Usually, a high level of market skepticism spells trouble for a publicly traded company. When investors are confident enough to bet real money on a stock’s decline — and risk losses if they’re wrong — that kind of conviction is usually a red flag. But in the case of BigBear.ai Holdings (BBAI), that very skepticism could be the catalyst that sends the stock higher.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

To be sure, the company commands its own compelling narrative that goes beyond speculating on contrarian psychology. One of the top players in artificial intelligence (AI), BigBear.ai focuses on decision intelligence, utilizing AI, data fusion, sensor networks, and other advancements to help organizations make better, faster, and more reliable decisions, particularly in high-stakes environments.

Much of what makes BBAI stock exciting is the broader success story in big data and its applications. We’ve already seen how Palantir Technologies (PLTR) has utterly dominated Wall Street by offering its AI-driven data analytics and decision-intelligence platforms to government agencies and top-tier enterprises. While BigBear.ai operates at a much smaller scale, this also means it has tremendous growth potential.

Of course, the company isn’t without its criticisms. The biggest knocks against BigBear.ai largely stem from the financial print associated with growing pains, such as negative adjusted EBITDA. However, in light of the company’s expanding partnerships and growth opportunities in the still-burgeoning AI ecosystem, the overall narrative arguably favors the bulls. Indeed, BigBear.ai is one of those names where I can only be Bullish.

Skepticism May Help Drive the Bullish Case for BBAI Stock

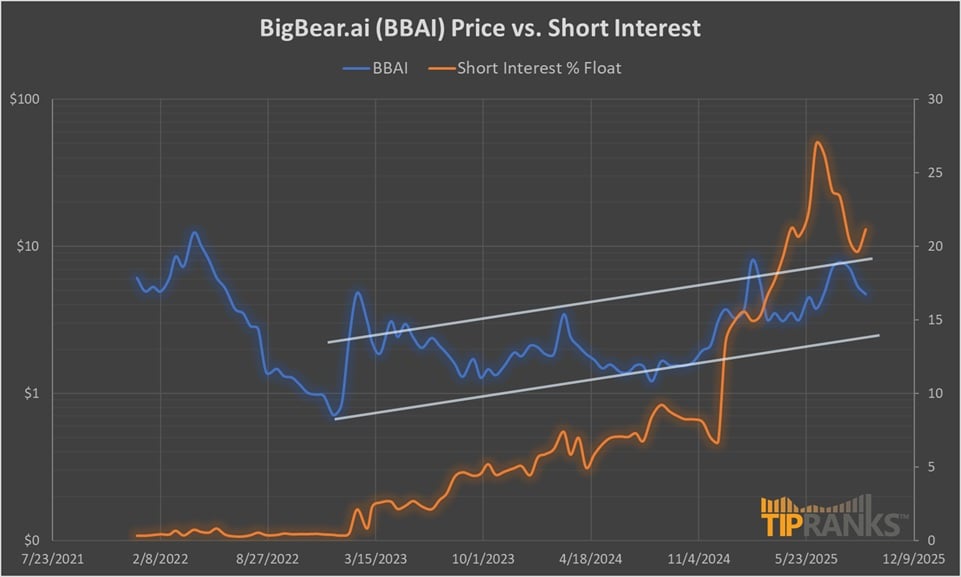

Upon an initial glance at the short interest in BBAI stock, investors may take a double-take. Currently, the metric stands at 21.31% of the float, which is an extremely high ratio of shares earmarked for downside speculation. Ordinarily, a short interest of 10% of the float is considered a warning sign, with 20% being a huge red flag.

Structurally, a short trade is a credit-based transaction. Initially, the short speculator borrows shares of the target security from a broker and immediately sells them in the open market. Should the stock fall in value, the speculator can reacquire the deflated shares at a relative discount. From there, the borrowed securities are returned to the broker, with the rest pocketed as profit.

It can be a highly lucrative means of earning money. Obviously, though, the target security must drop in value. What keeps short traders up at night is the possibility that the stock could rise in value. At that point, the speculator would be incurring losses. What’s worse, if the stock continues to rise, the obligatory payment (penalty) becomes greater.

Since we’re dealing with credit-based transactions, the creditor must be made whole — irrespective of whatever happens to the stock. Essentially, the contract focuses on the nominal count of the borrowed shares, rather than their individual value. As such, prudent bears have a vested interest in cutting their losses early.

On the other end, those who decide to tough it out could see the security skyrocket as panicked buy-to-close orders overwhelm the system. That’s the bears’ nightmare known as the short squeeze — and it’s a very real possibility for BBAI stock.

Not only is BigBear.ai tied to exciting digital innovations, but its equity is priced under ten bucks a pop. Potentially, this allows for easier coordination among retail traders, making BBAI stock a must-watch spectacle.

A Brewing Showdown for BigBear.ai

Another factor to consider besides just the raw short interest figure is the relationship between this metric and the BBAI stock price. Comparing the totality of the relationship, the correlation coefficient between the two metrics is only 19.19% — there doesn’t seem to be much of a correlation. However, when calculating the same between late-October 2023 and early September 2025, the coefficient suddenly jumps to 76.19%.

In other words, during the aforementioned time period, as BBAI stock marched higher, so too did its short interest. To be fair, it can’t be absolutely ascertained that one is causing the other to rise. However, it does appear that as BigBear.ai attracted more capital inflows, bearish traders saw an opportunity for cynical profits.

However, I also believe that the bears are overstretched, which is part of the reason why I acquired shares. For example, between December of last year and June of this year, BBAI’s short interest increased fourfold. Even at the current level, the expansion of short interest comes in at over 3x. Yet even with the enhanced skepticism, BBAI stock is clearly charting an ascending trend channel.

To make a long story short, I’m anticipating an explosive rise, with the bears at some point giving up their cynical endeavor. Looking ahead, then, I’m tempted by the January 15, 2027 $10 call. Right now, the contract can be acquired with a bid-ask spread of only 1.9% at the midpoint, which, in my opinion, is excellent for such a low-priced equity.

Is BBAI a Good Stock to Buy?

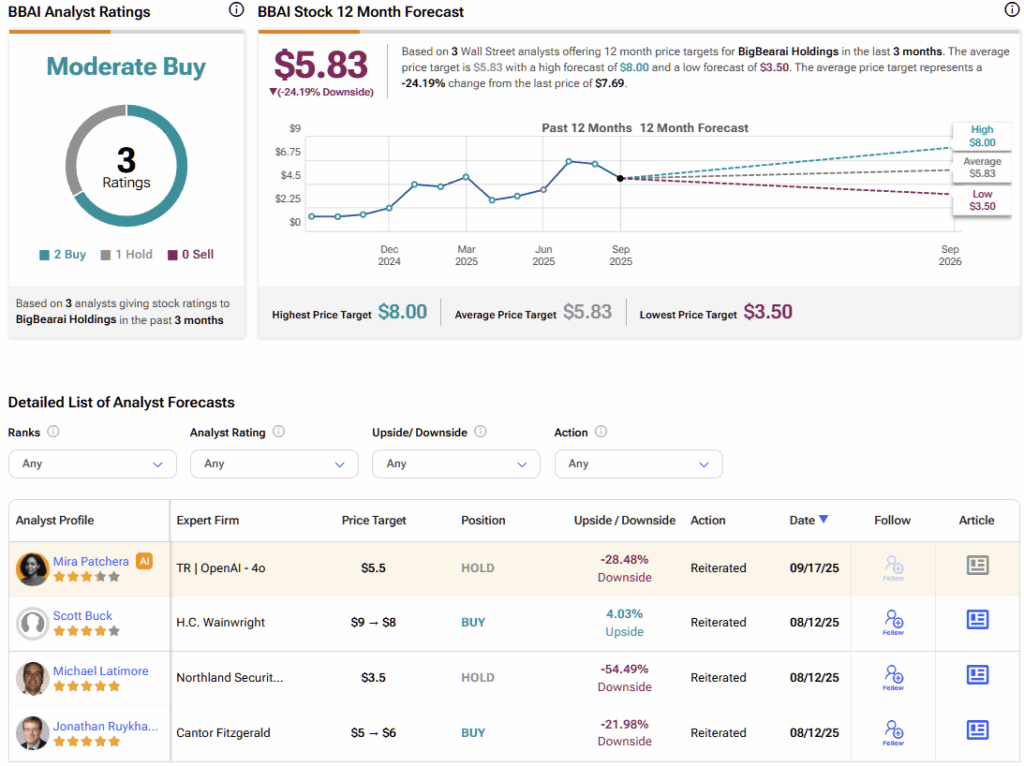

Turning to Wall Street, BBAI stock carries a Moderate Buy consensus rating based on two Buys, one Hold, and zero Sell ratings. The average BBAI stock price target is $5.83, implying ~24% downside risk over the coming 12 months.

A Bear Attack Only Makes BBAI Stock More Interesting

Under normal circumstances, excessive bearish speculation represents a warning sign to steer clear of potential trouble. However, for BigBear.ai, the potential for the business to promote positive disruption presents an intriguing contrarian tale. That short traders may be overexposed, combined with the “cheap” price of BBAI stock, makes the bullish narrative all the more alluring.