XRP (XRP-USD) is often dismissed as just another altcoin, overshadowed by Bitcoin’s dominance and the hype around newer tokens. Analysts say XRP may be the “sleeper asset” of the crypto world, meaning its value is underestimated today yet it could prove more durable than its rivals. In markets, a sleeper asset is one that quietly builds real-world utility and institutional support while others burn bright and fade.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

With use cases spanning remittances, loyalty rewards and institutional finance, XRP is starting to look like just that.

XRP Powers Cross-Border Payments

International payments remain one of XRP’s strongest value drivers. The token helps eliminate pre-funding, reduce settlement time, and cut costs by acting as a bridge currency.

Examples include SBI Remit in Japan, which uses XRP to send money instantly to the Philippines, Vietnam and Indonesia, and Tranglo in Southeast Asia, which taps XRP for remittance corridors across Malaysia, the Philippines and Bangladesh. Pyypl in the Middle East and Africa integrates XRP for payments targeting unbanked populations, while Banco Rendimento in Brazil uses it to move funds globally.

Compared with SWIFT, which can take days and rack up fees, XRP’s near-instant settlement makes it attractive in emerging markets where remittances are essential.

XRP Expands into Loyalty and Travel Programs

XRP is increasingly being used outside financial institutions. Travel and loyalty programs are adopting it for rewards and settlement, building everyday utility for millions of users.

Webus (WETO) and Wetour have established a $300 million XRP treasury to support blockchain-powered travel vouchers and loyalty points. This means more than 60 million members can use XRP for services like airport transfers and premium rides. In Japan, SBI VC Trade offers XRP rewards through loyalty campaigns, bringing the asset closer to consumers’ daily lives.

When loyalty programs integrate XRP, it shifts from being just an investment asset into something practical, giving it stickier adoption.

XRP Gains Institutional Adoption

Institutions are adding XRP to their balance sheets and operations, validating its use beyond speculation. By treating it as a serious treasury and settlement asset, they provide long-term confidence in its stability.

SBI Holdings (SBHGF) not only invests in Ripple but also integrates XRP into subsidiaries like SBI Remit and SBI VC Trade. Santander (SAN) explored XRP-based settlement for cross-border payments, while Bank of America (BAC) has been linked to Ripple’s efforts as well. Even travel platforms like WeBus are building XRP reserves to back settlement operations.

When corporations integrate XRP into liquidity management and payments, it signals durability and helps cement its role in finance.

XRP Improves Technology and Ledger Features

The XRP Ledger continues to evolve with upgrades that make it fast, scalable and practical for both businesses and consumers. Its speed and low cost keep attracting new use cases.

Transactions settle in three to five seconds with fees that average a fraction of a cent. The XLS-20 amendment introduced native NFTs, enabling loyalty points and collectibles directly on-chain. Proposals like XLS-70 and XLS-80 expand digital credentials and governance features, opening doors for regulated adoption. Projects like Sologenic even use XRPL to tokenize stocks and ETFs.

With over 150 independent validators, including universities and financial institutions, the ledger delivers both decentralization and efficiency.

XRP Secures Regulatory Clarity

The end of Ripple’s long-running battle with the SEC gave XRP the legal clarity it needed in the US. In July 2023, a federal judge ruled XRP is not a security when sold on exchanges, and by August 2025 the SEC dropped its appeals entirely. Ripple agreed to pay a $125 million penalty, clearing the way for expansion.

Japan and Europe also recognize XRP’s legal standing, while Ripple has aligned its usage with the EU’s MiCA framework. As of 2025, XRP counts more than 6.6 million active wallets worldwide, with SBI Group holding roughly $10 billion worth of XRP-related assets.

Regulatory certainty and network growth combine to strengthen XRP’s position as an asset that can endure.

XRP Faces Competitive Pressures

Despite its progress, XRP still faces steep competition from stablecoins and central bank digital currencies. USDC (USDC-USD) alone moves trillions of dollars annually, far outpacing XRP’s on-chain activity. Fireblocks, Circle (CRCL) and other networks are also embedding stablecoins across more than 100 countries.

While regulation is now a tailwind in some regions, global adoption remains uneven. China’s crypto restrictions, for instance, limit XRP’s reach. Against this backdrop, XRP must prove it can move from integrations to widespread usage.

Why XRP Could Outlast Rivals

The sleeper asset label fits because XRP is not the flashiest player in crypto, yet it has durability that others lack. It combines cross-border efficiency, institutional support, loyalty integrations, ledger innovation and regulatory clarity.

Whether it can scale adoption and compete with stablecoins remains the central challenge. But after years of legal uncertainty, XRP has the foundation to move beyond speculation. Its ability to quietly build trust and real-world utility is what makes some analysts believe it could be the crypto asset that outlasts rivals.

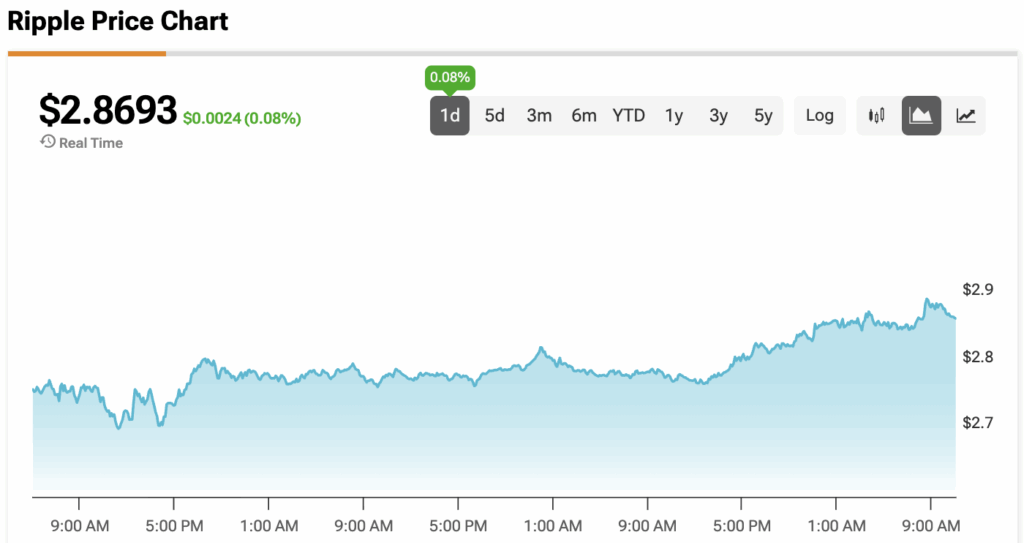

At the time of writing, XRP is sitting at $2.8693.