerator could fill the gap in demand for high-performance AI chips. The delay also gives AMD more time to refine and optimize its MI325X processor, potentially closing the performance gap with Nvidia’s offerings. Also, data center and AI customers may look to diversify their chip suppliers, giving AMD a chance to gain market share and establish new partnerships with major industry players.

Limited supply of Blackwell GPUs could allow AMD to charge higher prices for its MI325X accelerators, which would be good for the company’s margins. It’s important to note that Nvidia’s strong demand and sold out status for its Blackwell chips indicates the overall strength of the AI chip market.

AMD’s Valuation

AMD’s valuation might be problematic for some investors. At 45 times forward earnings, the stock is trading at an 87% premium to the information technology sector as a whole. That’s a rich valuation. Of course, it’s a growth-oriented stock with analysts forecasting a CAGR of 41% over the medium term, which would give it a price-to-earnings-to-growth (PEG) ratio of 1.1 – a 39% discount to the sector.

All eyes will be on AMD’s next quarterly earnings report scheduled for October 29. The consensus estimate is for earnings per share (EPS) of $0.92. Revenue is projected at $6.71 billion, with seven upward revisions and 25 downward revisions in the last 90 days.

Is AMD Stock a Buy?

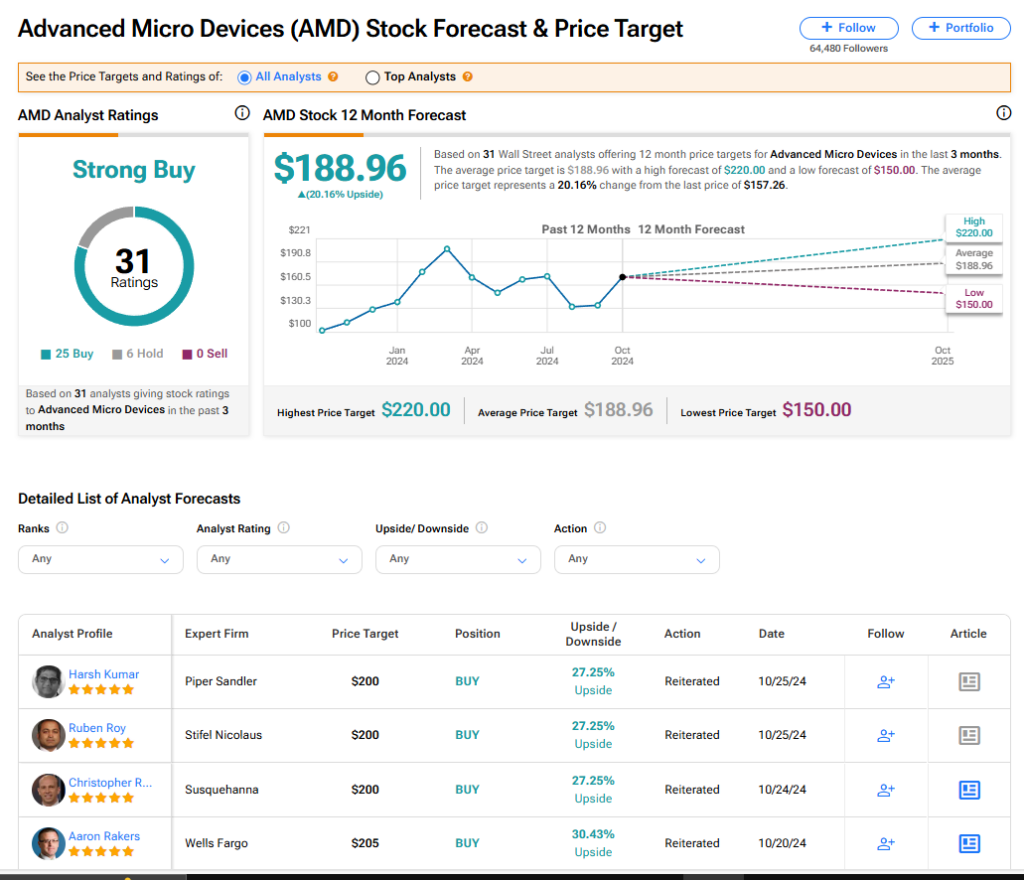

On TipRanks, AMD is a Strong Buy based on 25 Buys, six Holds, and zero Sell ratings assigned by Wall Street analysts in the past three months. The average AMD stock price target is $188.96 implies 20.16% upside potential.

Read more analyst ratings on AMD stock

Conclusion

AMD stock has rewarded investors over the past 12 months, but not as much as Nvidia. However, there’s evidence that AMD could be growing into the AI and data center segment. Ongoing innovation internally and delivery delays at rival Nvidia could provide AMD with additional tailwinds. While the stock is expensive, I’m confident enough in the company’s growth prospects to remain bullish on this security.