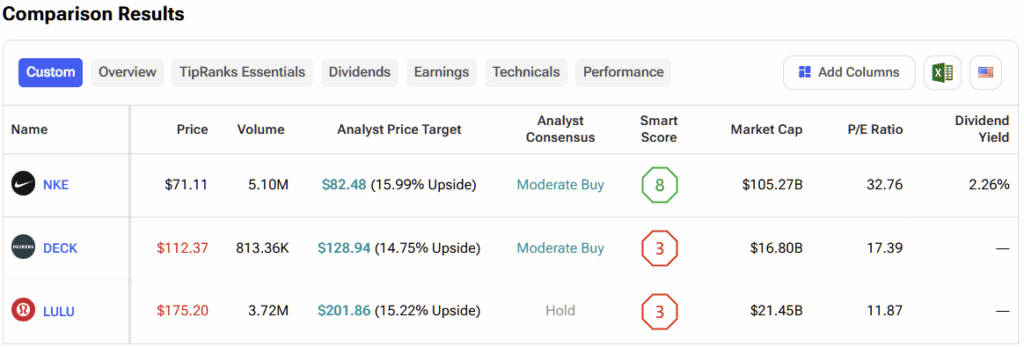

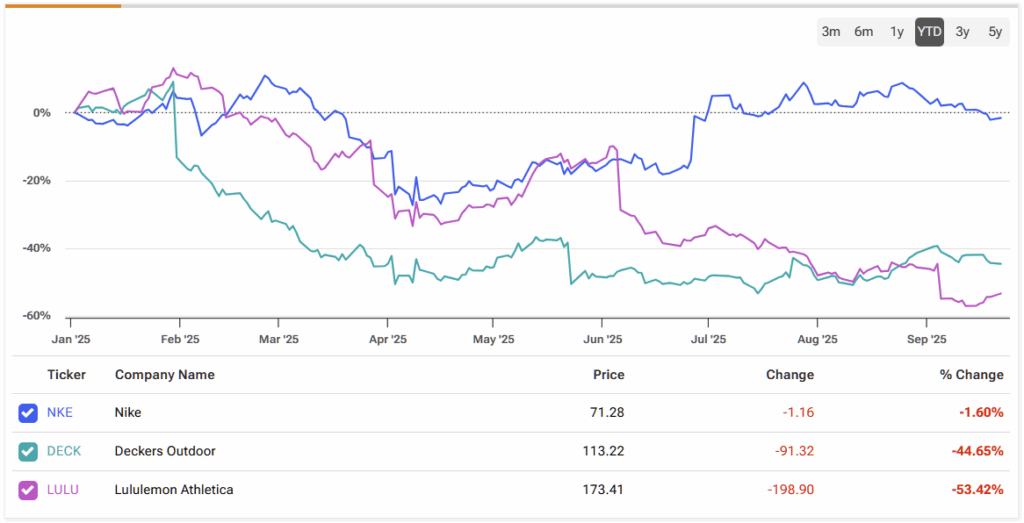

As the market pushes to new all-time highs, investors hunting for opportunities beyond the frontrunners have had to cast a wider net. One area that stands out for potential bargain-hunting is sportswear and what’s quickly become known as “athleisure”, where once high-flying names like Nike (NKE), Lululemon (LULU), and Deckers Outdoor (DECK) have stumbled—each trading 20% to 60% below their 52-week highs. The question now is whether any of these beaten-down stocks deserve a spot on value investors’ watchlist.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Nike (NYSE:NKE)

Shares of iconic sneaker and sportswear brand Nike are down 20.2% from their 52-week high. The last time Nike released quarterly and full-year results, shareholders were left disappointed. The company’s revenue declined 12% for the quarter (11% on a currency-neutral basis) and 10% for the year (9% on a currency-neutral basis).

The reason I’m bearish on Nike is that despite the challenges, it still trades at an extremely rich valuation, which looks undeserved at this point in time. Nike trades for about 43x May 2026 earnings estimates, meaning it’s actually twice as expensive as the broader market — the S&P 500 (SPX) only trades for 22.5x forward earnings estimates. If Nike were growing earnings and revenue at a rapid rate and setting the world on fire, one could perhaps justify this type of multiple, but that clearly isn’t the case here. Not only is Nike twice as expensive as the S&P 500, it’s also significantly more costly than other beaten-down stocks in the general sportswear/athleisure space, as we’ll discuss shortly.

Anecdotally, I’m also concerned about increasing competition from brands like Asics (ASCCF) and privately held New Balance, which I am seeing gain significant popularity among many of the kids and young people across America. Add in competition from On Holding (ONON), Decker’s Hoka, and traditional rival Adidas (ADDYY), and this looks like an increasingly crowded field for Nike to find its footing in as it seeks to return to growth.

To be fair, Nike has plenty of good things going for it; it is obviously an iconic brand with worldwide recognition. Furthermore, it’s also a strong dividend growth stock, as the company has paid a dividend for 35 consecutive years and increased its payout for 23 years in a row. Furthermore, after the selloff, it now yields a reasonable 2.26%, which may not sound like much to income-driven investors, but it’s still higher than the S&P 500’s average yield of 1.3%.

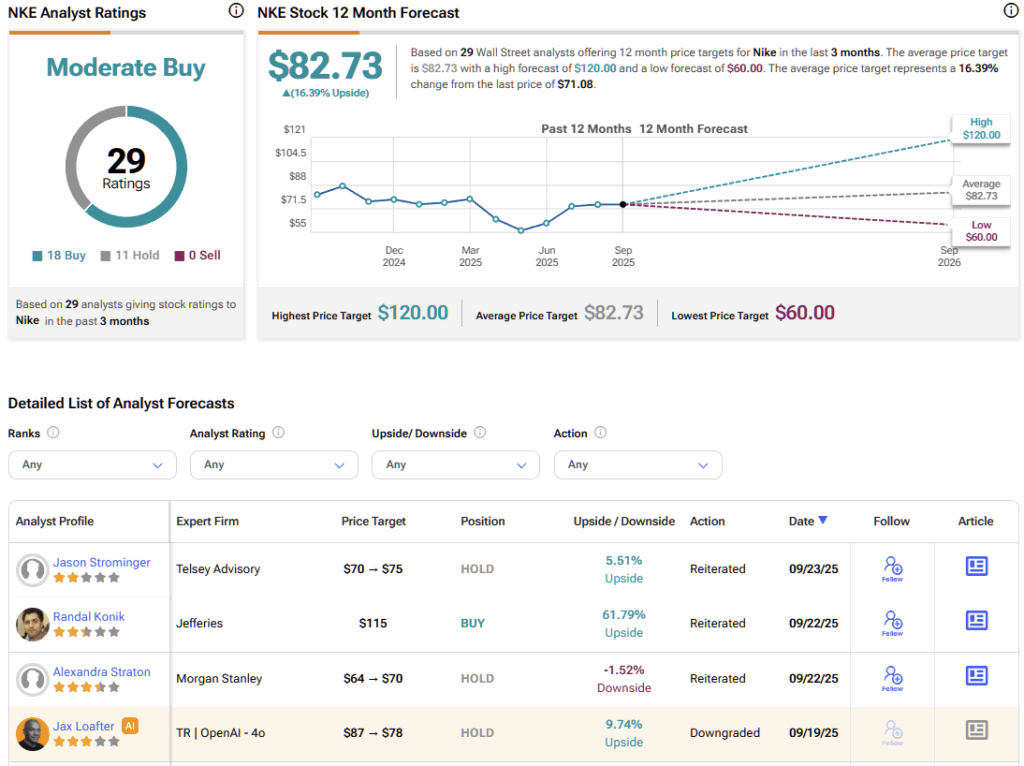

Is Nike a Buy, Sell, or Hold?

Turning to Wall Street, NKE earns a Moderate Buy consensus rating based on 18 Buys, 11 Holds, and zero Sell ratings assigned in the past three months. The average NKE stock price target of $82.73 implies more than 16% upside potential over the coming year.

Deckers Outdoor (NYSE:DECK)

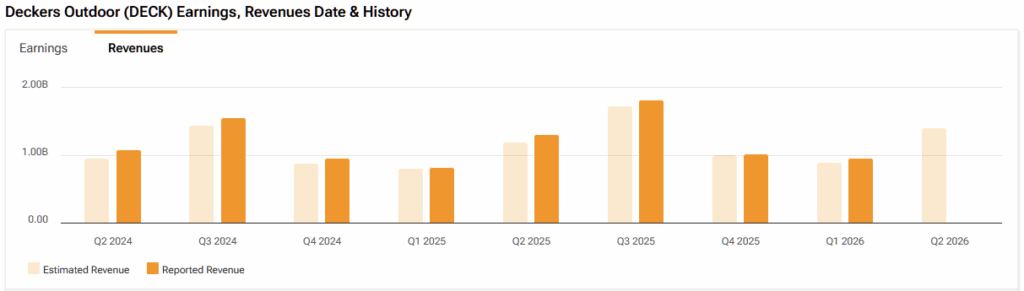

Deckers Outdoor, the parent company of Hoka, UGGs, and others, is down even more sharply than Nike, falling 49% from its 52-week high. However, its recent results have actually been better. When Deckers last reported earnings in July, it posted an impressive 17% year-over-year gain in revenue and a 24% gain in earnings per share.

Yet despite these strong results and the positive momentum, the stock has not fully recovered to pre-decline levels, following earlier concerns about tariffs and the absence of full-year guidance, both of which contributed to a sharp drop earlier this year. It’s worth noting that international sales grew 49% during the quarter, which should help the company mitigate some of the tariff-related headwinds in the U.S.

Additionally, concerns about slowing sales growth—based on 6.5% revenue growth in the fourth quarter of fiscal 2025—have weighed on sentiment. However, the company’s recent positive results address these concerns, although they have yet to be fully reflected in the share price.

Unlike Nike, shares of Deckers are relatively inexpensive after the selloff, making them a more compelling “buy-the-dip” candidate for value-oriented investors. Shares trade at just 18x March 2026 earnings estimates, well below the S&P 500’s valuation and less than half of Nike’s valuation.

Another difference between Nike and Deckers is that Deckers does not pay a dividend, but it has been returning capital to shareholders via share repurchases, which appears to be an accretive decision, given that the stock is trading at inexpensive levels. During the quarter, Deckers repurchased 1.7 million shares at an average price of $109.84 per share, which is below today’s share price.

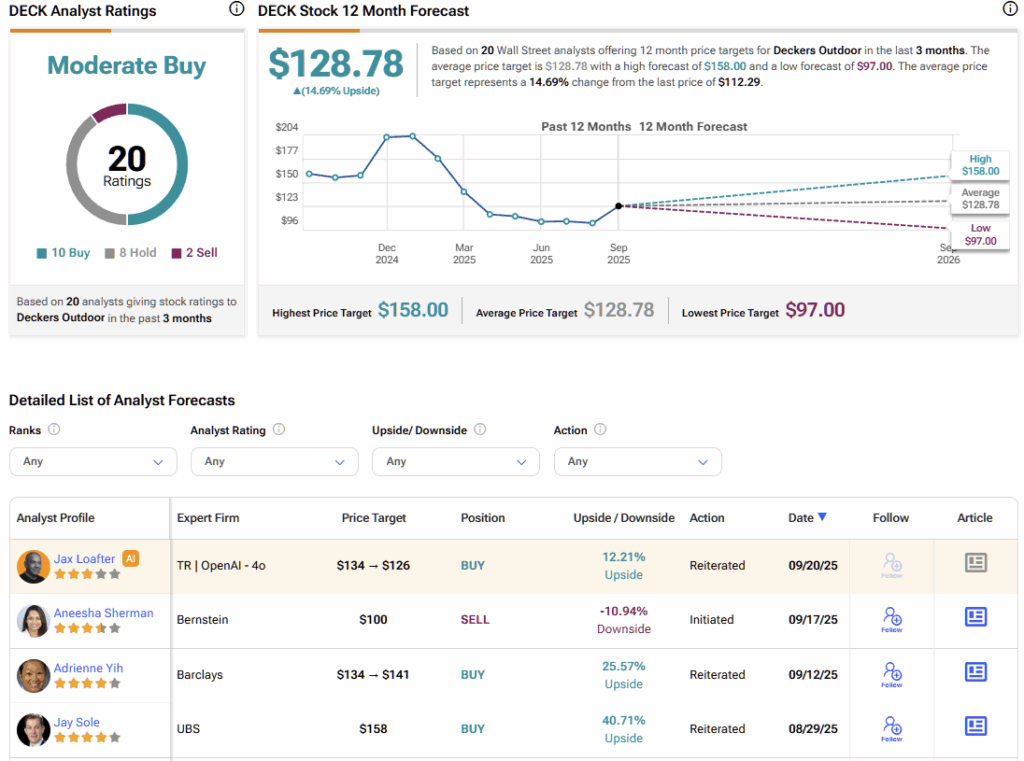

Is DECK a Good Stock to Buy?

DECK earns a Moderate Buy consensus rating based on 10 Buys, eight Holds, and zero Sell ratings assigned in the past three months. The average DECK stock price target of $128.78 implies ~15% upside potential over the coming year.

Lululemon Athletica (NASDAQ:LULU)

Lastly, let’s take a look at athleisure brand Lululemon, which is down 59% from its 52-week high, making it the biggest laggard in this group by far.

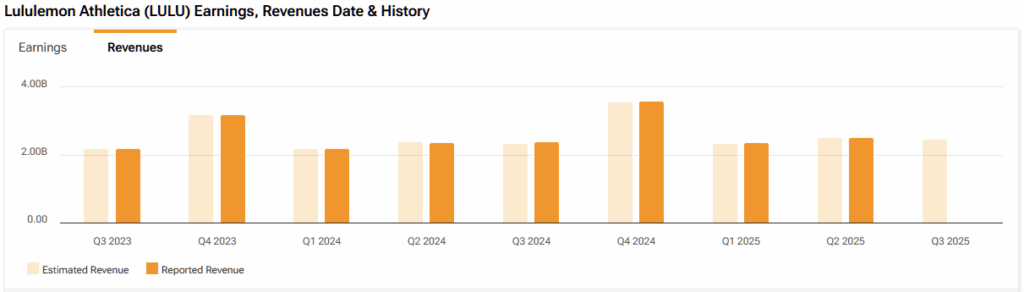

Lululemon has struggled for much of 2025, but the stock plummeted 20% in a single day earlier this month after it released underwhelming Q2 earnings and reduced its full-year guidance for earnings and revenue, including a $240 million hit to its gross profit as part of the reduced guidance.

Revenue of $2.53 billion narrowly missed Wall Street’s expectation of $2.54 billion, but still grew 7% year-over-year, placing it between Nike and Deckers in this comparison. On the negative side, the company’s same-store sales in the Americas shrank by 4%, which management acknowledged was due in part to missed trends and product cycles that had grown stale.

However, at this point, Lululemon is simply too cheap to ignore. While Nike stock remains expensive, Deckers Outdoor offers investors a slight discount to the broader market. In contrast, Lululemon appears to be a genuine bargain, trading at just 13.5x earnings, a significant discount to the broader market and both of its peers in this comparison.

Plus, there are some green shoots of life here. Like Deckers, Lululemon is enjoying strong international growth. The company was able to grow revenue by 7% despite the negative same-store sales growth in the Americas because its international revenue increased 22% (20% on a constant currency basis), led by a booming 25% sales growth in China (24% on a constant currency basis). The company continues to enter new markets, opening new franchised locations in Belgium and Turkey during the quarter, and plans to enter the Indian market in 2026.

Lastly, Lululemon is repurchasing stock, buying back 1.1 million shares at an average price of $278.50 during the quarter. This was well above today’s prices, and the company has plenty of cash on hand, so I would expect the company to continue buying back shares during Q3. I remain bullish on Lululemon based on its inexpensive valuation, strong international growth, and share buybacks.

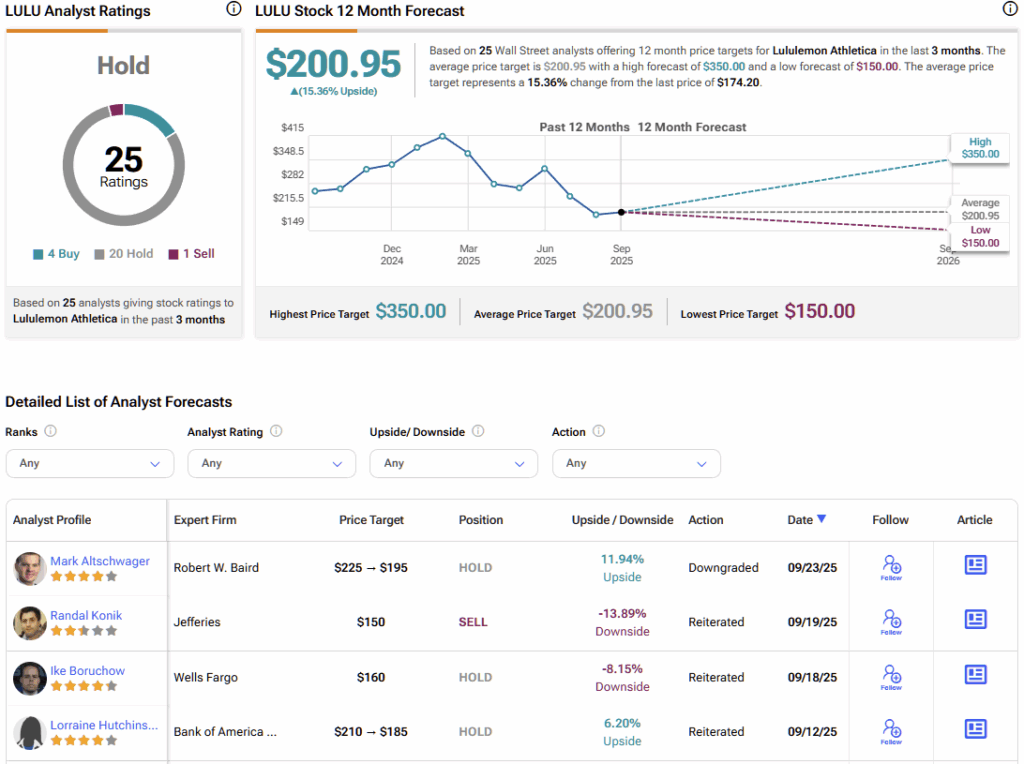

Is LULU a Good Stock to Buy Right Now?

Turning to Wall Street, LULU earns a Hold consensus rating based on four Buys, 20 Holds, and one Sell ratings assigned in the past three months. The average LULU stock price target of $200.95 implies 15.4% upside potential.

Nike Looks Pricey, but Deckers and Lululemon Offer Real Value

While there are bargains to be found in the sportswear space, Nike is not one of them. Despite declining revenue, the stock continues to trade at a sizable premium to both the broader market and its peers, leaving me negative on the name for now.

By contrast, both Deckers and Lululemon present compelling opportunities. I am bullish on Deckers given its reasonable valuation, strong top-line growth, expanding international footprint, and consistent share repurchases. That said, my strongest conviction lies with Lululemon. Its highly attractive valuation, coupled with international expansion and buyback activity, makes it the standout value play in this segment.