A group of Democratic senators, led by Elizabeth Warren, has sent a letter to executives at media giant Disney (DIS) to raise concerns about ESPN’s new partnerships with major sports leagues. Indeed, they argue that these deals could hurt competition in the sports media market and end up forcing fans to pay more. The lawmakers believe that ESPN is gaining too much control over how sports content is distributed and priced.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, ESPN reached a major agreement with the NFL in August in order to secure assets like NFL Network, the RedZone Channel, and NFL Fantasy in exchange for giving the league a 10% ownership stake in the network. Around the same time, ESPN signed a $1.65 billion, three-year deal with Major League Baseball to bring MLB.TV into its upcoming direct-to-consumer streaming service. Together, these moves significantly increase ESPN’s power in two of the country’s most profitable sports leagues.

As a result, Senators Warren, Bernie Sanders, Joaquin Castro, and Patrick Ryan said that these agreements could leave fans and competitors worse off by limiting choices and driving up prices. They have also asked Disney’s leadership to respond to their concerns by October 8, 2025. Interestingly, this pushback shows that lawmakers are paying closer attention to the influence of large media companies and the impact of their deals on consumers.

Is DIS Stock a Good Buy?

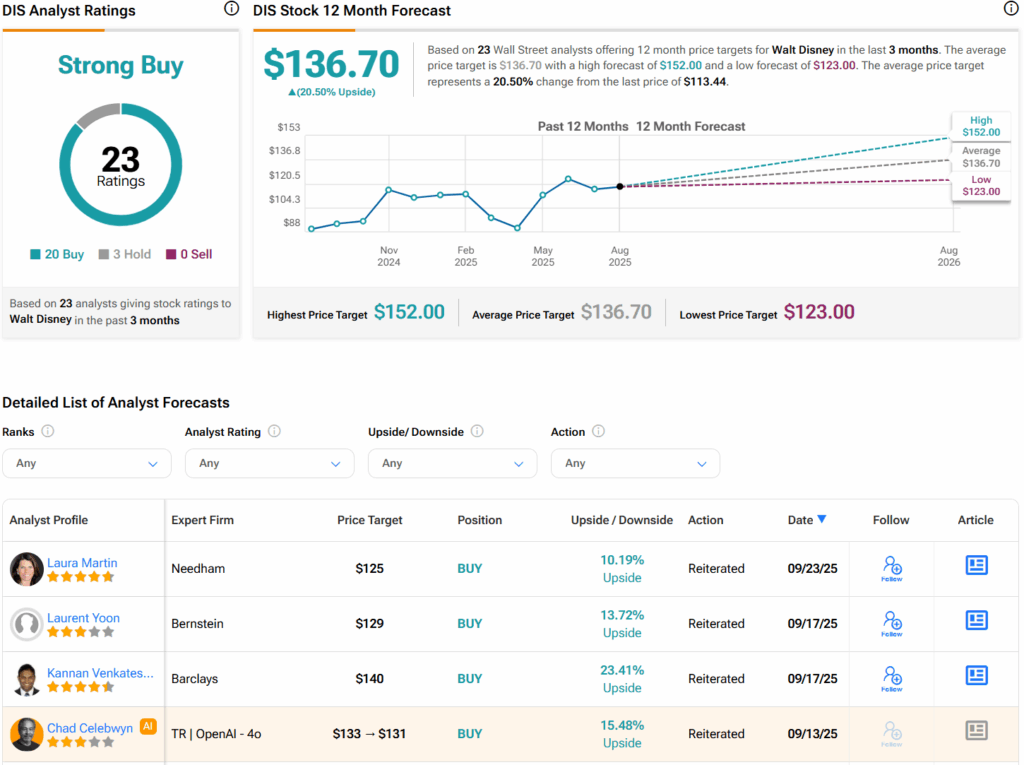

Turning to Wall Street, analysts have a Strong Buy consensus rating on DIS stock based on 20 Buys, three Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average DIS price target of $136.70 per share implies 20.5% upside potential.