Broadcom (AVGO) stock’s valuation looks rich, yet durable AI-driven growth justifies it. With inference computing, $20B AI run-rate, $27.5B backlog, and 44% free-cash-flow margin, shares could gain 20–30% over the coming 12 months.

Education

About Us

Working with TipRanks

Follow Us

Why Wall Street is Still Screaming ‘Strong Buy’ on Broadcom Stock (AVGO)

Story Highlights

At first glance, Broadcom (AVGO) may look expensive, but as the AI market transitions from volatile training demand to steadier growth in inference and AI networking, its valuation is poised to keep rising. With Broadcom’s resilient growth trajectory and the long-term momentum of the AI super-cycle—now that the once-touted winners are truly delivering—I see no reason for caution. My base case calls for a 20% upside over the next 12 months, with potential for gains above 30%.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Why Broadcom Still Screams “Buy”

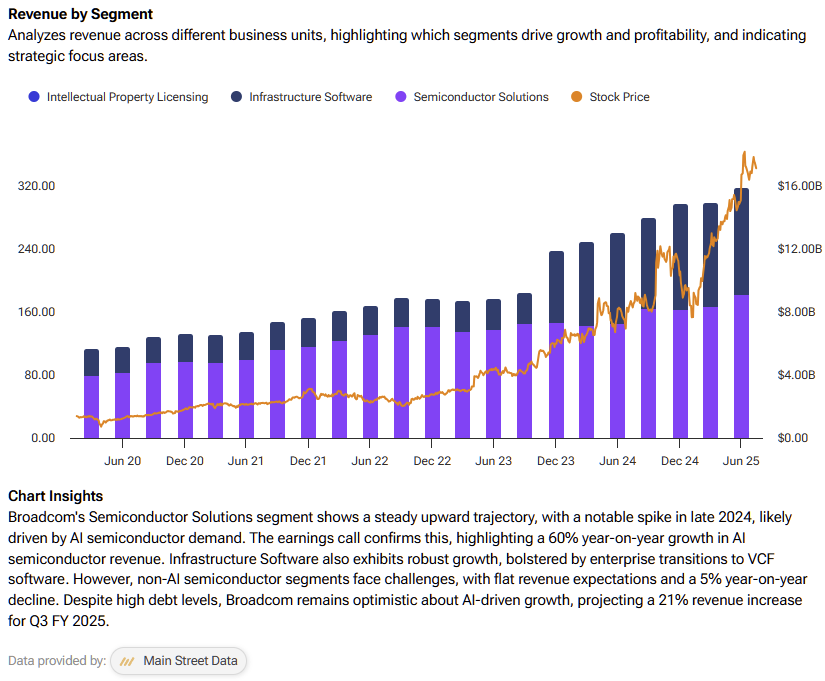

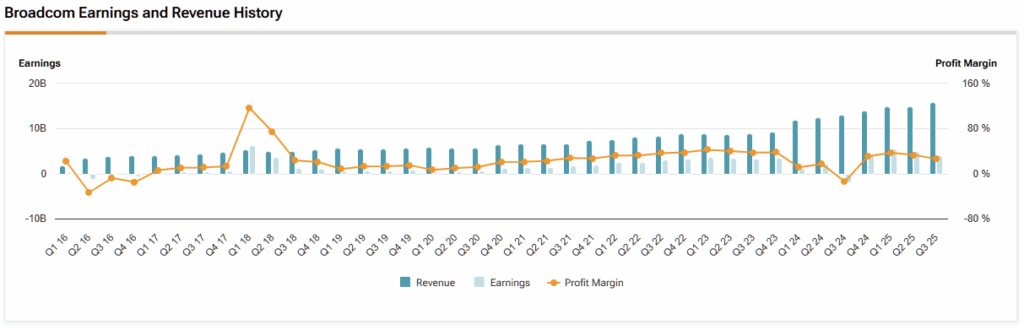

Broadcom reported impressive Q3 FY25 results, with revenue reaching $15.95 billion (+22% year-over-year) and AI semiconductor revenue climbing to $5.2 billion (+63% year-over-year). The company also guided for Q4 AI semiconductor revenue of $6.2 billion, putting its FY25 AI revenue run-rate near $20 billion. This positions Broadcom to sustain (and potentially amplify) positive sentiment heading into a rate-cut-driven 2026.

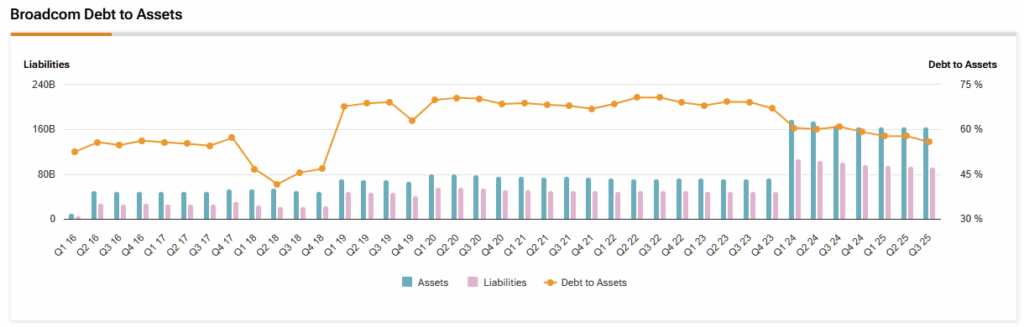

In addition, Broadcom disclosed Remaining Performance Obligations (RPO) of approximately $27.5 billion, with about 34% expected to be recognized within the next 12 months. This reinforces the company’s earnings visibility and provides a strong contractual foundation for growth.

Meanwhile, Broadcom continues to generate substantial cash even as it scales, posting $7 billion in free cash flow (44% of revenue) in Q3. That level of cash generation underscores the company’s operational efficiency and fuels an investment flywheel that should keep shareholders confident in the durability of its growth story.

Inference is the Next Great Chapter of AI

While AI training is the bedrock of the new age of computing, “inference” is where unit volume and persistence live. In AI development terms, inference refers to the process of using a trained AI model to make predictions, decisions, or generate outputs based on new input data.

Broadcom is one of the best businesses positioned to thrive in this era; its semiconductor solutions segment drove Q3 outperformance, specifically “custom AI accelerators and AI networking solutions,” while infrastructure software (VMware Cloud Foundation) contributed to the mix that supports margins.

However, even as AI demand accelerates, softness in non-AI segments—such as enterprise networking and storage—could weigh on Broadcom’s overall performance. Additionally, any moderation in hyperscaler spending could temporarily slow both inference and training demand, creating short-term headwinds despite the strong structural growth trend.

Custom silicon and networking ramps are skewed toward serving hyperscalers, so any deferral by a top account can sharply shift revenue down in earnings reports. Broadcom’s RPO disclosures warn that if all future revenue isn’t captured, then termination rights can exist (even if rarely used) on contracts excluded from official RPO.

Why There’s No Bubble Here

Broadcom’s stock grows more expensive by the day, but calling it a bubble is premature. Management is clearly constructing a durable, inference-focused AI franchise where custom accelerators and open Ethernet fabrics reinforce each other’s growth. As the market moves past pure AI “hype” and begins demanding long-term sustainability, Broadcom represents the right kind of “expensive” — premium for a reason — that can still deliver meaningful alpha.

All the evidence you need that this is a reasonably priced investment is the company’s forward PEG ratio of 1.71, which is 5.5% below the sector median. That’s not a value investment, but it’s accurately priced for the immense growth on offer.

That said, investors should remain mindful of valuation. Broadcom’s current and forward P/E of roughly 80x stands well above the sector average of around 30x—not excessive in the context of AI-driven growth, but certainly worth monitoring. In time, Broadcom will need to meet or exceed those elevated expectations to sustain its premium—or risk relinquishing some of its gains if performance falls short.

Consensus EPS forecasts point to 30–40% normalized annual growth over the next several years. Even if Broadcom’s P/E multiple remains flat or contracts slightly, that level of earnings expansion still implies 25%+ upside potential in the stock. This is the kind of growth worth backing with real capital, not just theoretical conviction.

My portfolio is currently fully allocated, but I’m considering making room for Broadcom—the company’s durable, inference-driven growth and the scale of the ongoing AI super-cycle are simply too compelling to ignore. Despite widespread macro concerns about an AI bubble, I’ve scanned the market and see little evidence of one.

That said, concentration risk remains real: an industry-wide capex pause or digestion phase from Big Tech could trigger a meaningful pullback in semiconductor stocks before the next leg of infrastructure expansion takes hold.

What is the Forecast for AVGO Stock?

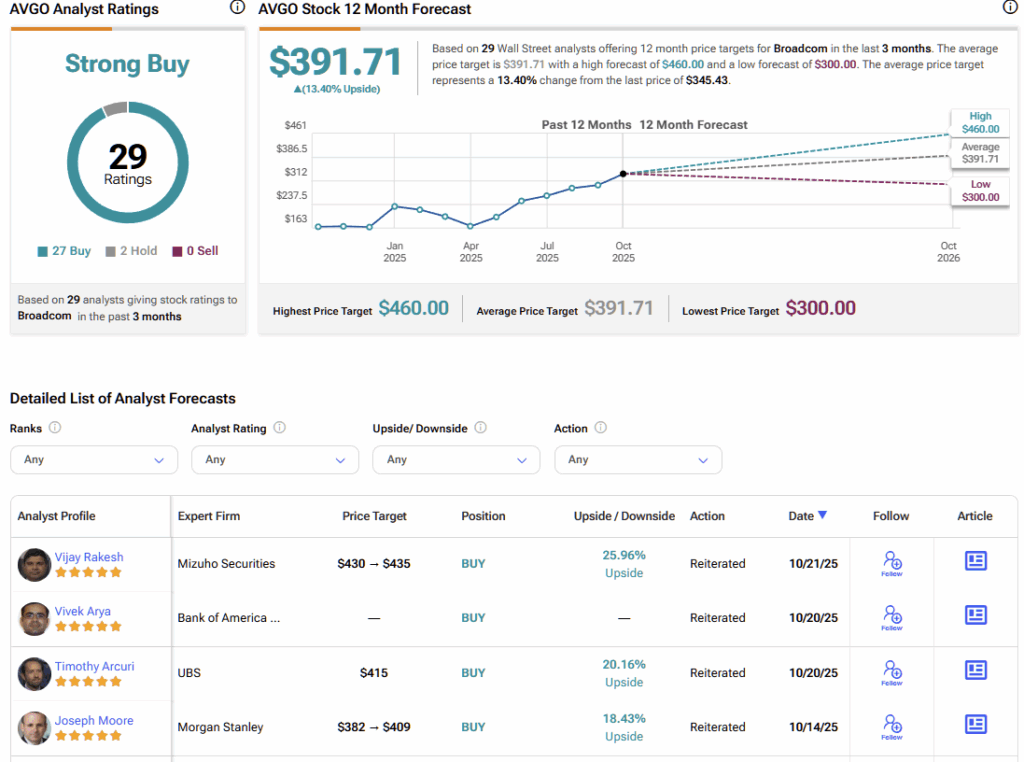

On Wall Street, Broadcom has a consensus Strong Buy rating based on 27 Buys, two Holds, and zero Sells. The average AVGO price target of $391.71 indicates ~13% upside potential over the next 12 months. However, the high estimate (where I’m personally positioned) is $460, indicating a much larger 35% return in the bullish case.

Broadcom Stock Ain’t Done Yet

It’s always tempting to sell or trim when a leading stock hits new highs and flashes overbought RSI levels, but in Broadcom’s case, this could actually be a buying opportunity. While a short-term pullback on valuation is possible, the long-term thesis remains firmly intact.

If AI capex were to pause, the resulting slowdown would likely extend beyond tech stocks to the broader economy. For that reason, I’d remain constructively greedy while momentum is strong—maintaining a cash buffer for opportunistic buying during any drawdowns and ensuring balanced diversification across growth sectors.

1