Byron Deeter, a partner at Bessemer Venture Partners, doesn’t agree with the idea that today’s AI boom is just like the dot-com bubble. Indeed, in an interview with CNBC, he said that the key difference now is real revenue growth. While it’s fair for people to feel uneasy about high AI valuations, Deeter believes that those concerns are off the mark because companies like OpenAI and Anthropic are already making billions in revenue.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

He also explained that these companies are using different business strategies to grow. For instance, OpenAI is looking to challenge Google’s (GOOGL) lead in search through ChatGPT, while Anthropic is focused on selling API tools that help businesses create value. Deeter, who has invested in Anthropic, Canva, and Perplexity, said he’s confident that the large sums being invested in AI infrastructure will pay off. In fact, he believes that the AI market could become significantly larger than traditional software, suggesting that investors may need to “add a zero” to their past estimates.

In addition, when it comes to concerns about AI replacing jobs, Deeter called himself a “tech optimist.” He believes that AI will improve efficiency and create more valuable and interesting jobs, just like past industrial revolutions did. While the shift may happen faster this time, he sees it as a positive change. Deeter also talked about the energy demands of AI by pointing out that there are investments in nuclear and fusion energy being made in order to solve power issues.

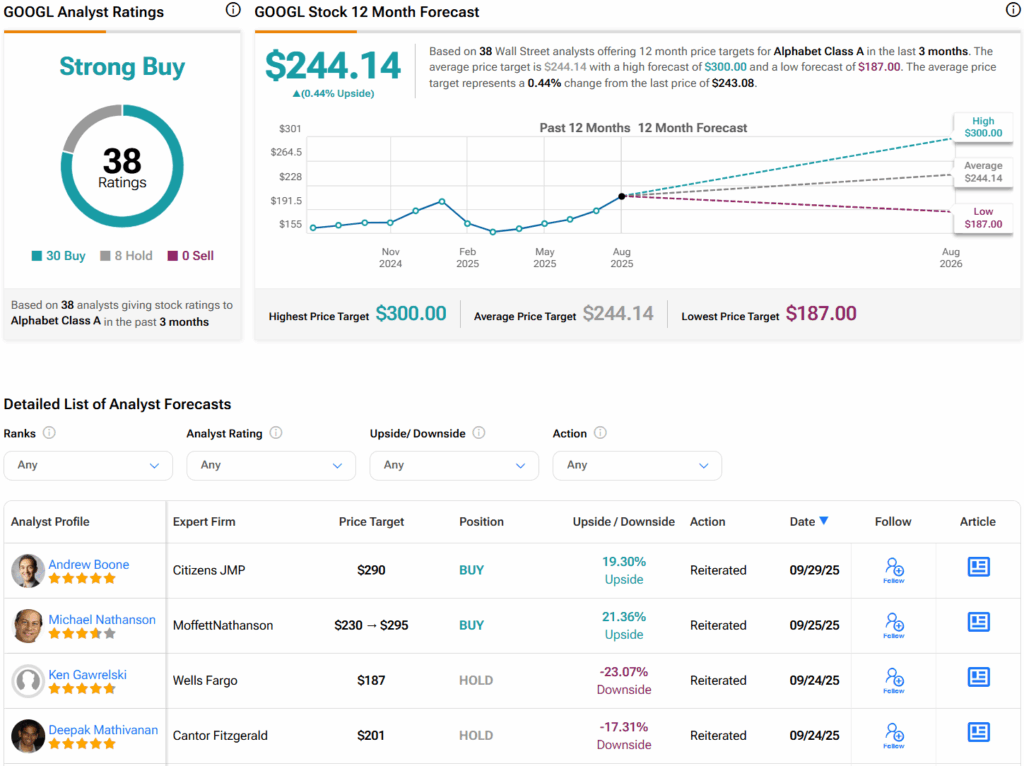

Is Google Stock a Good Buy?

Turning to Wall Street, analysts have a Strong Buy consensus rating on GOOGL stock based on 30 Buys and eight Holds assigned in the past three months. Furthermore, the average GOOGL price target of $244.14 per share implies that shares are trading near fair value.