Axon Enterprise (AXON), best known for its Tasers, recently received a Buy rating from investment firm Piper Sandler. Indeed, 4.5-star analyst James Fish pointed to Axon’s steady recurring revenue, growing cross-sell opportunities, and strong innovation pipeline as reasons for the rating. As a matter of fact, the company has expanded far beyond non-lethal weapons by adding body cameras, in-car Fleet systems, connected workflows, and AI-powered intelligence software.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It is also worth noting that about 70% of Axon’s current business comes from government clients, especially state and local agencies. Fish considers this an advantage because these customers have steady budgets and are investing more in technology to improve law enforcement. In addition, out of two billion frontline workers worldwide, only about one million currently use its products, and U.S. penetration in state and local markets is below 15%. Piper Sandler also expects much of Axon’s future growth to come from upselling customers to premium Officer Safety Plans, which bundle devices with advanced AI tools.

These upgrades could bring in as much as $4.5 billion in recurring revenue, with Axon’s Draft One AI assistant alone representing a $600 million opportunity. Furthermore, with over 95% of its customers on subscription contracts, Axon has a large backlog and a recurring revenue base that provides it with reliable growth prospects. More specifically, Piper Sandler estimates that the company could maintain an annual growth rate above 25% through 2027. As a result, it set a price target of $893 for Axon.

Is AXON Stock a Good Buy?

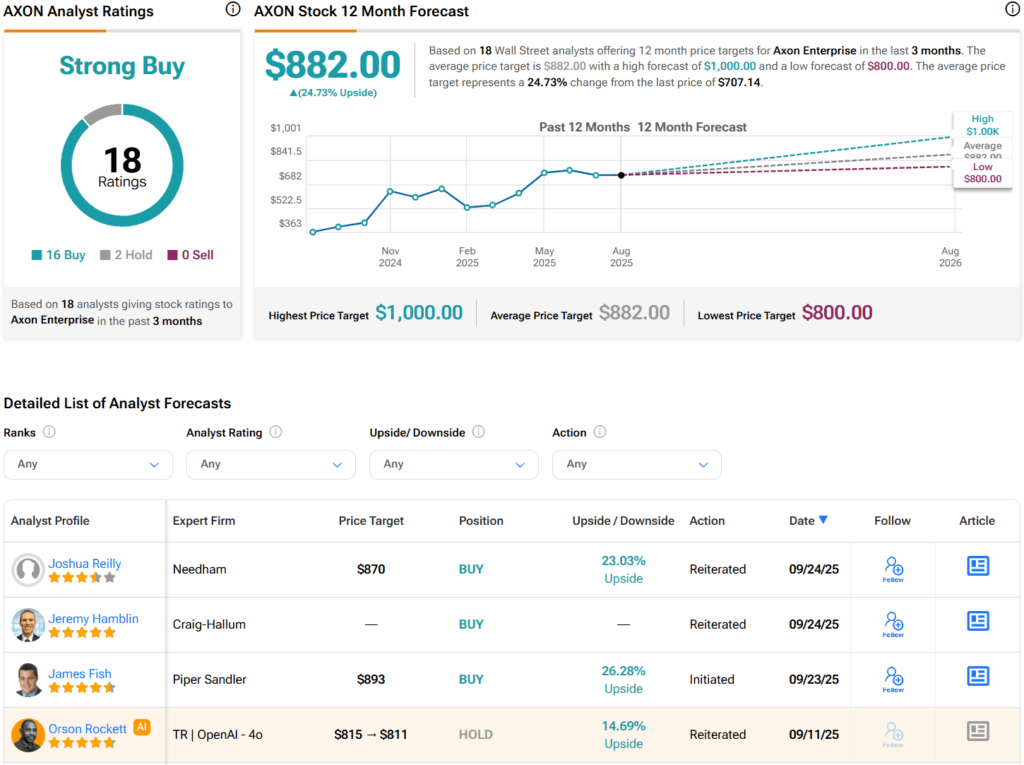

Turning to Wall Street, analysts have a Strong Buy consensus rating on AXON stock based on 16 Buys, two Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average AXON price target of $882 per share implies 24.7% upside potential.